\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) – U. S. institutional investors have become more bullish on stocks during the summer rally, but retail investors under 40 are becoming increasingly pessimistic about the direction markets are taking. .

Most read from Bloomberg

Biden to Unveil Long-Awaited Student Debt Relief Measures on Wednesday

Covid incubation shortens with new variant, study finds

Saudi Prince Says Oil Disconnect Could Force OPEC to Act

Apple’s new iPhone 14 will show that India is ending the tech hole with China

Cuts from home sellers in prosperous cities due to the pandemic

“I don’t think the typhoon will end this year or next,” said Errol Coleman, 23, of Tampa, Florida, who creates educational content for social media platforms. excited. “

Millennial and Gen Z investors are now experiencing the inflation of their lifetimes, an aggressive Federal Reserve, and their first bear market not stimulated by the pandemic. This limits your trading activity and customers for stocks.

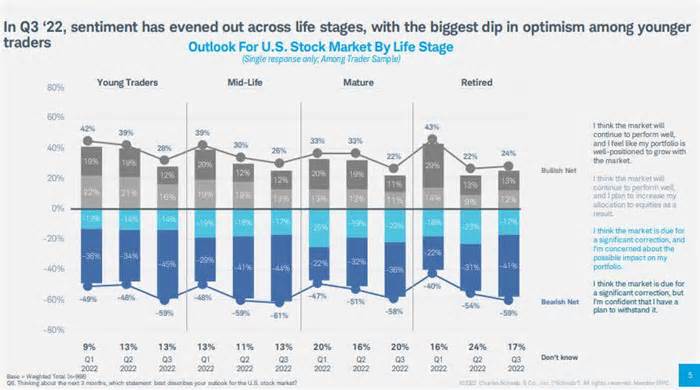

This is demonstrated through surveys. Earlier this month, Charles Schwab

“This is the first time young investors have navigated a bear market and that’s why they’re taking a more conservative approach,” said Barry Metzger, head of trading and education at Charles Schwab.

Kyle Granger, a 24-year-old waste industry investor and entrepreneur, said the market would revel in a momentary decline that could be “even worse” than the low it hit in June, one that would “affect the entire economy. “””

DIY investors have experienced a meteoric outlook in recent years. Thanks to Covid lockdowns and government monetary assistance, the percentage of retail investors in U. S. inventory trading volumes is still in the world. The U. S. rose to 24% in the first quarter of 2021, according to data from Bloomberg Intelligence. 17% in the current quarter of this year.

Young investors continued to hide. A survey by TD Ameritrade found that the majority of its millennial clients reduced their exposure to equity in July and, unlike its overall visitor base, net stock traders deteriorated.

And a reversal of the meme inventory craze in the pandemic era ended badly, again. The actions of Bed Bath

Worried about violent inventory market fluctuations and the option of a prolonged collapse, some young investors have replaced their trading style. Sebastian Tejero Gutierrez, an 18-year-old student in Bolivia, said the pandemic is a wonderful time for retailers, but he now believes short-term positions are safer due to high inflation and economic uncertainty.

“This is not a smart time for long-term investments,” he said in a phone interview. “I’m afraid of an inventory market collapse and I don’t think I’ll win by keeping inventories for more than a day. “

Joel Perez, 33, who runs real estate and structure businesses in New Jersey but who just over a year ago made retail his main focus, said investors are more talented and can “play the game better” to make money.

“While many investors are willing to take the same risk, the strategy has shifted from holding stocks hoping they will to short-term trading,” said Perez, who believes long-term investments lead to a decline in returns due to market volatility.

Retail investors have had to shift their attention from social media signals to economic indicators.

“The young trader is concerned about inflation, but not because of consensus estimates, followed by top experts, but because it has an effect on the fast stocks he plays,” said Jaime Rogozinski, founder of the popular online stock exchange discussion. WallStreetBets forum.

However, in this organization of investor wrapping styles or wrapping indicators, investment professionals are encouraged by the fact that many retail investors remain engaged with the markets.

“Once they are informed to invest and work themselves, they will invest more as they grow,” said Hady Farag, spouse and managing spouse of Boston Consulting Group.

Most read from Bloomberg Businessweek

Get in position for the magic mushroom pill

SoftBank’s Epic Losses Reveal Masayoshi Son’s Broken Business Model

IRS injection of $80 billion more in audits, in 2026 or 2027

Inflation is popping up everywhere, yet how much depends on where you live?

The Finnish florist who brings flowers back to life

©2022 Bloomberg L. P.