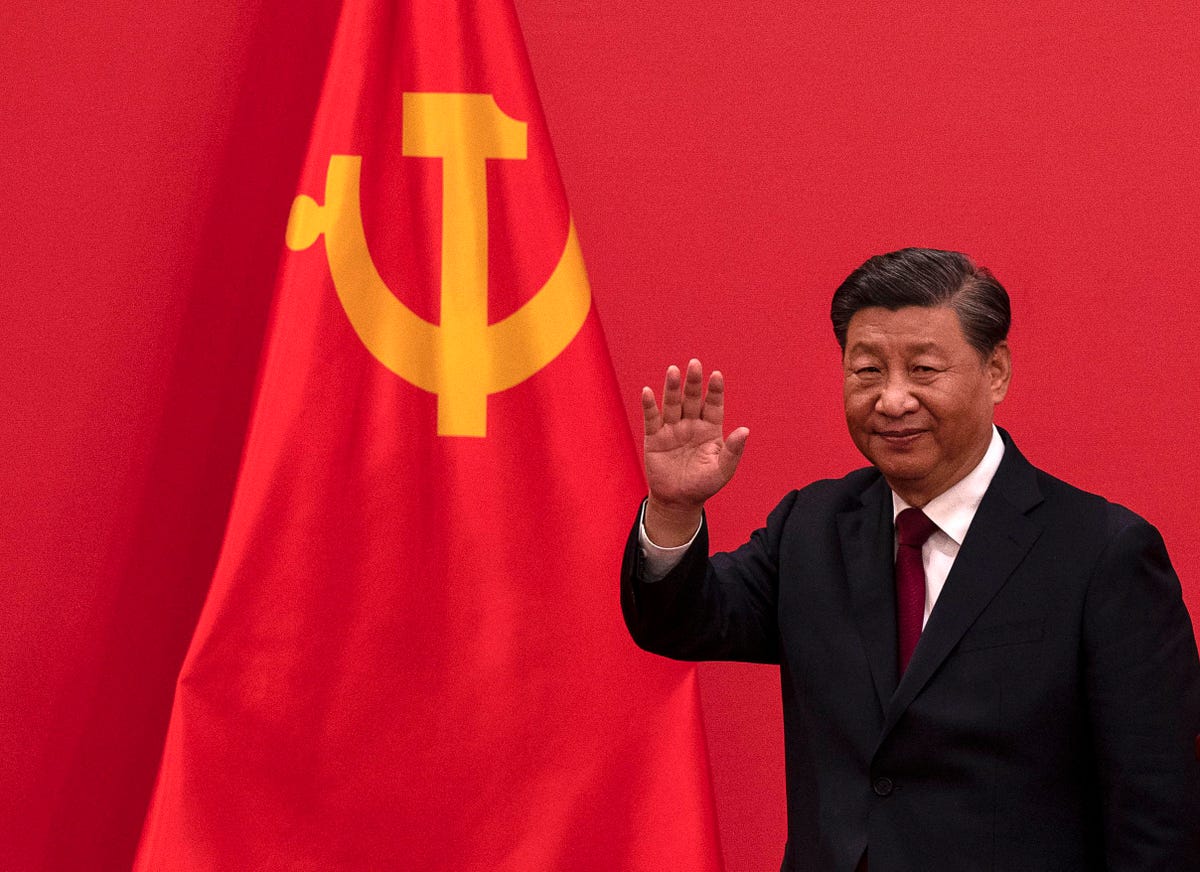

Chinese markets fell on Monday after President Xi Jinping further tightened his grip on the force by stacking the party’s toughest decision-making framework with key allies and securing a third term.

Hong Kong’s benchmark Hang Seng Index fell nearly 6. 4% to 15,180 points, the second-lowest point since the 2008 currency crisis. Chinese tech giants Tencent and Meituan fell 10. 2% and 13. 8%, respectively. Corporate billionaire tycoons Ma Huateng of Tencent and Wang Xing of Meitian – each saw more than a billion dollars of their wealth disappear in the hour area, placing them among the worst performers on the global list of real-time billionaires on Monday.

Shanghai’s benchmark CSI 300 index fell about 2. 9% on Monday, pushing the gauge for the year down more than 26%. The onshore yuan weakened against the dollar to its lowest point since the currency crisis.

On Sunday, Xi revealed the composition of the Politburo Standing Committee, China’s most sensible governing body. The other six men on the committee are all loyalists with close ties to Xi, and none belong to rival factions within the Communist Party.

Analysts say investors are concerned about the new administration’s continued regulatory pressure on personal businesses, as well as the country’s strict Covid-Zero policy that has shown no signs of budging. In Xi’s keynote speech at the week-long congress, he praised China’s Covid. prevention measures such as a “people’s war” to combat the coronavirus and shield lives.

These measures, along with a focus on areas such as security, housing market regulation and promoting shared prosperity, disappointed investors looking for symptoms of regulatory easing.

“The challenge is that President Xi now has absolute strength to adopt market-friendly policies,” said Justin Tang, director of Asian research at Singapore-based United First Partners.

Dickie Wong, chief executive of Hong Kong-based Kingston Securities, also said the congress gave investors little to celebrate. He added that considerations are also being developed on the escalation of tensions between China and the United States.

In a thinly veiled complaint from Washington, Xi said in his opening speech that China had opposed unilateralism, protectionism and “bullying. “Access to complex chip manufacturing equipment.

Meanwhile, China’s economy has shown signs of recovery, but its long-term expansion customers remain cloudy. Gross domestic product (GDP) grew 3. 9% more than expected in the third quarter compared to the same era a year ago, according to published data. Today, which was originally scheduled to be released on October 18, but was delayed due to the party congress.

But with few signs of a relaxation of the country’s strict Covid measures that, according to Fitch Ratings, have “stifled consumption and exacerbated trade uncertainty,” the country’s economic expansion will likely slow to 2. 8% this year, well below policymakers’ initial target of around 5. 5%, according to the ratings agency.

Xi said China will continue to put progress on the most sensible part of its agenda, saying he wants the country to embark on a trajectory of expansion as part of its national rejuvenation, a term that refers to achieving higher living standards and possessing comparable complex technologies. to Western countries.