“o. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

(Bloomberg’s opinion) – Last week’s virtual assembly of oil ministers from the OPEC alliance was a desirable idea of the exercise of force through Saudi Arabia’s Oil Minister Prince Abdulaziz Bin Salman. The importance of honoring the discounts on oil production they accepted, not as an act of charity but as an important commitment to maximizing the profits of each member country.

The only user sitting at the table with him in Riyadh, the oil minister of the United Arab Emirates, the last country to brazenly forget his production target. This could not be a particularly comfortable place.

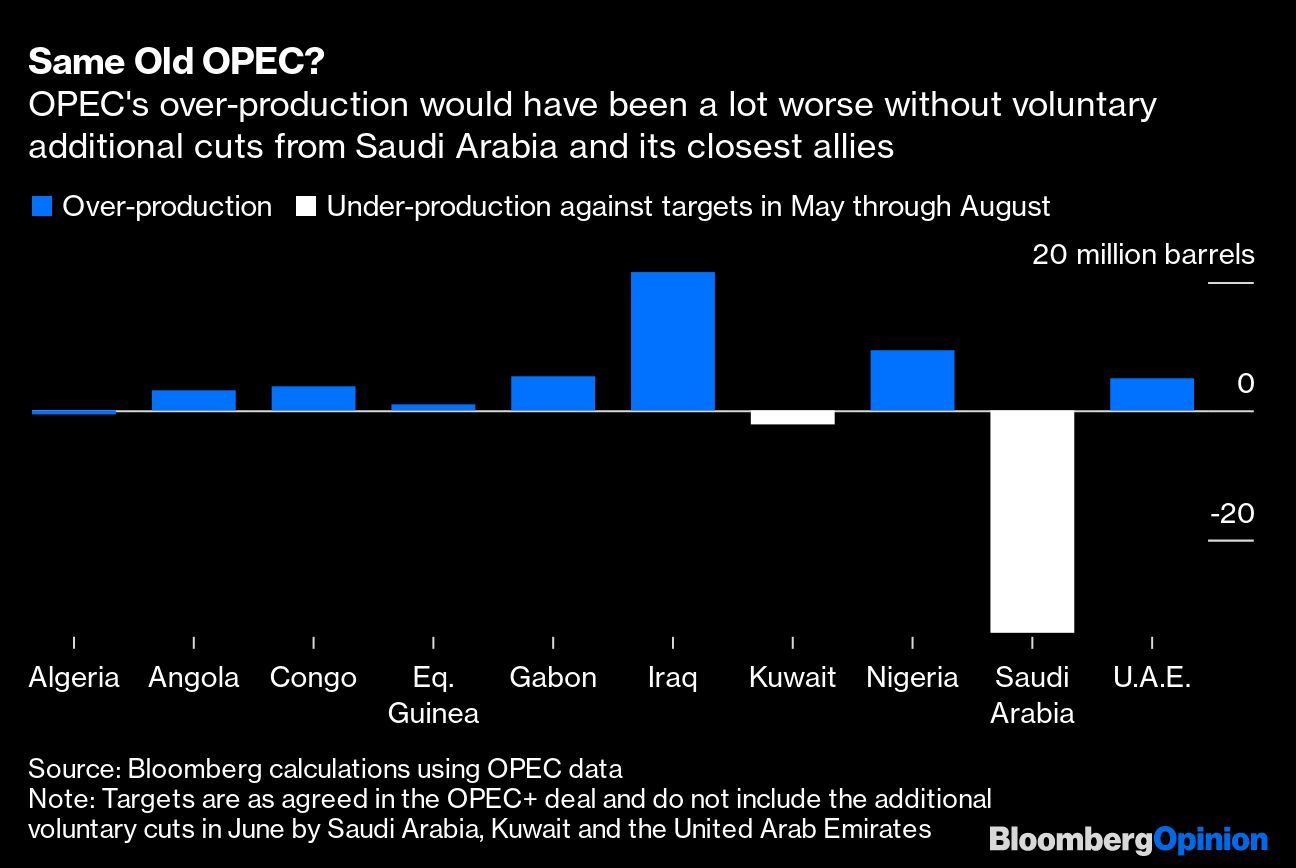

It turns out that the new OPEC, where members are destined to be all together, clinging to production targets and compensating for any deficits with deeper compensatory cuts, is beginning to show similarities to the old OPEC, which was contaminated through The Cheat.

In the first 4 months of the OPEC agreement in April, implementing record production cuts, the 10 OPEC countries linked through the pact, plus another 10 outside the organization’s doors, pumped only 12. 7 million barrels more than they had agreed. 98%, a strangely high number for an organization known for lacking its goals so far.

Saudi Arabia’s oil minister deserves credit, but it’s not just because he and his fellow OPEC members enacted the law. totaled 1. 18 million barrels consistent with the day of June. Without these, the group’s overproduction would have been much higher across 48. 1 million barrels, with 93% less impressive compliance.

It is still quite old in comparison. Compliance with production discounts brought in January 2009, for example, has never exceeded 70%, according to knowledge gathered through the Center for Global Energy Studies.

After opening the assembly publicly rebuking the organization’s quota traps, the Saudi minister concluded with terrible warnings to oil investors who may bet on lower crude oil prices. “To prevent the source from exceeding demand. ” I need the boys in the market halls to be as nervous as possible. I’ll make sure anyone who plays in this market place will be crazy, ” he said.

Then why all those theaters? The misleading speech sounded almost like desperation: if all went well with the oil market, it would want to threaten the operators.

There are two ideas on the state of the oil market, summarized in the divergent perspectives of the world’s two largest independent oil trading companies, Vitol Group and Trafigura Group.

Vitol CEO Russell Hardy says drastically fallen oil inventories will continue to fall for the rest of the year. year, he said in an interview at the Asia-Pacific Oil Conference (APPEC) last week.

Trafigura’s top executives see the global differently. “I remain concerned about the oil market for the next three to six months,” chief executive and President Jeremy Weir said last week. He echoed the comments of the company’s oil trade co-director, Ben Luckock, who told the APPEC rally that he was “in no hurry to worry about a recovery operation. “he said, adding that he expects crude oil stocks to accumulate for the rest of the year and Brent’s costs “are in the $30 range. “

After all, the outlook for the world’s top 3 oil forecasting agencies has deteriorated over the next month as the Covid-19 pandemic continues to weigh on demand. The U. S. International Energy Agency, OPEC and Energy Information Administration have been able to do so. America slowly than in August.

Can the Saudi oil minister convince investors that OPEC will remain the global market for Vitol? Oil costs have risen, but your protests recommend that you worry that we may be early enough in the global defined through Trafigura.

Seen in this way, their obsession with obtaining compensatory discounts from OPEC members who have not met their objectives is understandable. But this refund is becoming more complex in the future. Last week, it was through the committee that he co-chaired that the deadline for filling the gaps would extend for 3 months until the end of the year.

However, not being able to loose OPEC riders, its new OPEC will be very similar to the old OPEC, where Saudi Arabia endured the lion’s percentage of the market balance load, which would possibly not be sustainable.

This column necessarily reflects the perspectives of the editorial board or Bloomberg LP and its owners.

Julian Lee is Bloomberg’s oil strata and previously served as a senior analyst at the Center for Global Energy Studies.

For more items like this, visit bloomberg. com/opinion

Subscribe now to forward the highest source of reliable business news.

© 2020 Bloomberg L. P.