Australia is fortunate to have giant deposits of minerals and energy. China’s increase and insatiable appetite for iron ore and energy, two of Australia’s major exports, have expanded uninterrupted economicly for more than 3 decades. get this over with. Over time, normality will return to markets and Canberra stands firm in returning to expansion. As a result, the National CoVID Coordination Commission of Australia has been responsible for identifying investment opportunities that will enable an immediate economic recovery.

Green recovery has a widely used term that highlights the unique opportunity to achieve two goals at once: reducing CO2 emissions and boosting economic growth. To be clear, Australia’s renewable energy outlook is unprecedented. The country has a lot of sun and coastal regions are conducive to wind turbines. The vast open spaces ensure low land prices, meaning Australia could be Saudi Arabia’s hydrogen.

The country’s COVID Commission, however, has other plans: The head of the advisory committee, Nev Power, has warned that a fossil fuel technique is the preferred option, although business leaders have instructed the government for a recovery that blocks low emissions. Power said. it does propose “a green recovery consistent with se”. According to the head of the commission, the green valuation wants a broader definition that includes low-emission fuels such as herbal gas.

This is a clear sign that the head of the commission has a strong preference for helping national herbal fuel intake. Especially in manufacturing, Power believes that government aid for energy projects can only be competitive in some sectors that rely on low prices for herbal fuels.

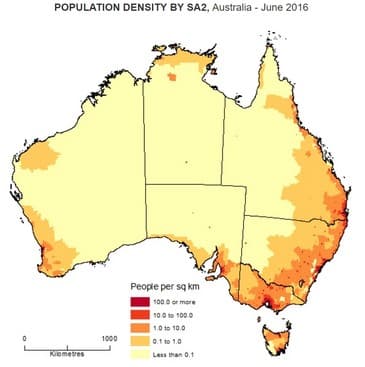

The proposed acquisition therefore aims to strengthen the country’s pipeline infrastructure, which would reduce energy shipment prices. Most of Australia’s population lives in the east and southeast of the island, while most plant fuel is produced in the northwest. Large distances and the absence of pipes mean that shipping prices are high.

The Australian Competition and Consumer Commission, the country’s festival control body, has highlighted the value differential in domestic gas development. Foreign buyers gain advantages from low foreign securities, while domestic consumers still pay a premium for Australian energy. Asian consumers paid $6 consistent with gigajoules, while home users were presented with a value between $8 and $11. The giant hole fuels the argument for better national connectivity through investments in intra-State pipelines.

The COVID Commission sees an opportunity to use the economic slowdown caused by COVID-19 to set Australia’s long-term energy policy timetable. This is no surprise, as the Commission decided through Morrison’s government.

The Commission’s advice is accompanied by the government playing a role in supporting the structure of pipelines between the east and northern states, and the $6 billion trans-Australian pipeline could connect from east to west, according to the Conservative Commission, the government has to subsidize these projects and achieves its objectives by acquiring a stake , a minority shareholding or investment subscription.

He is less favorable for the Australian coal industry. According to Sam Mostyn, non-executive vice president of the Center for Policy Development, “the challenge with coal is that, as the most carbon-polluting fossil fuel, there is a shortage of friends. “The public has opposed highly polluting fuel, especially after last year’s devastating fires that deeply shook Australian society.

A blow to Australia’s energy industry, the country’s biggest customer, China, is receding due to recent tensions. Work has begun in Pakistan on a huge $ 1. 9 billion open pit mine that could supply the Asian giant with coal for the foreseeable future. the seventh largest box of lignite in the world with about 175 billion tons of coal.

As a result, Australia’s economic recovery may take longer than expected, as countries face a momentary wave of COVID-19 and uncertainty.

By Vanand Meliksetian for Oilprice. com

Read this article in OilPrice. com

This story gave the impression to Oilprice. com