\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

Vancouver, British Columbia–(Newsfile Corp. – August 25, 2022) – Whitehorse Gold Corp. (TSXV: WHG) (OTCQX: WHGDF) (“Whitehorse Gold” or the “Company”) announces that its wholly-owned subsidiary, Stannum Metals Corp. , has entered into agreements to obtain a one hundred percent interest in a Bolivian personal mining corporation (the “Tin Company”) from its 3 shareholders (the “Sellers”), free of any debt (the “Contracts”). The concessionaires are of Bolivian nationality and independent parties.

Tin Company’s main asset is an allocation of tin-zinc-silver-lead polymetallic minerals or ATE (Temporary Special Authorization) located in the Oruro, Bolivia branch. Rio Tinto in 1999.

Two historic Rio Tinto boreholes intercepted significant tin mineralization. The ESF001 drill intercepted a constant range of 236 m (from 125 m to 361 m) containing 0. 41% tin, 1. 12% zinc and 15 grams consistent with one ton of silver. diameter of 180 m (94 m to 274 m) with a grade of 0. 29% tin, 1. 06% zinc and thirteen grams consistent with one ton of silver, to which is added a content of 56 m consistent with a grade of 0. 58% tin, 1. 86% zinc and thirteen grams consistent with one ton of silver.

Principal of the two agreements

Confirmatory Drilling Agreement: The Company will pay US$100,000 to the concessionaires as a non-refundable down payment to perform a confirmatory drilling program. The program will pair two historic holes over the next 3 months.

Acquisition Agreement: The Company will pay a total amount of US$3. 65 million to obtain one hundred percent of Tin Company in the following tranches:

Subject to acceptable drilling purposes (as we decided through Whitehorse Gold), an additional $400,000 will be paid to distributors for a one hundred percent interest in Tin Company to be transferred to Whitehorse Gold’s subsidiary, Stannum Metals Corp.

US$1. 25 million on the first anniversary of the acquisition agreement.

$1. 25 million at the time of the acquisition agreement’s anniversary, plus an additional $500,000 in money or shares of Whitehorse Gold.

An intermediary payment of $250,000 will be paid from this transaction.

Failure to pay in full will result in the return of one hundred percent of the interest to the sellers.

The end of the transaction is subject to regulatory and other approval set forth in the agreements.

“Tin is a green steel and an essential component of each and every electronic circuit board manufactured in the world. The tin market has seen exponential gains over the past two years and is expected to experience further expansion as electrification with decarbonization advances globally. gordon said. Neal, CEO of Whitehorse Gold, “with the success of our team in exploration in Bolivia, this tin allocation will be another successful exploration venture. “

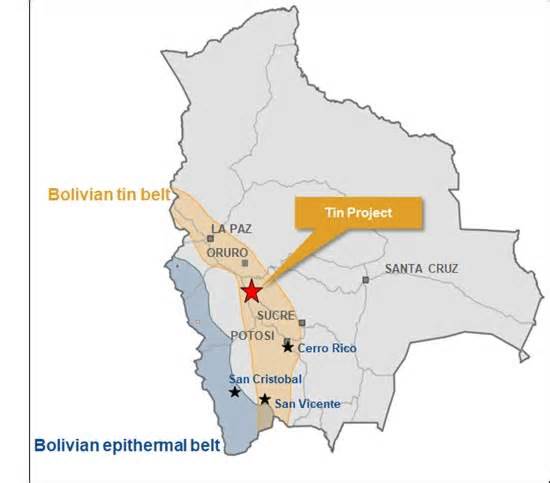

Location map of the property

To see a preview of this chart, visit: https://images. newsfilecorp. com/files/7553/134859_6e653bd864d4389b_004full. jpg

Location and history At an altitude of about 4,200 meters, the assets cover a domain of about 2. 0 square kilometers (km). The assets are located in the departments of Oruro and Potosí in Bolivia, about 65 km northeast of the Huanuni mine, the largest tin mine in Bolivia and the largest cassiterite deposit in the world. Access is easy thanks to a forty-five kilometer paved road from Oruro and a 25-kilometer gravel road.

Historical exploration and mineralization The host rocks of the mineralization are Quartz sandstones of The Silurian age (called quartzites) and archosic sandstones of the Llallagua Formation, which rest on the grauvaca of the Cancañiri Formation. The tin mineralization is 2 kilometers long and appears to be oriented to the north. northwest, with a dip to the west.

In 1999, Rio Tinto completed a program of 7 diamond drilling wells (including five completed wells on the property). Below you can find a map of historic drilling sites and an effects table:

View in well plant

To see a preview of this chart, visit: https://images. newsfilecorp. com/files/7553/134859_6e653bd864d4389b_005full. jpg

Table 1: Historical drilling results

(Source: EMICRUZ, 1999 report)

To see a preview of this chart, visit: https://images. newsfilecorp. com/files/7553/134859_6e653bd864d4389b_006full. jpg

Cross section showing historical drilling esf001

To see a preview of this chart, visit: https://images. newsfilecorp. com/files/7553/134859_6e653bd864d4389b_007full. jpg

Cross section showing historical sounding ESF002

To see a preview of this chart, visit: https://images. newsfilecorp. com/files/7553/134859_6e653bd864d4389b_008full. jpg

Donald J. Birak, an independent consultant geologist and qualified user as explained in National Instrument 43-101, conducted a site scale of these assets and reviewed and approved the clinical and technical data contained in this press release. Since there are no intact samples from old cores or analytical samples for inspection or resampling, the qualified user was unable to validate the old drilling effects and relies on the old effects as signs of asset foresight.

Confirmatory Drilling In accordance with the recommendations of the qualified person and the terms of the Confirmatory Drilling Agreement, the Company will conduct a confirmatory drilling program to match two historic drilling holes. The Company has initiated the procedure of assembling a Bolivian team and contracting a drilling rig for all confirmation drilling. This drilling program will be implemented in accordance with the industry’s most productive practices for the quality of drilling results.

Appointment to the Board of Directors Whitehorse Gold is pleased to announce the incorporation of Hernán Uribe to its Board of Directors. Uribe is a professional geologist with over 25 years of experience in mineral exploration. He has worked with Billiton, Eaglecrest Exploration, New World Resources Corp, Apogee Minerals Corp, Lydian International and New Pacific Metals Corp. Mr. Uribe delights in exploration and exploitation projects of gold-copper deposits, polymetallic deposits of silver-lead-zinc. and lithium brines in Bolivia, Chile, Argentina, Peru and the Republic of Georgia, in stages, from exploration to development, with roles such as Exploration Geologist, Chief Geologist, Exploration Manager and Director of País. Sr. Uribe earned his degree in Geology from the University of La Paz, Bolivia, and has directed several courses in mineral exploration and mineral deposit evaluation.

About Whitehorse GoldWhitehorse Gold is a mining exploration and progression company focused on tin allocations in Bolivia and a gold progression assignment in the Yukon. The company is entitled to obtain a one hundred percent stake in a tin allowance 65 km southeast of Oruro in Bolivia. The company also owns one hundred percent of the Skukum Gold allocation located in southern Yukon, approximately 55 km south-southwest of Whitehorse. The Skukum Gold assignment houses the former Mount Skukum. The infrastructure of the assignment includes an all-weather access road, a camp for 50 people, approximately 6 km of underground advance and a three hundred tpd plant in operation in the past and related facilities. From 1986 to 1988, underground operations conducted through a former operator at Mount Skukum saw 233,400 tons of ore mined and processed to recover approximately 79,750 ounces of gold (Total Energold Corporation, 1989).

On behalf of Whitehorse Gold Corp.

signed “Gordon Neal”

Gordon Neal, Executive Director and Director

For more information, please contact: Investor Relations, Whitehorse Gold Corp. , Phone: (604) 336-5919 Email: info@whitehorsegold. ca www. whitehorsegold. ca

Neither tsx Venture Exchange nor its Regulatory Service Provider (as that term is in TSX Venture Exchange’s policies) accepts responsibility for the adequacy or accuracy of this press release.

DISCLAIMER – FORWARD-LOOKING STATEMENTS

Some of the emails and settings contained in this news release constitute “forward-looking emails” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking settings” within the meaning of applicable law. applicable Canadian provincial values. . Any form or manner that expresses or leads to discussions relating to long-term predictions, expectations, beliefs, plans, projections, goals, assumptions, or occasions (often, but not always, employing words or expressions such as “expects,” “expects,” is planned”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “supposes”, “intends”, “strategies”, “goals”, “goals”, “forecasts”, “objectives ” , “assumptions”, “deadlines”, “potential” or diversifications thereof or indicating that certain actions, occasions or effects “could”, “could”, “could”, “could” or “should” be taken, happen or achieved , or the negative form of any of those similar terms and expressions) are not s in fact old and possibly would be s or Forward-Looking Inshapeation Forward-Looking s or Inshapeation relate to, among other things: the value of gold and other rail goods; the accuracy of mineral resource and mineral reserve estimates at the Company’s curtain properties; the adequacy of the Company’s capital to finance the Company’s operations; estimates of the Company’s capital expenditures; time of receipt of authorizations and regulatory approvals; the availability of a production budget to finance the Company’s operations; and access to and availability of long-term construction financing, use of proceeds from any financing, and progression of the Company’s properties.

Forward-looking statements or data are subject to a variety of known and unknown risks, uncertainties and other issues that may cause actual events or effects to differ from those reflected in the forward-looking statements or data, including, without limitation, social. and economic points. effects of COVID-19; hazards similar to: fluctuations in the prices of raw materials; calculation of resources, reserves and mineralization and recovery of valuable and base metals; mineral resource interpretations and assumptions and mineral reserve estimates; exploration and progression programs; feasibility and engineering reports; rentals and licenses; name of the assets; asset interests; joint venture partners; the acquisition of commercially exploitable mining rights; money; recent market occasions and conditions; economic points that affect the Company; timing, estimated quantity, capital and operating expenses, and long-term economic returns from production; the integration of long-term acquisitions into the Company’s existing business; competition; political operations and conditions; regulatory environment in Canada and Bolivia; environmental hazards; legislative and regulatory projects that address global climate substitution or other environmental concerns; replacement rate fluctuations; Sure; hazards and dangers of mining operations; key personnel; conflicts of interest; management dependency; internal monetary reports; and file motions and enforce judgments under US securities laws.

This list is not exhaustive of the points that may also be forward-looking statements or data of the Company. Forward-looking statements or data are statements about the long term and are inherently uncertain, and the Company’s actual achievements or other long-term occasions or situations may differ materially from those reflected in the forward-looking statements or data due to a variety of risks, uncertainties and other points, including, but not limited to, those discussed in the Company’s Annual Information Form for the year ended March 24, 2022, under the heading “Risk factors”. Although the Company has attempted to identify vital points that may also cause actual effects to differ materially, other points would possibly cause the effects not to be those anticipated, estimated, described or anticipated. Accordingly, readers deserve not to place undue reliance on forward-looking statements or data.

The Company’s forward-looking statements and data are based on the assumptions, beliefs, expectations and control reviews as of the date of this press release and, as required by applicable securities laws, the Company assumes no legal responsibility to update: statements and data if the cases or assumptions, beliefs, Management’s expectations or revisions warrant changes, or adjustments at any other time that affect such statements or data. For the reasons set out above, investors deserve not to place undue reliance on forward-looking statements.

Warning to U. S. Investors

The data contained in this press release and referenced herein were prepared pursuant to National Instrument 43-101, which differs materially from the needs of the U. S. Securities and Exchange Commission. U. S. (the “SEC”). The terms “Proven Mineral Reserves”, “Probable Mineral Reserves” and “Mineral Reserves” used in this press release refer to the mining terms explained in the Canadian Institute of Mining, Metallurgy and Petroleum standards (the “CIM Definition Standards”), the definitions of which were followed through NI 43-101. Accordingly, the data contained in this press release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to data published through other U. S. corporations. of that.

Investors are cautioned not to assume that any component or all of the mineral resources will ever be converted to reserves. According to the CIM Definition Standards, an “Inferred Mineral Resource” is that component of a Mineral Resource for which the quantity and grade or quality are estimated based on limited geological evidence and sampling. Such geological evidence is sufficient to signify but not to determine continuity and geological grade or quality. An Inferred Mineral Resource has a lower confidence point than an Indicated Mineral Resource and deserves not to be changed to a Mineral Reserve. However, it is reasonable to expect that most inferred mineral resources can be upgraded to indicated mineral resources with continued exploration. Under Canadian regulations, inferred mineral resource estimates cannot form the basis of feasibility or pre-feasibility studies, in rare cases. Investors are cautioned not to assume that all or any component of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted under Canadian regulations; however, the SEC generally only allows issuers to report mineralization that does not constitute “reserves” through SEC criteria such as tonnage and grade in place without reference to unit measures.

The Canadian criteria, which aggregate the CIM and NI 43-101 definition criteria, differ in particular from the SEC Industry Guide 7 criteria. Effective February 25, 2019, the SEC followed new mining disclosure regulations under Sub-Part 1300 of Regulation S-K of the United States Securities Act. of 1933, as amended (the “SEC Modernization Rules”), compliance with which is required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules supersede the disclosure requirements of historic property included in industry guidance following the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC modified its definitions of “proved mineral reserves” and “probable mineral reserves” to substantially align them with the corresponding definitions in the CIM definition criteria. During the era prior to the SEC Modernization Compliance Date, data relating to mineral resources or reserves contained or referred to in this press release may not be comparable to data published through corporations that publish their reports in accordance with U. S. criteria. Although the SEC Modernization Rules are intended to be “substantially” compliant with the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules. the SEC and the CIM Definition Standards. Accordingly, there can be no assurance that the Company will be able to report Mineral Reserves or Mineral Resources as “Proven Mineral Reserves”, “Probable Mineral Reserves”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. under NI 43. -101 it would be the same if the Company had ready the estimate of reserves or resources in accordance with the criteria followed under the SEC Modernization Rules.

To view the original edition of this press release, visit https://www. newsfilecorp. com/release/134859