n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Israel’s central bank warned that the government’s fiscal reaction to the war against Hamas threatens to put the country further into debt and may simply be an impediment to further financial easing, after cutting interest rates for the first time since the peak of the global pandemic crisis in 2020.

Most on Bloomberg

Iran Sends Warship to Red Sea After US Sinks Houthi Boats

Tokyo runway collision kills five and Airbus plane catches fire

US Pressured Netherlands to Block China-Bound Chip Machinery

India’s crude oil imports from Russia fall on payment problems

Earthquake Strikes Northwest Japan, Kills Four More People and Destroys Homes

The finance committee on Monday ended a pause in place since July and lowered its policy rate from 4. 75% to 4. 5%, as expected by top economists. Markets say rates will fall below 3. 4% until the end of 2024.

An update to the central bank branch’s outlook shows the government is on track for a larger-than-expected budget deficit in November, with the war’s tax burden also revised upwards, to around NIS 210 billion ($58 billion).

“A risky fiscal policy would possibly qualify decisions in the future,” Gov. Amir Yaron told a news conference, calling for changes that would reduce spending and increase revenues.

“If markets understand that Israel is moving towards a prolonged accumulation of debt, this will likely lead to higher yields, depreciation and inflation, so central bank interest rates will be higher,” he stated.

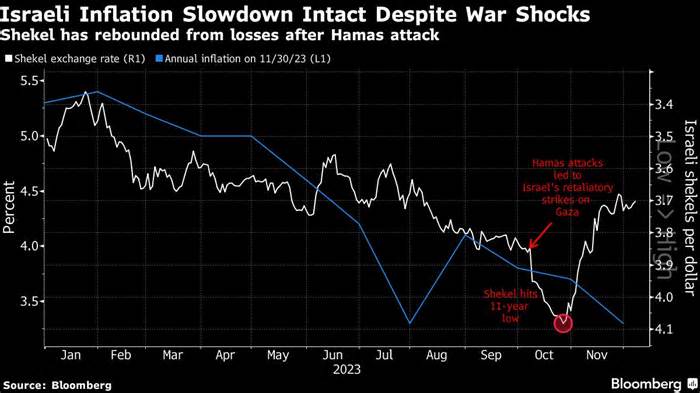

The resolution indicates that priorities are beginning to shift towards supporting the economy, following an effort by the authorities to stabilize markets following the Hamas attack on Oct. 7. The emphasis has shifted as inflation slows and local assets recoup losses, while the shekel has seen the biggest global decline. against the dollar over the past two months, gaining more than 12%.

The shekel trimmed its gains after the rate announcement and little replaced against the dollar.

In a document attached to Monday’s resolution, policymakers largely reiterated their November guidance, saying the focus was on “stabilizing markets and reducing uncertainty, along with price stability and supporting economic activity. “

The central bank has not given any transparent signal about the timing of its next moves. Its research arm forecasts an interest rate of 3. 75% to 4% in the fourth quarter of 2024.

Yaron said forecasts recommend that the Bank of Israel could cut rates up to 4 times this year, calling it “a more moderate downward trajectory than the market is pricing in. “

“The trajectory of interest rates will be determined through the evolution of the war and the resulting uncertainty,” the central bank said. “To the extent that the recent stability of economic markets consolidates and the inflation environment continues to moderate towards the target range, policy can focus more on supporting economic activity. “

Arguments are developing for Israel to implement financial stimulus as inflation converged to the 1% to 3% target for the first time since 2021 and the economy is at risk of contracting. The central bank said on Monday it expects inflation to hit target. diversity in the first quarter of the year.

“Until this decision, the Bank of Israel was focused on monetary stability,” said Nira Shamir, lead economist at the Israel Discount Bank. “Now they’re taking a proactive step: they’re looking to help households. “

War, Budget

The dangers are numerous, however, as the central bank weighs the implications of Hamas’ war-related fiscal plans, which could simply burden the country with even greater debt.

Differences with the government may result in the future as officials reform the wartime budget.

A Finance Ministry report released in December cites a war bill of NIS 75 that will have to be financed through borrowing or budget cuts, combined with higher taxes. The government has indicated that it is not willing to take any action that the central bank might probably deem sufficient to rein in the debt.

The threat that the war against Hamas could escalate into a wider confrontation explains why caution must be exercised in the future. Disruptions to the economy persist with the deployment of thousands of troops and the evacuation of entire communities from their homes along Israel’s border. southern and northern borders.

Yaron said on Monday that besides a “transitory increase” in the budgetary costs from the war, Israel also faces a more permanent burden from bigger defense outlays, higher interest expenses and other long-term spending commitments linked to the conflict’s fallout.

The outlook is that to fund those increases, the government would have to make cumulative budget changes “of a permanent nature” that would total about NIS 30 billion a year until the end of 2025, he said.

The central bank’s research arm believes that such adjustments will cause public debt as a percentage of economic output to begin to decline after 2025. If the budget is left unchanged, the debt-to-GDP ratio will most likely rise in the coming years. years.

“A marked portion of the above adjustments should already be made in the 2024 budget,” Yaron said. “Not acting now to adjust the budget via cuts in expenditures, removing redundant ministries and increasing revenues in view of the needs of the war is likely to cost the economy much more in the future.”

–With Joel Rinneby.

Most Read from Bloomberg Businessweek

Help, I Saw My Boss on a Dating Site

On Businessweek: What the Audience Needs to See

Elon Musk made 2023 about himself

©2024 Bloomberg L. P.