The spot costs of vanadium were higher in August.

Vanadium Market News: The power garage for electric vehicle recharging can be successful in 1,900 MW through 2029. The U.S. vanadium calls on the government to take steps to bring domestic vanadium production to life.

Vanadium News: TNG Ltd LOM has signed a collection agreement with VIMSON. Silver Elephant’s subsidiary acquires Bisoni Vanadium Project together with Gibellini.

Welcome to the news of the miners of Vanadio.August saw the costs of the upper vanadium during the month and many news about the vanadium market and the company.

Vanadium has historically been used to harden metal. China’s new criteria for rebar require more vanadium. In addition, vanadium [VRFB] batteries are popular in China, especially for advertising energy storage. Vanadium pentoxide [V2O5] is used in VRBS and ferrovanadium [FeV] is used in industry metal.

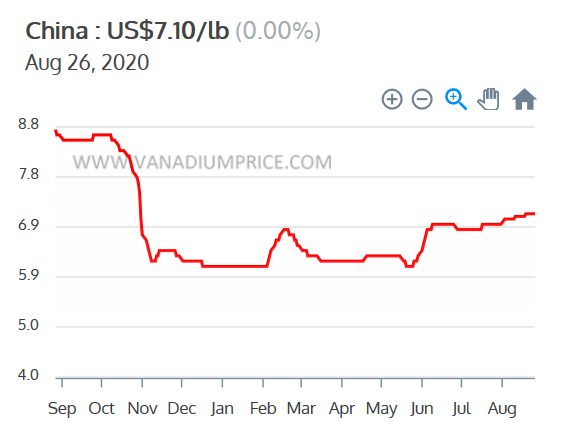

Scale table 98% vanadium pentoxide [V2O5] for 1 year – Price – $7.10 / lb

Ferrovanadio de China [FeV] 80% Price – $30.30

Source: Vanadiumprice.com

The graphs below show that Power Garage is a new source of vanadium demand, and overall demand is expected to increase very sharply until 2025.

Total demand for vanadium is expected to exceed 2020-2025

We believe a revolution is looming in converting redox batteries into vanadium,” he says. You’ll want to enter the mining sector and produce an ultra-fast vanadium electrolyte for those large-scale batteries. We are very interested in how to buy force electricity in the grid. The good appearance of the vanadium redox battery is that you can rate and reduce it at the same time, which you can’t do with a lithium battery. With a vanadium battery with redox force, you can put the sun and wind strength on the battery and you can put excess network strength into the battery at night while at the same time you can have a solid outlet in the network.

On August 4, Energy Storage News reported:

Guidehouse: Energy Garage to help charging electric cars can be successful in 1,900 MW through 2029. “A garage battery formula can be powered through the grid in case of low demand and release energy to rate peak periods of an electric vehicle,” Maria Chavez, study analyst at Guidehouse Insights, told me. Their studies revealed that the overall compound annual expansion rate in all segments of the Electric Automotive Desk Electric Garage (ESEV) is expected to be 28% through 2029. At the regional level, Europe, North America and the Asia-Pacific region are expected to have a large majority of the total. garage capacity. In the UK, the desk garage is already being deployed in parallel with electric vehicle recharging through several companies, adding Pivot Power, which was purchased through EDF last year.

Power garage systems to pave the way for the next phase of the energy transition, says GlobalDataArray …..ESS serves as a very important center for the entire power grid, from peak periods of energy control, allowing energy control and energy stimulation quality and reliability to help reduce environmental impact.Energy Garage also facilitates the integration of variable or intermittent renewable energy resources into the grid through source-demand correspondence.

On August 19, EE World Online reported:

Flow batteries: what can you use them for? Flow batteries are used in various application areas, adding strength storage across the utility enterprise, micro-networks, renewable force integration, backup force and remote and off-grid strength. Flow batteries are highly scalable and their strength and strength can also be scaled independently. They have little or no self-discharge force. Flow batteries have demonstrated a lifespan of more than 10,000 cycles with minimal capacity degradation.

Battery flow: technological synergies will allow networkArray stabilization. Flow batteries promise common and virtually unlimited cycles without degradation, giving them a special niche in energy storage.

The UK’s first transmission-connected battery, a lithium-ion/vanadium flow battery, planned sited at National Grid’s Cowley Substation

The source

On August 26, Metal Tech News reported:

U.S. Vanadium is asking the government for help. U.S. Vanadium Holding Company LLC, a manufacturer of high purity vanadium pentoxide founded in Arkansas, urges the U.S. government. To take steps to bring the national production of vanadium to life. Vanadium-related metals are used in virtually all high-strength metal structure programs in military equipment, adding metals used to build aircraft carriers and submarines, combat vehicles, tactical bridges, aircraft and ammunition.

Vanadium producers

Glencore [LSX: GLEN] [HK: 805] (OTCPK: GLCNF)

Glencore is a major vanadium manufacturer, but vanadium production accounts for a small part of its revenue.

On August 6, Glencore announced, “Semen 2020.” Highlights include:

… Metals $2.2 billion (16% less) $700 million (65% less).Most of our assets operated relatively frequently over the six-month period, and energy assets were disproportionately affected by the decline in coal costs.

AMG Advanced Metalurgical Group NV [NA: AMG] [GR: ADG] (OTCPK: AMVMF)

AMG Vanadium is a leading supplier of products and facilities for the metals, manufacturing, refinery and petrochemical industries.AMG Vanadium produces ferrovanadium and similar ferroaliajes from refinery catalysts used through an exclusive pyrometallurgical process.

Strategic Highlights

You can see the latest presentation for investors here.

Bushveld Minerals Limited [LN- AIM: BMN] (OTCPK: BSHVF)

Bushveld is a diversified resources company indexed in AIM with a portfolio of vanadium, tin and coal assets in southern Africa and Madagascar.

On August 3, Bushveld Minerals Ltd. announced:

Investment in January GmbH. Bushveld Minerals Limited ….. announces the acquisition through Enerox Holdings Limited (“EHL”) of another 65.1% of the percentage capital of Enerox GmbH (“January”), as scheduled in its announcement of 19 December 2019. EHL is a newly formed investment vehicle formed through a consortium of investors, adding Bushveld Energy Limited (“BEL”) (an 84% owned subsidiary of Bushveld).

You can see the latest presentation for investors here.

Largo Resources [TSX: LGO] [GR: LR81] (OTCQX: LGORF)

Largo Resources is a manufacturer of pure vanadium pentodium at its Maracus Menchen mine in Brazil.

On August 13, Largo Resources announced: “Largo Resources announces the effects for the time of the 2020 quarter, highlighted through the continuation of its cheap operations; sales and general sales functionality in line with expectations. Highlights include:

Second Quarter 2020 Highlights

Other highlights

Ferroalloying [LON: FAR]

FAR is arriving at the giant Balasausqandiq vanadium depot in Kyzylordinskaya Oblast in southern Kazakhstan. FAR status: “The ore in this place has a particularly higher content than all other number one vanadium extractions, which allows much reduction of processing costs.”

Not for the month.

Vanadium developers

Western Uranium – Vanadium Corp. (OTCQX: WSTRF)

Western Uranium – Vanadium Corp. triumphs over the permitting audience. The company was a success in the mining permit hearing before the Colorado Mining Field Recovery Board (MLRB). The challenge was the prestige of the five existing rentals that make up the Sunday Mine Complex [SMC]. Due to COVID-19 restrictions, the audience was conducted in virtual format only on Wednesday, July 22, 2020, and the procedure was recorded and viewed on the MLRB Natural Resources Division YouTube channel. Although the challenges are complex, Decision 3-1 identified that paintings made in Sunday Mines under the supervision of the Division of Rehabilitation, Mining and Safety (DRMS) were timely and sufficient to allow Western to retain SMC’s permits.

Investors can see the company’s latest presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals is 100 percent owned through the Barrambie Titanium Vanadium Iron assignment in Western Australia. Barrambie’s eastern band is one of the highest quality hard rock titanium deposits in the world.

On July 31, Neometals announced: “Quarterly Trade Report for the Quarter Ended June 30, 2020.” Highlights include:

Company

Vanadium recovery project

Barrambie Titanium and Vanadium Project

LOM binding collection agreement with VIMSON secure. The conclusion of the third mine life extension agreement marks another key step towards financing and developing the Mount Peake Vanadium-Titanium-Iron project. TNG has already entered into binding mine life agreements of up to one hundred percent titanium dioxide pigment with the Swiss organization DKSH and up to 60% vanadium pentoxide with the Korean organization WOOJIN. “

On August 10, TNG Ltd. announced: “Mount Peake FEED and NPIArray Progress in key FEED study and NPI workflow work”

You can watch the latest investor video here.

Aura energy [ASX: AEE] [GR: VU1] (OTC: AUEEF)

Aura Energy is a mining company founded in Australia that owns one hundred percent of the polymetallic and uranium projects with significant resources in Sweden (the Huggon project) and Mauritania (Tiris project). Aura focuses on the H-ggon project, located in the Swedish province of Alum Shale, one of the world’s largest vanadium custodians.

On August 4, Aura Energy announced: “June Quarterly Report.”

On August 10, Aura Energy announced:

Aura files before the Supreme Court of Victoria.Aura Energy Limited to inform shareholders that the Company has filed documents with the Supreme Court of Victoria to initiate proceedings (Process) alleging violations of the 2001 Corporate Act [Cth] through THE ASEAN Deep Value Fund [ASEAN] Array.

The Silver Elephant subsidiary acquires the Bisoni Vanadium project together with Gibellini. Silver Elephant Mining Corp. announces that its wholly owned subsidiary Nevada Vanadium LLC (“Nevada Vanadium”) has entered into a Definitive Asset Acquisition Agreement (“APA”) with CellCube Energy Storage Systems Inc. (“Cellcube”) to obtain the Vanadium Bisoni Project (Bisoni Project) located southwest of the Gibellini allotment in Nevada Vanadium. Subject to APA terms and conditions, Nevada Vanadium obtains the allocation of Bisoni through its parent company Silver Elephant by issuing four million non-unusual shares of Silver Elephant and paying $ 200,000 in cash to Cellcube at closing. . In addition, Silver Elephant will make a one-time payment to CellCube of $ 500,000 of non-unusual shares of Silver Elephant, worth a value of European vanadium pentoxide in excess of $ 12 according to the pound for 30 consecutive business days, no later than the 31st December 2023. The acquisition is expected to close in September 2020 and is subject to final approval through the Toronto Stock Exchange. Together, the Gibellini and Bisoni assignments contain a total of 93 four contiguous claims over a 20.7 km duration (NE-SW) covering four3.4 square km (four, 342 hectares).

You can see the latest presentation for investors here.

Vanadium Resources Limited [ASX: VR8] (formerly Tando Resources [ASX: TNO])

Vanadium Resources is a junior exploration company created to explore and expand gold, zinc, lead, copper and mining mining opportunities. Vanadium Resources owns 74% of a world-class vanadium project, the Steelpoortdrift [SPD] project in Gauteng Province, South Africa.

On 31 July, Vanadium Resources Limited announced: “Trade Report – June 2020. Highlights include:

You can see the latest presentation for investors here.

King River Resources [ASX: KRR] (formerly King River Copper)

King River has 785 square kilometers of mining rental covering an exclusive geological feature in Western Australia’s eastern Kimberley, called Speewah Dome. However, the company states on its website: “King River Copper Limited is the exploration of gold, silver and copper.” , their deposits also contain vanadium.

On August 18, King River Resources announced:

SPP finished. King River Resources Limited will announce that the Securities Purchase Plan [PSP] has been completed and that applications totaling $7,861,240 have been received. “

You can see the latest presentation for investors here.

Vanadiumcorp Resource Inc. [TSXV: VRB] [GR: NWN] (OTCPK: APAFF)

Vanadiumcorp Resource Inc. owns one hundred percent of Lac Dore Vanadium-Fer-Titane’s allocation in Quebec, Canada. The company also holds royalties on the Raglan Nickel-PGM mine. The company seeks to adopt a vertically incorporated technique and also develops procedural technologies, “VanadiumCorp-Electrochem Processing Technology” and “Electrochem Globally patented Electrowinning”.

On August 11, Vanadiumcorp Resource Inc. announced:

VanadiumCorp publishes the final effects of Davis tube testing in Lac Doré, Quebec, adding thirteen m, a 30.5% magnetic to 1.65% V2O5Array …

You can see the latest presentation for investors here.

First Vanadium Corp.(CCCCF) [TSXV: FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

The Cornerstone Carlin Vanadium Project is home to one of North America’s largest number one vanadium deposits in Nevada. His West Jerome assignment targets a large-scale high-grade zinc and copper deposit in Arizona. Carlin has an old inferred resource from 28 Mt to 0.525% V2O5 (2010 SRK).

There are no novelties similar to the vanadium of the month.

Investors can see the company’s latest presentation here.

Thank you for reading the article If you need to register with Trend Investing to learn about my most productive investment ideas, the latest trends, exclusive interviews with the CEO, a chat room for me and other complicated investors aimed at renewable energy and the electric vehicle and metals sector. You can get more information by reading “The Difference in Trend Reversal”, “Subscriber Reviews on Trend Investment” or signalal here.

Latest articles: