\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

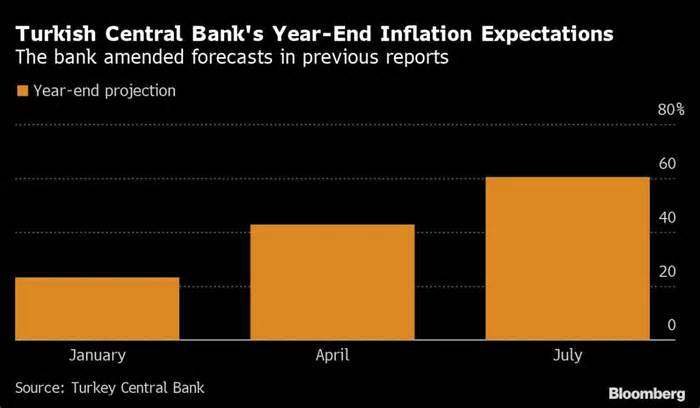

(Bloomberg) – Turkey’s central bank is likely to raise its year-end inflation projection following a series of unorthodox interest rate cuts that have pushed up costs, but few are likely to take it seriously.

Most read from Bloomberg

The new Covid reinforcements are nothing more than the old ones, according to a study

Adidas breaks ties with Ye and absorbs 250 million euros in profits

These are the most esteemed cities in the U. S. for tenants right now

Blinken warns of whether nuclear weapon is used in Ukraine

Once the focus of Turkey’s economic calendar, the quarterly inflation report has been negligible because the bank has continuously painted an overly optimistic picture.

On Thursday, Governor Sahap Kavcioglu is expected to review the benchmark customer value situation for the next two years, even as he moves toward a single-digit rate cut next month amid pressure from President Recep Tayyip Erdogan over ultra-low borrowing costs.

“The bank’s projections have no chance of holding,” said Senol Babuscu, a professor of finance and banking at Ankara’s Baskent University, adding that he expects his year-end inflation estimate to be successful at around 70 percent, based on his own forecast of around 80 percent. percent.

The bank’s latest report in July forecast inflation would end the year at 60. 4%, well below economists’ expectations. Bloomberg Economics calculated at the time that year-end inflation would be 69% and now sees it at 75%.

What Bloomberg Economics says. . .

“The central bank’s track record indicates an underestimation of inflation of 13% in recent years and 10% in the longer term. Given this bias, a very likely prognostic diversity of 65% to 68% is suggested, above the prognosis of 60. 4%. conducted in July, but still well below our estimates. Base-effects attendance value gains fall from their 24-year high, but not as temporarily as the government expects.

–Selva Bahar Baziki, economist. Click here to learn more.

Since July, the central bank has cut interest rates through 350 fundamental issues, to 10. 5% last week, even as inflation soared to more than 83% in September.

Shock rate cuts are coming to an end in Turkey after the biggest move to date (1)

Turkey has boosted economic growth by capitalizing on a weak lira to make its exports more attractive, but its set of policies has done little for value stability. The lira has lost only about 50% of its value against the dollar over the past year. .

Depreciation encourages consumers to anticipate their purchases and flock to hard currencies for their savings, creating a vicious inflationary cycle.

Kavcioglu blamed the price increase on the “delayed and oblique effects of emerging energy costs” after Russia’s invasion of Ukraine in February. He said inflationary pressures will ease once “an environment of world peace is achieved. “

Instead of an orthodox policy, the bank relied on marginal and oblique measures to manage lending expansion and announce wider use of the currency.

“It’s not just the inflation report that’s insignificant, the central bank itself is also insignificant,” Babuscu said.

Most read from Bloomberg Businessweek

What is the advance of Alzheimer’s drugs for other diseases?

The fantasy of surrender implodes

From bedrooms to kitchens, Europe wonders what it’s like too

10 conclusions from Matt Levine’s “The Crypto Story”

California tech millionaires can’t agree on tax to fund electric vehicles

©2022 Bloomberg L. P.