n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Turkey’s most sensible policymakers will meet with investors in New York to convince them to start buying domestic assets again and that a dominant new monetary strategy is here to stay.

Most on Bloomberg

Google lays off many hardware and voice assistant teams

SEC Clears Bitcoin-Spot ETFs in Crypto Breakthrough

These are the strictest passports in the world in 2024

Amazon Twitch to 500 employees, or about 35% of the workforce

SEC Says FBI Investigating Agency’s X Account Compromise

The event, which will be held Thursday at JPMorgan Chase headquarters

Finance Minister Mehmet Simsek, appointed along with central bank governor Hafize Gaye Erkan in June as part of the reshuffle, has been added. The event, which Erkan will attend in person, was aimed at instilling more confidence in investors, many of whom are unsure whether the upgrade is set in stone. Erdogan has long opposed top interest rates and fired financial officials he deemed too aggressive.

Investors approved of Erkan’s financial tightening, which raised Turkey’s main interest rate to 42. 5%. But many demanding situations persist and the lira weakened to 30 to the dollar for the first time ahead of the event. JPMorgan’s own analysts said on Thursday that they expect the coin to fall to 36 by the end of 2024, up from their previous forecast of 34.

Some Turkish regulations further complicate the selling point for Erkan and Simsek, who have held senior positions on Wall Street. Restrictions in the offshore lira transfer market, designed first and foremost to deter short sellers, hamper investors’ ability to protect their exposure to Turkey. .

“The challenge right now is that the cost of hedging the currency threat is very high, around 40%,” said Grant Webster, portfolio manager and co-head of emerging markets at Ninety One in London. “Investors want to make a long-term decision: This is straightforward in Turkey, given the recent history of political mistakes. “

However, Turkey now has the local currency yields among the top emerging countries, according to Bloomberg’s Emerging Markets Local Currency Governments Index, which tracks 18 countries, adding China, Brazil, Mexico and South Africa.

Erkan has said this may be the most optimal time to enter the Turkish debt market, citing plans for a more “moderate” policy environment to come.

Read more: Turkey helps keep investors on hold as it trades checks to keep them in position for now

Lingering doubts

Investors have lingering doubts about how long the truce between Erdogan and markets will last, according to Webster. A 2020 episode, when Erdogan appointed a technocrat central bank governor after years of unconventional policies, lasted just four months.

There is “tremendous” confidence in the central bank and the finance ministry as they have been created lately, he said. “The challenge remains how long they will stay in their positions – investors have been burned in the past. »

Erdogan has already advocated reasonable loans to spur expansion and its proximity to elections, and a local vote is scheduled for March. He said he had “full confidence” in the economic team.

Still, Brendan McKenna, an emerging-markets economist and currency strategist at Wells Fargo Securities LLC, said a demonstration of even higher rates could simply breathe life into confidence.

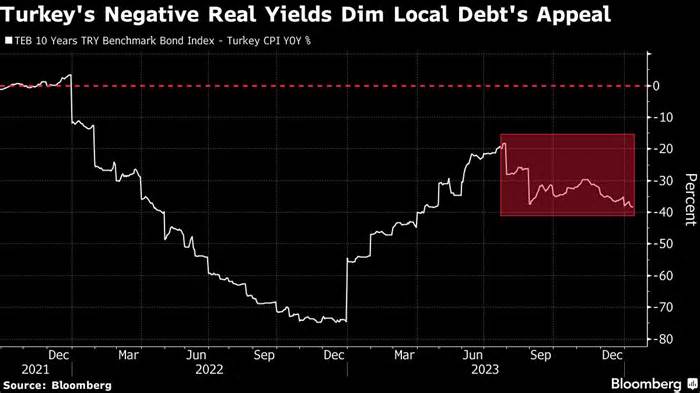

“Real rates remain deeply negative and high enough to buck the current trend in inflation,” he said. “If they are not adjusted further, there is also a risk of squandering credibility, which can lead to further depreciation of the pound and push inflation even higher. “

Inflation accelerated to 65% in December and the central bank expects it to exceed 70% in the coming months. The general consensus among economists is that the bank will raise rates to 45% in January, marking the end of its tightening cycle.

Erkan argued that investors are not focused on existing inflation, but on the central bank’s projections that it will slow to 36% by the end of the year.

In a note, JPMorgan analysts, adding Fatih Akcelik, said bond investors are waiting for lira yields to rise or inflation dangers to subside.

Read more: Inflation in Turkey ends the year at around 65%, with a peak in a few months

“For foreigners to return they need to see patience, because this is going to take a long time to unwind,” said Ninety One’s Webster. “It’s not going to be painless.”

–With those of Ugur Yilmaz and Inci Ozbek.

(Updates with the lira and JPMorgan report).

Most read Bloomberg Businessweek

Trumponomics 2. 0: What to expect if Trump wins the 2024 election

U. S. Uses New Economic Tools to Rein in China’s War Machine

How AI replaced the metaverse as Zuckerberg’s top priority

Five ETFs to watch in 2024

Elon Musk’s alleged drug use is under the microscope

©2024 Bloomberg L. P.