\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) — As many investors turn to methods that take advantage of lowering interest rates in Latin America, some major banks warn it’s too early to claim victory over inflation.

Most read from Bloomberg

In defeat, Cheney vows to do “whatever it takes” to block Trump

The $7 trillion pension crisis is getting worse

Saudi billionaire earned $500 million in Russia at the start of the war

Bill Gates and the Secret Push to Save Biden’s Bill

These six cities are emerging as new hotspots for expats

Bank of America Corp. said rates in the region could remain at high levels longer than markets expect, and it’s worth holding positions that take advantage of higher rates in countries like Mexico and Chile. Goldman Sachs Group Inc. said investors should be selective in adding receivers — positions that take advantage of a rate cut — because the value expansion has not peaked.

The rate-cut bets came after lower-than-expected U. S. inflation fueled hopes of a less competitive tightening through the Federal Reserve. Latin America has been the most popular destination for such bets, as the region’s central banks have been among the first to start raising rates and may be the first to make cuts, with Brazil being the ultimate productive example.

“While the beginning of the curve more or less aligns with our view of the financial policy path, we continue to say that the market is valuing too many cuts too quickly,” BofA analysts Claudio Irigoyen and Christian Gonzalez Rojas wrote. note this week. ” Therefore, our view is that the risk-reward ratio of mitigating accommodative market fluctuations is attractive. “

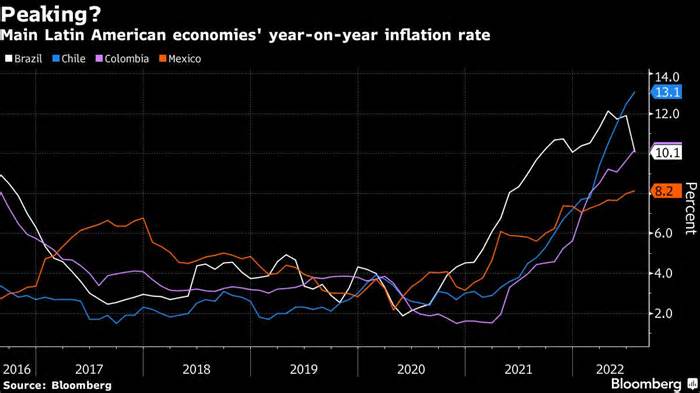

Swap rates in primary emerging economies have been trending downward since last July, when fears of a global recession intensified. runaway inflation.

Some of the biggest falls in exchange rates have been noted in Latin America, where the adjustment cycle is at a more complex level in many countries. from last month.

In Chile, Colombia’s two-year Camara rate has fallen by 70 base issues from a peak in mid-July, while Colombia’s IBR rate of the same adult age has fallen by around 120 base emissions during the same period. ITIE failed in 65 basic problems over the past month.

However, inflation in those countries remains at multi-year highs, well above the central bank’s target and is starting to fall in Brazil.

For BofA, recent moves open up an opportunity to pay rates in Mexico, which is not expected to close its rate differential with the U. S. In the U. S. in the short term, and in Chile, where inflation continues to accelerate. curve, since markets are front-loading cuts.

Others, Barclays and BBVA, have also warned that they oppose hasty bets on falling Mexican rates.

“Inflation will have to peak for there to be a more sustained and broader recovery in local emerging market rates,” Goldman analysts, who added Kevin Daly and Tadas Gedminas, wrote in a note this week. “While we expect inflation in Latin America and CEEMEA to peak in the coming months due to the base effects on energy and food prices; however, it is expected to remain high for longer than seemed likely in the past. “

Brazil appears to be the exception, where most agree that the rate cut is justifiable given the central bank’s recent guidance. After raising rates by 11. 75 percentage points since the beginning of 2021, policymakers noted that the cycle could be over and investors cut their bets on a final walk in September.

“Countries like Brazil and Mexico, especially the former, appear to be more complex in the rate hike cycle than all emerging markets,” said Todd Schubert, head of steady revenue source studies at the Singapore bank. -term in Brazil and favor the receivers of change in Brazil. “

Most read from Bloomberg Businessweek

Whole Foods’ War on black Lives Matter mask has a lot at stake

Andreessen Horowitz believes it’s time for Adam Neumann to build

China borrows and collects savings, threatening the engine of global growth

Being kicked off social media ended up ending Alex Jones’ career. This enriched him even more.

Women break the concrete roof of the structure while the scarcity of hard work leaves a void

©2022 Bloomberg L. P.