n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Middle East Corrugated Packaging Market Retail Value Of Online Sale

Dublin, January 27, 2024 (GLOBE NEWSWIRE) — The report “Middle East Corrugated Packaging Market Share and Size Analysis: Growth Trends and Forecasts (2023-2028)” has been added to ResearchAndMarkets. com’s offering. It was valued at USD 6. 42 billion in the last year and is expected to register a CAGR of 2. 58%, reaching USD 7. 44 billion tonnes in the coming years.

Reflexes

Corrugated products protect the storage and transportation of fragile, heavy, bulky, or high-value items. Multi-layer corrugated packaging adds rigidity to packaged products, making them more powerful than regular corrugated cardboard. The market is developing to meet the demand for corrugated products. in the structural and electronics industries.

The market for corrugated packaging products is expanding in the Middle East, mainly due to the growing awareness of the desire to reduce the carbon effect of classic packaging materials. Reduce the use of non-renewable resources by restricting waste generation in the country, the Qatari government has introduced several green economy systems under the National Vision 2030.

Strict enforcement of legislation banning single-use plastics in the UAE, Saudi Arabia, and other countries has increased the need for environmentally friendly packaging solutions, especially paper. The demand for ready-to-eat food is on the rise due to people’s busy lifestyles. Since corrugated packaging helps keep moisture away from products and resists long shipping times, corporations are adopting it to provide greater effects to customers, especially as a secondary or tertiary packaging medium.

The reliable, durable, and easily transportable corrugated boxes have been around for over a few years. However, longevity comes with challenges. Corrugated cardboard is made from cellulose fibers, virgin or recycled from used corrugated cardboard or other materials. The corrugated board industry is challenged with soaring raw material prices and bottlenecks in raw material supply. Severe shortages and unprecedented price increases push manufacturers to the brink of closure.

The COVID-19 pandemic has had a negative effect on the packaging industry, leading to lockdowns, companies moving to China, and a reconsideration of packaging materials. Despite a significant effect on the supply of packaging, the abundant growth in the number of end-users The call for express programmes has especially broadened the scope of the corrugated packaging industry.

Middle East Corrugated Packaging Market Trends Food Segment Expected to Witness Significant Growth

The food industry is one of the largest consumers of packaging in the region. The region is witnessing a peak rate of consumption of packaged food and beverages, due to immediate urbanization and an increasing number of tourists and expats who prefer safer processed foods. In addition, the region has strict regulations for food and beverage packaging.

The tourism sector in the region’s countries is gaining traction after a dip in 2020. According to Ahmed Al-Khateeb, Minister of Tourism, Saudi Arabia has targeted 25 million international tourists in 2023. Additionally, the country is investing capital in enhancing its tourism infrastructure.

According to the World Travel & Tourism Council, the economic contribution of capital investment in tourism in the UAE is estimated at AED 74. 4 billion ($20. 26 billion) in 2028, up from AED 27. 8 billion ($7. 57 billion) in 2018. With the building in addition to the number of tourists in the region, there is a commensurate increase in food delivery facilities and an increase in the sale of packaged food, which would possibly help the market during the forecast period.

In addition, the growing demand for packaged foods in the country is expanding the demand for corrugated packaging in the countries studied. According to Interpack (a trade fair for the packaging industry), the Middle East accounts for five percent of the global consumption and business of packaged goods in the country. The region is developing rapidly.

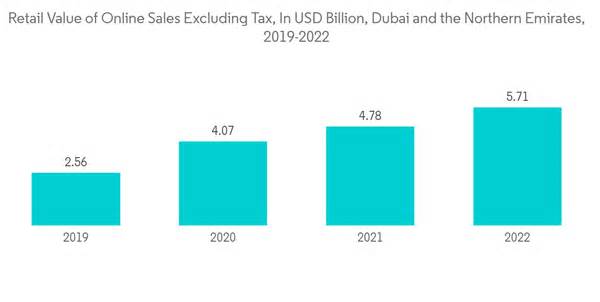

Moreover, food retail has the largest percentage in the UAE retail market and is expected to continue to be the dominant market sector. According to the U. S. Department of Agriculture’s Retail Food Report,In the U. S. , online grocery retail sales saw a physically powerful expansion in 2019, amounting to $2. 557 billion. The price rose further to $5. 705 billion in 2022. Therefore, the demand for corrugated packaging is expected to increase due to the upward trend of online retail sales in the region.

The region is witnessing a rise in the consumption of processed food, fresh produce, and meat sectors. New food growth in the country continues to be fueled by health and wellness trends and the increase in consumer concerns. Additionally, population growth would be the key driver behind the demand for fresh food during the forecast period.

A variety of corporations analyzed in this report include

Arabia Packaging Co. LLC

Queenex Corrugated Factory

United Corporation of Cardboard Industries (UCIC)

Napco National

Falcon Package

Cepack Group

Worldwide Package Industries LLC

Universal of carton industries.

Green Packaging Boxes Ind LLC

Tarboosh Packaging Co. LLC

Unipack Packaging & Carton Products LLC

Al Rumanah Packaging

For more information on this report, https://www. researchandmarkets. com/r/j8n1r2

About ResearchAndMarkets. com ResearchAndMarkets. com is the world’s leading source of market research reports and foreign market knowledge. We provide you with the latest insights into foreign and regional markets, key industries, largest companies, new products, and latest trends.

Attached you

Middle East Corrugated Packaging Market Retail Value from Online Retail