Schlumberger’s recent combination of the OneStim (NYSE: SLB) business with Liberty Oilfield Service (NYSE: LBRT) has created a colossus in hydraulic fracturing in North America. This seems like a lot, however, it should be noted that the entire fracture market in the US is not a problem. UU. se has recently consisted of 85 spreads as of September 11, representing an active fleet of approximately 17 for Liberty, or a device usage rate of 15% to approximately 30K HHP compatible with the extension.

Liberty

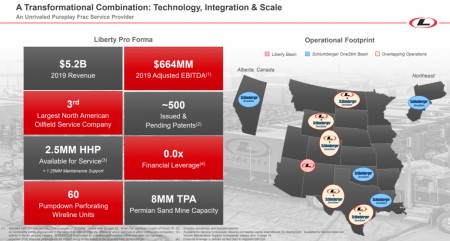

The previous slide shows bullish statistics in terms of profit and EBITDA, if the mix had been in effect for vital 2019. Es that investors do not forget that we are in 2020 and that the overall one is different, because the number of fracture spreads. and the WTI value indicated in the chart below.

I hope OPEC will replace its planned production increases for the fall to avoid a total collapse in the value of oil. This, coupled with sharp declines in US shale production, is a strong decline in the number of us. to more than $30 and pave the way for a really big value building later this year and in 2021.

As a benchmark, any of the corporations reported negative unscathed EPSs for the first part of 2020 due to asset impairments. In this article, we’ll talk about some of the points that have made this combination attractive to both corporations. The optimism that has resonated among investors, that is, with regard to the movement of 40% in one day of LBRT, is gently justified by what the market is telling us about the part of the moment of 2020. slate.

Related: This small nation is building the world’s next great energy center

As a benchmark, any of the corporations reported negative unscathed EPSs for the first part of 2020 due to asset impairments. In this article, we’ll talk about some of the points that have made this combination attractive to both corporations. The optimism that has resonated among investors, that is, with regard to the movement of 40% in one day of LBRT, is justified by what the market is telling us about the part of the moment of 2020. the decline of the shale.

Wsj

Schlumberger “Asset-lite”

In an OilPrice article in July, I discussed the conversion of the classical technique of oilfield service to a new “active-light” style. This style shifts the focus from the muscle old men and the big machine mode to a style that emphasizes synthetic intelligence, AI; and cloud-backed software solutions. Hands-on paintings from the platform to remote operations centers in real time where a small number of engineers monitor well operations and provide operational support. call.

The source

Given the evolution of its clients for the long-term oil services-FSS, this resolution has not been a surprise, after taking $12 billion in non-monetary commissions by the semester ended June 30 and pronouncing the permanent dismissal of 20% of its workforce, it is transparent that Schlumberger sees a very different technique in the area of long-term OFS delivery.

This move for them is a hat-trick. They move all the fracture assets reported in Liberty books with the few active spreads they had, as well as the other OneStim assets shown on the slide below. They get 37% of the U. S. fracking company. Dominant resulting and some seats on its board of directors. This is a very sensible resolution on the component of Schlumberger’s new CEO.

Liberty expands its fracking footprint

Liberty President and CEO Chris Wright discusses what’s new in the company he founded.

“This transaction will be a transformative step in our adventure as a company. Our expanded generation portfolio and the breadth of our operations will allow Liberty to further elevate our top bar for secure, innovative, effective and ESG-minded division operations. before the OneStim team meets Liberty as a component of our project for consumers to deliver cheap, blank oil and fuel to our country and the world.

The source

LBRT’s thesis

To be interested in LBRT as an investment, you need to know that things are about to improve in the US oil field. But it’s not the first time I’ve already explained in previous articles about OilPrice why I think this is about to happen. Three-quarters of the year behind us. , there is no option to reactivate drilling and terminations that will update the value of US production. U. S. down. Like the last count of the Baker Hughes platform, there are only 254 platforms that are turning right to drill new wells right now. This does not update the sharp decline in shale wells, which can fall to 60% of their production in the first year.

I have already forecast a 2020 output production rate of approximately five mm of BOEPD for shale wells, and I see nothing that can replace this result. The main thing is that U. S. production will fall sharply soon due to a lack of new drilling.

With its leading presence in the fracturing sector, at an uptick in U. S. oil activity, LBRT will be the largest beneficiary.

Your takeaway

In the coming months, there is nothing in this agreement between Schlumberger and Liberty to expand the market. I don’t see a catalyst for better oil costs until there’s a sharp recovery in the economy, Congress takes some kind of stimulus and we particularly our defenses opposed to the Covid-19 virus.

Until then I think the new LBRT will liquefi the same as the previous one and become neighborhoods without brightness, I do not see that the existing value is invertible, even though the LBRT has risen by 6. 5% today. Practically news-free. There is no rational basis for the company’s gigantic movement since the announcement of the agreement, and I think there will be higher profits in the coming weeks and in the fourth quarter.

Patience in making an investment can generate big dividends here.

By David Messler for Oilprice. com

More maximum Oilprice. com readings:

Read this article in OilPrice. com

This story gave the impression to Oilprice. com