n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

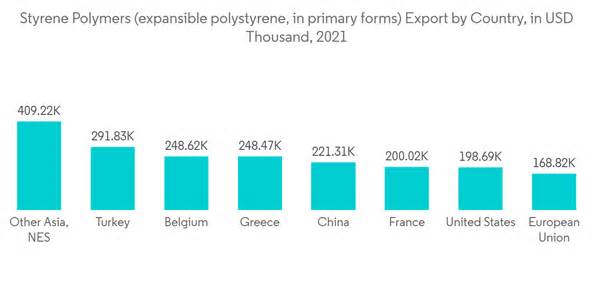

Ethylbenzene Market Styrene Polymers Primary Expandable Polystyrene Export Across Country in Thousands of Dollars 2021

Dublin, March 26, 2024 (GLOBE NEWSWIRE) — The report “Ethylbenzene: Market Share Analysis, Industry Trends & Statistics, Growth Forecast 2019-2029” has been added to the ResearchAndMarkets. com offering. The length of the ethylbenzene market is estimated at 34. 95 million tonnes in 2024 and is expected to reach 40. 56 million tonnes by 2029, with a growth of 3. 03% in the forecast period (2024-2029).

The market was adversely affected by COVID-19 in 2020. However, the market rebounded especially in the period 2021-2022, and automotive production and production activities restored the demand for polymers and other ethylbenzene-based products, adding dashboards and external coatings for automobiles. , styrene-acrylic emulsions, solvents and reagents for paints and coatings, among others. The pandemic has increased the demand for packaging by the food and e-commerce sectors, thus driving the demand for the market studied.

The increasing demand for styrene by end-user industries and the increasing use of ethylbenzene in natural fuel recovery are expected to drive the expansion of the market.

On the other hand, strict regulations related to the use of ethylbenzene will likely slow down the expansion of the market studied.

The application of ethylbenzene as a solvent and reagent in the production of products, such as paints and coatings, adhesives, and cleaning products, is likely to provide additional expansion opportunities for the market.

Asia-Pacific dominated the global market, with the highest intake coming from countries such as China and South Korea.

Styrene production to dominate the market

The production of styrene will affect the demand for ethylbenzene in the market. Styrene is a precursor to several commercial polymers, such as acrylonitrile-butadiene-styrene, polystyrene, styrene-butadiene elastomers and latex, styrene-acrylonitrile resins, and unsaturated polyester.

The aforementioned polymers, elastomers, and styrene-based resins locate a wide diversity of applications in end-user industries, such as electronics, packaging, agriculture, petrochemicals, and construction. Polystyrene is basically used in disposables, packaging and cheap products for the customer.

According to the World Bank, in 2021, the largest exporters of styrene polymers were the Netherlands ($620,100. 91 thousand), Turkey ($291,832. 22 thousand), Belgium ($248,619. 88 thousand), and Greece ($248,471. 97 thousand).

According to the OEC, in September 2022, China’s exports of styrene polymers accounted for $73. 9 million. Between September 2021 and September 2022, China’s exports of styrene polymers increased by $21. 9 million (42. 1%), from $52 million to $73. 9 million.

According to the World Bank, US exports of styrene polymers (expandable polystyrene) in its number one bureaucracy amounted to 198,686. 76 thousand dollars and an amount of 97,729,500 kg.

India’s imports of cyclic styrene hydrocarbons amounted to 907. 04 kilotonnes in the 2021-2022 fiscal year, and the intake is most likely to increase in line with the growing demand in the country.

The demand for styrene continues to grow due to the increasing demand for rubber tires. According to the European Rubber Journal’s annual global industry survey, sales of China’s smartest suppliers increased by 30% year-on-year in 2021 to $1. 561 billion. . More is expected to accumulate over the next year.

Asia-Pacific Region to Dominate the Market

The Asia-Pacific region dominated the global market share. With the expansion of the structures and packaging industries and the creation of programs such as solvents and reagents in paints and coatings, dyes, fragrances, inks, and artificial rubber in countries such as China, India, and Japan, the use of ethylbenzene has increased in the region.

Ethylbenzene is basically used for the production of styrene, which is then processed into polystyrene, a primary raw material for packaging products. According to the India Brand Equity Foundation, India is becoming a key exporter of packaging fabrics in the global market. Exports of packaging fabrics increased to $1,119 million in 2021-2022 from $844 million in 2018-19. This increase in the demand for packaging within the country is driving the demand for the market studied.

With expanding investments in public infrastructure, renewable energy, infrastructure, and advertising projects, the structures sector is expected to grow at a moderate pace in the coming years, which will improve customer and investor confidence and in turn increase the demand for ethylbenzene in the forecast period.

A variety of corporations analyzed in this report include

Carbon Holdings Limited (Cairo)

Changzhou Dohow Chemical Co. , Ltd.

Chevron Phillips Chemical Company LLC

Cos-Mar Company

Dow

Guangdong Wengjiang Chemical Reagent Co. , Ltd.

Honeywell International Inc.

INEO

j

LyondellBasell Industries Holdings B. V.

LLC “Gazprom Neftekhim Salavat”

PJSC “Nizhnekamskneftekhim”

Rosneft

Shanghai Myrell Chemical Technology Co. , Ltd.

CJSC “Sibur-Khimprom”

TCI Chemicals (India) Pvt. Ltd. Limited.

Versalis S. p. A.

Westlake Chemical Company

For more information on this report, https://www. researchandmarkets. com/r/p86vqq

About ResearchAndMarkets. com ResearchAndMarkets. com is the world’s leading source for foreign market research and market knowledge reports. We provide you with the latest knowledge on foreign and regional markets, key industries, larger companies, new products, and the latest trends.

Attached

Ethylbenzene Market Styrene Polymers Primary Expandable Polystyrene Export Across Country in Thousands of Dollars 2021