\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

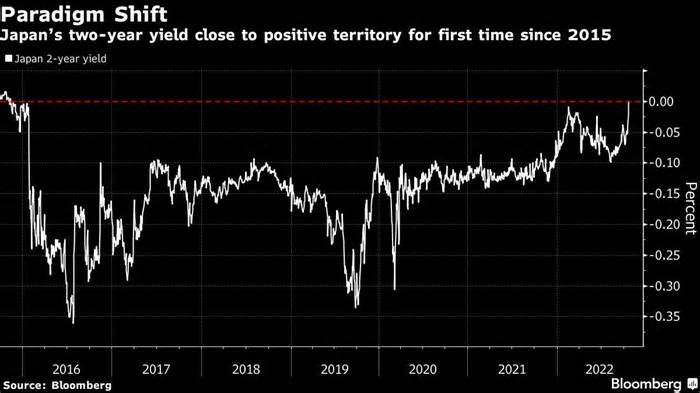

(Bloomberg) – The era of negative-yielding bonds appears to be about to end, with Japan’s two-year yield on the brink above 0 for the first time since 2015.

Most read from Bloomberg

China’s fall as leadership review disappoints traders

Tenants manage to break the sudden reversal point for landlords

Dove and Unilever dry shampoos recalled due to cancer risk

Korean Air overtakes runway as it lands in the Philippines

Stocks Continue to Rise as Tech Gains Loom: Markets Close

The short-term yield rose to minus 0. 005% on Monday, reflecting growing bets that the Bank of Japan could be forced to stick to its global peers and tighten policy as pressure on the value mounts and the yen collapses to its lowest point in 32 years. The BOJ meets later this week and while economists don’t see any policy changes, bets on tightening have risen this month.

Bond Vigilantes revives bets on a warmongering policy in the BOJ

The BOJ is the latest evolved central bank to keep interest rates lower to stimulate the economy and its key short-term rate remains at minus 0. 1%. BOJ Governor Haruhiko Kuroda has made it clear that he does not aim to convert politics.

One of the boldest economic experiments of the twenty-first century, negative interest rates were followed in Europe and Japan after central banks realized that excessive measures were needed to stimulate economies still suffering years after the economic crisis. The concept was to lower loan prices and prevent lenders from playing with cash accumulation.

But the step back from skyrocketing inflation meant abandoning the experiment, with the European Central Bank exiting negative rates in July and Denmark, the first to go below 0 in 2012, taking its benchmark back into positive territory in September. Now Japan remains.

There, inflation hit 3% for the first time in more than three decades, excluding the impact of tax increases, an acceleration that raises doubts about the need for additional central bank stimulus.

The overall market price of negative-yielding international debt has fallen to just under $1 trillion and is made up entirely of short-term Japanese securities, according to a Bloomberg index. measures to deal with the coronavirus pandemic.

–With that of Hidenori Yamanaka.

(Update the price of the negative retracement index. )

Most read from Bloomberg Businessweek

The fantasy of surrender implodes

What is the advance of Alzheimer’s drugs for other diseases?

The personal jet that drove a hundred Russians away from Putin’s war

Female bosses face new prejudices: painters refuse to paint overtime

Europe’s Most Valuable Tech Company Tries to Make Chip Wars

©2022 Bloomberg L. P.