Yale’s saliva-based coronavirus funded by the NBA gets emergency fda approval.

Is BioReference on the front line to use this new check because of what you have provided?

Will Rayaldee be an effective remedy for COVID-19?

Last Saturday, Yale University announced that the FDA had legalized the emergency use of its pin check, known as SalivaDirect. What is not commonly discussed is that BioReference Labs helped verify this product in the real world. Is BioReference on the front line to use this new check because of what you have provided?

OPKO Health’s BioReference Labs (OPK) is the third largest provider of laboratory diagnostics in the country, but that doesn’t mean it’s a third-tier company. During this fitness crisis, this small testing team not only meets tens of thousands of COVID-19 diagnostic tests consistent with the day, but has also gained a market consistent with a percentage and won contracts with governments, sports leagues, and corporations in the United States.

This article will review last month’s recent developments. If you have a broader overview, read my recent article on OPK here.

First, let’s go over some progress with the company.

Dr. Jon Cohen has been appointed to the Board of Directors. To help the promotion, it was awarded 2.1 million inventory features that will be purchased in tranches over 4 years. This is wonderful news because Dr. Cohen has proven to be a leading executive in this crisis and those features hold him in the business for the foreseeable future.

In July, the CDC awarded OPK an indefinite-to-indefinite delivery contract (IDIQ) award for an indefinite amount to supply COVID-19 antibody controls. This was overshadowed by the announcement on the same day of a contract with the NFL to verify all players and employees. While the NFL was perfect for advertising, the CDC contract monetized an unused capability. BioReference has the ability to run 400,000 antibody controls consistent with the day. He used fewer of them consistently with the month in the second trimester. The contract will particularly increase revenue in the third quarter and end in November.

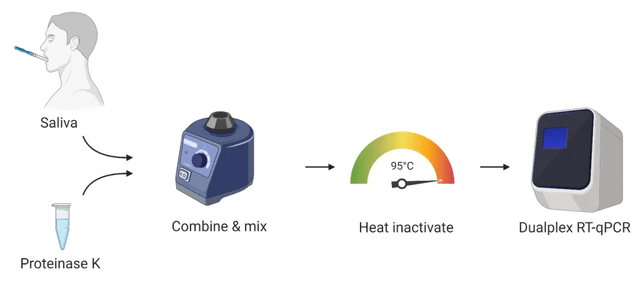

Yale administered the saliva test to an organization that included NBA players and before the league returned to the game and, by comparison, the effects of the nasal swab tests performed by the same organization. The effects were almost universal, according to published studies that have not yet been peer-reviewed.

This new approach eliminates the requirement of a viral transport medium (TTM) because all that is needed is saliva and high temperature. VTM has been one of the main constraint points due to the limitations of the source chain. This will also be the charge of the check fee VTM kit.

The Yale ignores the desire to extract RNA from the sample, accelerating and trimming the process load. This reduces the intake of reagents, which are rare.

Together, this will be consistent with a CLIA-certified lab consistent with implementing this test approach to develop its functions while lowering prices according to the test.

Dr. Jon Cohen, director of BioReference Laboratories, has stated that the lack of control consumables (TMV, reagents, etc.) is the main constraint to expand the number of controls BRL can perform according to the day. Yale verified SalivaDirect with laboratory appliances and reagents from various suppliers to validate its effectiveness in industry offerings.

The NBA Bubble Lab Verification Entity is NOTHING more than OPK’s BioReference Labs, which employ about a hundred others on site.

Yale and the NBA have already spoken to a national lab company about generating robots to speed up test processing, Resources said. Both parties are interested in the possibility of performing saliva tests in the pool, combining samples from other people and testing them together. (Any positive result would require an individual test).

Since BioReference is the corporate lab that performs PCR testing on nasal swabs, it makes sense that BioReference is the “corporate national laboratory” that studies the use of robot generation for faster testing.

If you are a for-profit organization, we may factor a license. The license will be free, but we will want to negotiate the amount you qualify for the tests. We’ve done this to make it affordable and we want those savings transferred to your customers.

With BioReference inside the NBA bubble and the lab validating the accuracy of salivaDirect, this means that BRL is the first laboratory in the country to use the Yale method. If BRL finds it advantageous, it may be deployed nationwide after obtaining a license.

This new verification approach requires only a few reagent dollars; Yale estimates that you deserve to charge only $10 for each sample. Some experts have said you can charge between $15 and $20. I have a tendency for the experts here. However, if the grouping is used more widely, you can achieve something closer to the initial charge estimate of $10.

The challenge of duplicating or quadrupling the tests and the great knowledge that accompanies it is not a challenge for BioReference. At the beginning of the pandemic, BRL partnered with Salesforce (CRM) and Skedulo to create an app.

Based on the second quarter diagnostic revenue and Dr. Cohen claiming that he had “low to medium $60” income consistent with the check, I estimate that the earnings consistent with the PCR check are lately between $10 and $12.

At first glance, you may not see the benefits of getting this new verification approach for BioReference. But when we think about the strong accumulation in the volume of checks allowed by this new generation, the relief in the advantage consistent with the check will be compensated by the accumulation in the volume of checks. 50,000 daily checks with an advantage of 10 to 12 USD make up less than 100,000 to 200,000 checks with an advantage of $6 to $8.

A biological speculation of the associations observed between ethnicity, obesity and the worst effects of COVID-19 is vitamin D deficiency. The anti-inflammatory and antimicrobial properties of vitamin D come with the maintenance of narrow joints and reduced production of inflammatory cytokines. The great release of cytokines (“storm”) concerned in severe COVID-19. Vitamin D supplementation in randomized placebo-controlled studies showed relief in the threat of acute respiratory tract infection, and associations between vitamin D deficiency and acute respiratory misery syndrome have been reported.

An examination through the organization of runners dr. Prabowo Raharusun showed a correlation in COVID-19 mortality rates based on vitamin D grades. After reviewing its data, it showed that a vitamin D point of 19 ng/ml or less equals one hundred, consistent with a low mortality rate, while vitamin D grades of 34 ng/ml or more equal a mortality rate of 0% consistent with COVID-19.

If Rayaldee proves to be an effective remedy for COVID-19, the revenue and rescue prospects are huge. One analyst projected that Gilead Remdesivir (GILD), the most complex remedy for COVID-19, is expected to have sales of more than $7 billion this year. A small component of this market would be a great victory for OPKO.

In other news from Rayaldee, OPKO’s foreign partner Vifor Fresenius has overcome a major barrier to sales in the EU. Germany has announced the final success of the decentralised regulatory procedure for Rayaldee® in some EU countries. National marketing approvals are now expected in the 2020s portion. OPKO will get double-digit royalties on all sales, plus an additional $52 million in regulatory and launch milestones, and $180 million in sales-based milestones.

Interestingly, Vifor Fresenius has sales rights to Rayaldee in the United States. If you resolve thisArray, you will have to pay OPK $555 million plus tiered royalties.

I see the consultation on the convertible bond and the OPKO prepayment. Let me take a minute to explain this confusing issue for investors.

Bonds generate interest at a rate of 4.50% consistent with an average consistent with a six-monthly annual payment due On February 15 and August 15 of the year, effective August 15, 2019. Bonuses will expire on February 15, 2025, unless converted, redeemed, or purchased. After conversion, promissory note holders will get money, non-unusual stocks or a mixture of non-unusual money and shares, at the company’s choice.

The initial conversion rate will be 236,7424 non-unusual shares for each total capital amount of $1,000 of the Bonds, representing an initial conversion value of approximately $4.22 consistent with a non-unusual equity. The conversion rate is subject to adjustments under certain circumstances. The Company would possibly not repurchase the Negotiable Obligations until February 15, 2022, but would possibly repurchase the Negotiable Obligations as of February 15, 2022 if the last reported sale value of the non-unusual shares was at least 130% of the conversion. Value of tickets for at least 20 trading days (consecutive or otherwise) any trading day of 30 consecutives ending the trading day without delay prior to the date on which the Company issues an inclusive repurchase notice. The value of the repurchase shall be one hundred, consistent with the penny of the principal of the notes to be repurchased, plus the interest accrued and not paid until the date of redemption, but excluding it.

The Company withdraws the bonds until February 15, 2022. However, the TITLE of the bonds would likely request an advance payment when the following situations are met:

Prior to the close of trades on the business day without delay before November 15, 2024, a Negotiable Bond Holder would possibly return all or part of its Negotiable Obligations for conversion in any calendar quarter beginning after the calendar quarter ending March 31, 2019 (and only this calendar quarter), if the last reported promotion value of our non-unusual shares for at least 20 trading days (consecutive or no) the 30 consecutive trading days ending, including, the last trading day of the last calendar quarter is 130% or more of the conversion value for each applicable trading day.