“r. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

Stay informed at a glance with top 10 stories

(Bloomberg) –

Israel’s currency is seen by disconnecting from an economy threatened by a recent increase in Covid-19 cases, according to a major central banker.

The shekel is trading at its most powerful level against the dollar in nine years, hitting it “on the margins of this dynamic window” that the Bank of Israel deems suitable for the currency, Deputy Governor Andrew Abir said Monday in an interview.

Abir attributed much of the recent movement to the dollar’s weakness and said a trade-weighted measure of the currency used through the central bank in “a very close diversity basically since early April. “

“The shekel is at this positive moment about what is happening in Israel, even in terms of lack of budget,” Abir said. “We remain involved in the lack of a budget by 2021. “

After the publication of Abir’s comments, the shekel erased the opposing earnings to weaken to 0. 22% and replaced little from 11:49 a. m. in Tel Aviv.

Driven by an existing account surplus and foreign capital inflows, Israel’s currency has stood out around the world over the past decade. .

It is a political challenge similar to that facing the European Central Bank, which faces the strengthening of the euro in a maximum of two years and a replacement in the strategy of the US Federal Reserve to periodically tolerate faster inflation.

In assessing the outlook, the Israeli central bank’s Research presented two scenarios at the end of August that qualified as positive and pessimistic.

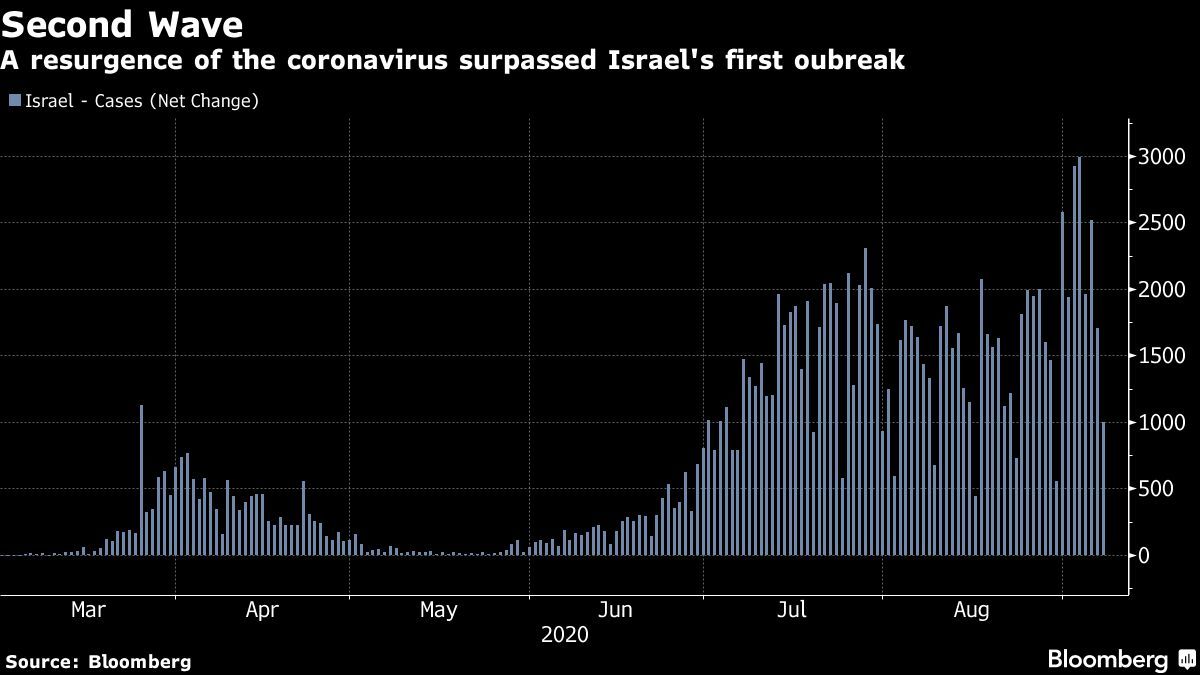

As the country suffers a momentary wave of sustained instances reaching new daily highs last week, Abir said the economy is closer to the pessimistic view that production dropped by 7% this year and will only recover by 3% next year.

“Overall, it turns out that there is a dislocation between money markets and the genuine economy in many areas,” he said. “Shekel is also one of them. “

Given the Bank of Israel’s reluctance to lower interest rates below zero, it has responded by buying dollars at the fastest rate since 2009 to restrict shekel’s profits, which accuses of limiting inflation. 3. 4 per dollar barrier and has since been traded more powerful than this level.

“We wouldn’t want to see a primary appreciation of shekel from those levels,” he said. “This will make it more complicated for the export sector. “

For more items like this, visit bloomberg. com.

Subscribe now to forward with the highest source of reliable business news

© 2020 Bloomberg L. P.