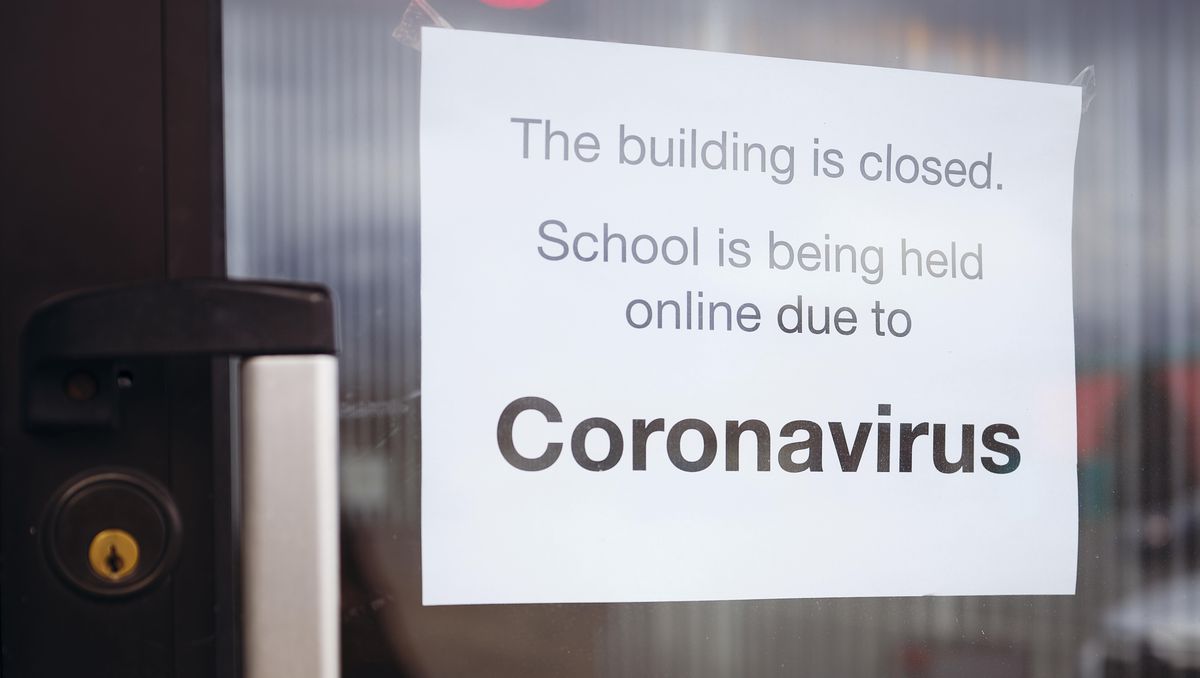

In the daily whirlwind of negative news, investors should be careful not to lose sight of the fact that while Covid-19 has caused difficulties for thousands of companies, defaulting on their debts or declaring bankruptcy around the world, it has also created wonderful profits. Opportunities. With thousands of schools, universities and vocational education centers closed around the world, many of them since February, the desire for online education for educators, parents, academics and lifelong students has never been more urgent.

Covid-19 caused primary disruption in the world of education, but it was a boon for education generation corporations (EduTech). Even when a vaccine opposed to Covid-19 is approved, online education is there to continue filling the gaps in school programs. Online education has helped to succeed in students from marginalized populations, as well as in students with special desires and disabilities. In addition, many parents and educators are likely to use online education to prepare for the next public or herbal fitness disaster.

Whenever a student or consumer asks me for advice, I tell them that the time has passed when other people were going to paint and stay there for the maximum of their lives. I take online courses several times a year to stay up-to-date in my professional field. EduTech corporations serve primarily from kindergarten through grade 12, however, many also offer online education to higher education students as well as those seeking education for their existing or long-term careers.

Khan Academy is the most productive online educator known. It is a non-profit organization whose stated project is to provide “flexible world-class education for everyone, anywhere.” Khan’s courses are for younger and older students. And Edutopia, which is a school base founded through filmmaker George Lucas, is a treasure trove of loose information, adding social and emotional learning, instructor progression and project-based learning.

In addition to those nonprofit online education providers, there are also a number of publicly traded corporations around the world that have everything to gain with the development call for online education for kindergarten students, elementary and higher schools, and schools. and schools and schools for graduate students.

EduTech Companies

Investors in banks and institutional investment firms would do well to learn about publicly traded companies, many of which are in the generation sector’s generation niche (EduTech).

· Arco Platform Limited (ARCE) serves more than 1,360,000 academics and 5,400 personal schools across Brazil, from kindergarten to high school.

· Chegg (CHGG) offers physical and virtual textbook rentals, online tutoring and student services.

· China New Higher Education Group (2001.HK) is an in-person and online provider of vocational training and instructors in seven provinces of China.

· Connections Academy (LSE: PSON, NYSE: PSO) is owned by Pearson, an online company committed to K-12 education.

· Instructure, Inc. (INST) is an online educator for K-12 professionals, schools and businesses.

· Kahoot (KAHOOT-ME. OL) is headquartered in Norway and is an online educator for number one and secondary academics, as well as for business students for life. It was founded in partnership with the Norwegian University of Science and Technology.

· K12 (LRN) provides online instruction, in some cases with in-person instruction, to elementary and high school students. It also focuses on training global languages in Spanish, French, German, Latin and Mandarin.

· New Oriental Education – Technology Group Inc (EDU) is a Chinese company that offers online preschool and grade 12 courses, as well as advice for academics who wish to be examined abroad.

· Perdoceo Education Corporation (PRDO) is an online higher education provider where academics can download undergraduate and graduate degrees.

· Tal (TAL) is a K-12 online tutoring and coaching company in China.

· 2U (TWOU) is a school-generation corporate partnering with universities to exercise higher education and permanent apprentices, especially with technical skills.

The shares and bonds of the aforementioned corporations can be purchased or, in some cases, are components of the exchange-traded budget and the mutual budget. Warn Emptor! Watch out for the buyer. To conduct your own due diligence on the above corporations, do your own studies and/or consult your own monetary advisor.

A smart way to start your research is to look for corporations to analyze their strengths and weaknesses, as well as the opportunities and risks presented to them. In combination, another framework that can help you analyze those corporations is Professor Michael Porter’s Five Forces style of Harvard Business School. This framework is helping you read about supplier strength, buyer strength, competitive rivalry, replacement risk, and the risk of new access that can have an effect on the corporations you’re analyzing. Porter’s style can help you discover the competitive benefits of those corporations.

For more physically powerful business research, I use a business credit framework. The purpose of a corporate credit investigation is to determine whether a company will default and, if so, to what extent a lender would suffer losses. This research includes the identity of the country and the economic points that would possibly have an effect on the industry in question, in this case, school technology. From there, it analyzes the company’s balance sheet, profits and money flows to determine whether the business is successful and liquid enough to continue paying lenders and bondholders.

If, as an inventory analyst, you need to expect the percentage value of those companies, the method has some similarities to the corporate credit framework. Once you reach the balance sheet, revenue source, and money flow table, you can design assumptions to create an existing net cost style for inventory value. Qualitative and quantitative data that will help you perform your FODA, the Five Porter Forces, a corporate credit analysis, or if you expect inventory values, can be found in the previous live links.

I am committed to providing clients with high-quality monetary advice, studies and education on Basel III, threat management, threat-based supervision,

For more than 25 years, I have been committed to providing my clients with high-quality monetary advice, studies and education on Basel III, threat management, threat-based supervision, capital markets, money derivatives and Dodd-Frank. I have extensive global experience and have led projects in the monetary and energy sectors in more than 30 countries in English, Russian and Spanish.