(Bloomberg’s opinion) – There is a bright look at Singapore’s property: cavernous shopping malls; Large work buildings; Expensive condos; Luxury hotels; and hospitals where rich Indonesians and Bangladeshi seek a five-star remedy and visitor service.

But there is also a dynamic market at the non-attractive end of the spectrum: warehouses, factory sheds and, increasingly, knowledge centers. Its owners are genuine commercial real estate investment trusts, which collect rent and pass it on to shareholders. that appeals to an aging population that values more the certainty of divided results than the shame of growth.

Some owners, such as Mapletree Industrial Trust, rank market costs twice as high as their net asset value. Others, such as sabana’s Shari’ah industrial REIT or Sabana’s REIT, the industry at a chronic discount. This column talks about Sabana and how she a vehicle in the crusade of a valuable Swiss investor to make conflicting paintings about shareholder capitalism in a well-mannered and obedient Singapore.

Sabana is among the smallest REIT in Singapore: its 18 houses throughout the island state in general just over four million square feet, but has had major governance and functionality issues. In 2017, Sabana left a genuine property acquired from its then-sponsor under pressure. participants; the CEO of the REIT manager resigned, but the functionality remained poor. In September 2018, Sabana agreed to sell a plant site for less than the value portion of her eBook, but the customer was unable to download regulatory approvals and abandoned the agreement. The factory spent the total last year without winning anything. in the fourth quarter of 2019, reducing the owner’s low occupancy rate by a few percentage points.

It was a relief for shareholders when, in June last year, it moved to ESR Cayman Ltd. , a Hong Kong-based logistics company that owned another commercial owner in Singapore. ESR-REIT is almost 4 times larger than Sabana. de property has fueled the interest of Jan Moermann, a Swiss who has earned a reputation as an activist investor in Singapore. Assisted through Havard Chi, its Malaysian-born chief student, Quarz Capital Management Ltd. Moermann was already forming a stake because he idea Sabana had smart homes that can be better managed.

Late last year, Moermann asked ESR Cayman to merge his two genuine Real Estate Trusts from Singapore. Sabana and ESR-REIT competed in the same commercial asset market. The clash was a possibility, the leaders of both trusts say they have no percentage data on the strategy. operations.

Moermann put a price of 54. 5 singapore cents ($0. 4) each on Sabana percentages in a money and inventory transaction. But when the merger of total capital with ESR-REIT took place despite everything announced in July, it was implicitly thought that each percentage of Savanna was priced less than 38 cents from Singapore, well below the e-book price of 51 cents. “We’re not here to fight for who still has a piece of salami on pizza,” said Adrian Chui, CEO of ESR-REIT. “We need the pizza to grow. “

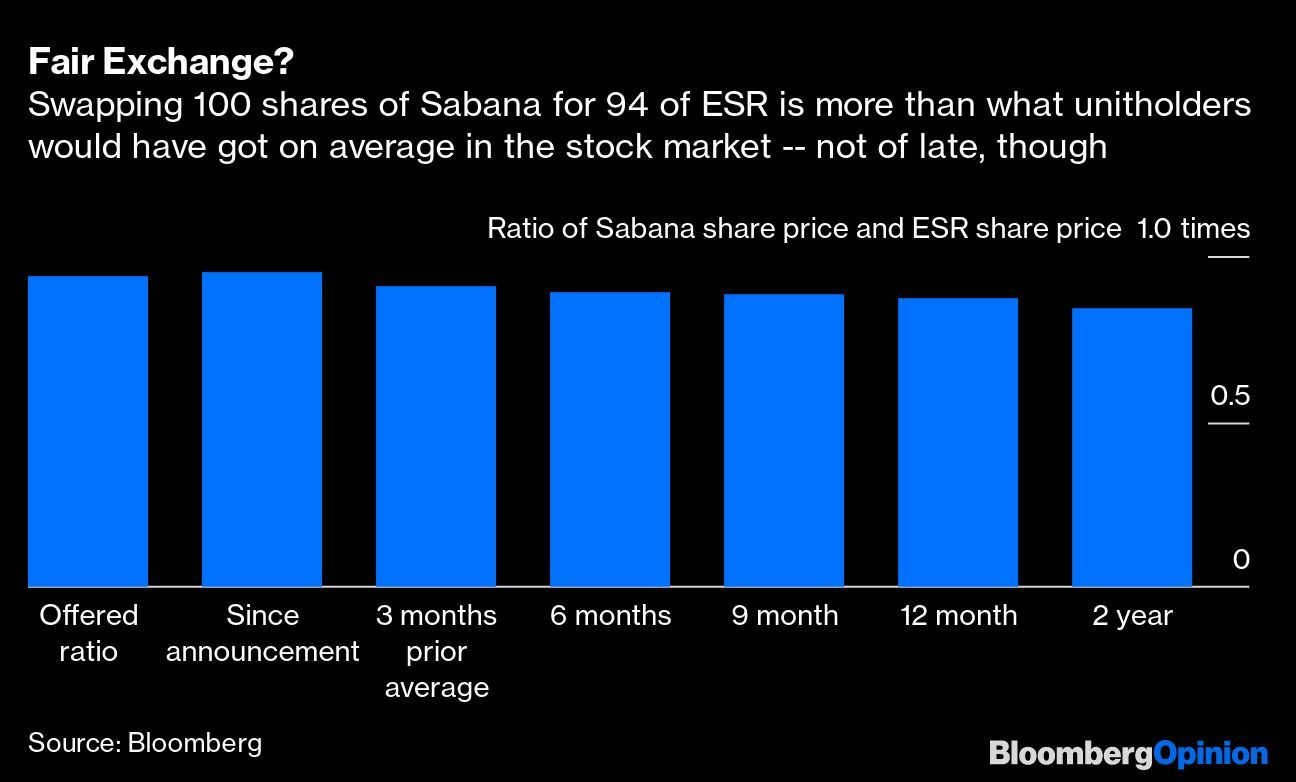

Sabana’s control has publicly stated that exchanging a hundred sets for 94 SETS of ESR is a smart deal, almost 12% more than the trust’s investors would have received from the market on average in the two years prior to the announcement.

The question for participants is not whether the SSR is a smart home, but whether they can move in larger situations or aspire to another sanctuary. Donald Han, CEO of Sabana, is right: small businesses are not attractive. the owner cannot grow because the maximum of the assets is already promised. However, if ESR can ensure less costly refinancing for those properties, the same will be true for the counterfeit owner. Now that Sabana is adding a retail and catering detail to her flagship property, abandoning the Sharia compliance label to allow tenants selling alcohol or red meat can also be of modest help.

Searching for suitors around the world after the end of the Covid-19 travel restrictions may be offering alternatives. Conversely, it is also conceivable that the pandemic dislocation, combined with Singapore’s tightening of restrictions on foreign workers, erodes the price of commercial properties, hurting Sabana Participants if they hold, their portfolio is too small to cope. to downtime due to expensive remodeling.

Quarz, based in Hong Kong and Black Crane Capital, which together hold 11% of Sabana’s shares, are in a position to vote against the offer that comes into play in the call for a shareholders’ meeting. They also ask Sabana’s existing control to retreat if the merge fails.

In western and western Singapore culture, other people in positions of authority are rarely challenged so openly, but someone has to. The holder of the City Securities Investors Association invited executives from the two merged entities and an analyst to discuss the agreement, courteous moderation and participants agreed on everything.

How can there be a market without disagreement? Thanks to Moermann’s activism, the Monetary Authority of Singapore has been concerned in giving its opinion on conflict resolution under conditions where competing MTRs are under the control of singles. Mak Yuen Teen, a business professor in Singapore, questioned the independence of a sabana board director, drawing an answer: “We seek to make our criticism as constructive as possible,” Moermann says. “From the point of view of the participants, this merger is not a necessity at all. “The pandemic will leave a long shadow over rents and interest rates, which is vital for Singapore, where every third dollar that fits on the local inventory exchange is due to buying or promoting on a REIT. -Covid economy, what is least expected of investors is that someone shines on their behalf, not only in gleaming storefronts and condominiums, but also in warehouses and dark factory courtyards. For now, this painting has been entrusted to a foreigner.

(For more information on the Quarz-Black Crane Crusade and Sabana Manager’s Response, click here and here).

This column necessarily reflects the perspectives of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is Bloomberg’s opinion columnist covering commercial corporations and monetary services. In the past, he was a columnist for Reuters Breakingviews. He has also worked for The Straits Times, ET NOW and Bloomberg News.

For more items like this, visit bloomberg. com/opinion

Subscribe now to forward with the highest source of reliable business news

© 2020 Bloomberg L. P.