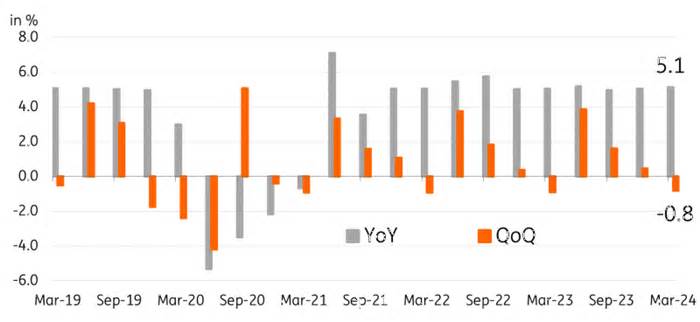

Indonesia’s economy grew 5. 1% year-on-year in the first quarter, helped by physically powerful intake and higher government spending. Compared to the previous quarter, GDP fell by 0. 83%, higher than the market consensus. Household intake increased by 4. 9% year-on-year, and Ramadan is very likely to provide a further stimulus to spending. Public spending increased by only about 20 per cent annually, in the run-up to the February elections and due to an increase in civil servants’ salaries. employees in the sector.

At the same time, capital formation has been subdued and exports have moved slightly. Capital expenditure increased by 3. 8% year-on-year, most likely constrained by high borrowing costs, while exports rose 0. 5% year-on-year due to global weakness. demand.

Source: Badan Pusat Statistics

In the near term, we expect headwinds that could undermine the economy’s momentum. Price pressures will increase in 2024 due to rising food and energy prices, which could limit households’ purchasing power until price pressures ease.

At the same time, capital formation, which posted only a modest gain of 3. 8% year-on-year, will remain under pressure after the Bank of Indonesia raised its key interest rates last month to 6. 25%. Now the focus will be on the president-elect. Prabowo Subianto’s inauguration at the end of this year, with details on his spending plans.

Despite the headwinds, the economy remains strong, with annual expansion on track to reach 5% year-on-year, with prospects for further expansion if the long-suffering export sector recovers strongly.

Read the original analysis: Strong intake drives expansion in Indonesia, but uncertainties remain

EUR/USD regained its recent gains from last session, trading around 1. 0780 in Tuesday’s Asian session. From a technical perspective, the research points to a sideways trend for the pair as it continues within the symmetrical triangle.

GBP/USD is soaring around 1. 2560 on Tuesday’s Asian consultation on how to improve threat appetite. The pound gained on the back of higher-than-expected British gross domestic product figures released on Friday.

Gold price recovers despite the US dollar’s consolidation on Tuesday. The bullish outlook for the yellow metal is also limited, as investors would likely wait on the sidelines until key US inflation data is released this week.

Meme coins in the cryptocurrency market posted impressive gains on Monday following a recent rally in GameStop shares. The surge in those tokens indicates a possible resumption of March’s meme coin frenzy.

We are entering an era for money markets and forecasters, as Americans’ short-term inflation expectations rise again. The upcoming CPI and PPI reports for April, as well as new insights into retail sales and commercial output, will provide valuable insights.

Note: All data on this page is subject to change. Use of this constitutes acceptance of our User Agreement. Read our privacy policy and legal notice.

Trading forex on margin carries a high level of risk and may not be suitable for all investors. The high level of leverage can be detrimental to you and to you. Before you decide to trade Forex, you need to take it conscientiously. Consider your investment goals, your point of experience, and your risk appetite. You may experience the loss of some or all of your initial investment, so you shouldn’t invest money you can’t afford to lose. Be aware of all the threats involved in forex trading and seek the recommendation of an independent monetary advisor if in doubt.

The reviews expressed on FXStreet are those of the individual authors and do not necessarily constitute the opinion of FXStreet or its management. FXStreet has not verified the accuracy or factual basis of any statement or made through an independent author: errors and omissions may occur. . Any reviews, news, research, analyses, prices or other data contained on this website, through FXStreet, its employees, clients or contributors, are provided as general market observation and do not constitute investment advice. FXStreet shall not be liable for any loss or damage, including but not limited to any loss of profits, possibly arising directly or indirectly from the use of or reliance on such data.