\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) — The Spanish government’s plan to invest more than 12 billion euros ($12. 3 billion) in building a domestic semiconductor from scratch has run into a major problem: Chipmakers willing to take on the challenge are few.

Most read from Bloomberg

Here’s How China Can Retaliate Against Pelosi to Taiwan

You may not like what comes after inflation

Pelosi is expected to travel to Taiwan, escalating tensions between the U. S. and China. USA and China

Pelosi to Land in Taiwan as China Breaks ‘Provocative’ Journey

Funded through European Union liquidity allocated to offset the economic impact of the Covid-19 pandemic, the rise of Spanish chips is hampered by the strong festival of other EU countries to attract major investors, according to others familiar with the situation.

The main challenge has been to attract corporations willing to engage in long-term investments of up to billions of euros, said the people, who asked to be known through the discussion of confidential information. Instead, corporations have opted for countries like Germany that have a semiconductor ecosystem. with suppliers and talent already established.

Spain’s ambitious effort is expected to contribute to the EU’s purpose of generating a fifth of the world’s microchips by 2030, up from around 10% by 2020. Enshrined in the bloc’s so-called chip law, the plan allows member countries to supply state aid to chipmakers with projects designated as “first of their kind” on the continent.

Manufacturers have shown interest in the government’s chip reader since its unveiling two months ago, but they want time to make investment decisions, according to an email sent to the office of Spanish Prime Minister Pedro Sanchez in response to questions from Bloomberg. those talks will soon bear fruit in the corresponding announcements,” he said.

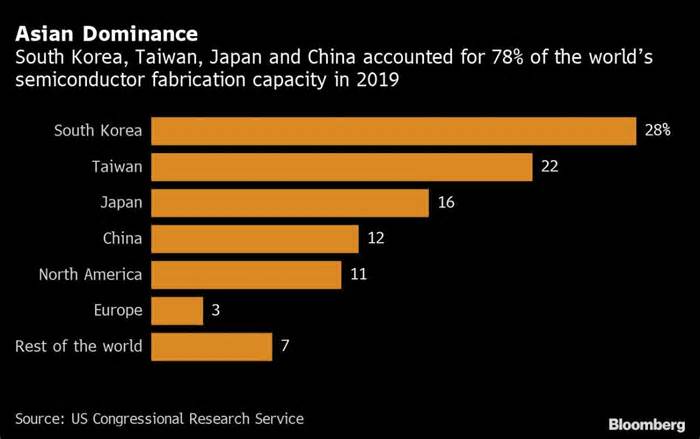

After facing significant supply chain disruptions from the pandemic, the EU and the US are facing significant supply chain disruptions. UU. se rush to increase chip production, as governments must reduce their dependence on countries like Taiwan and South Korea.

The U. S. Chip Act The U. S. was approved by both houses of Congress last week, adding $52 billion in subsidies and incentives for domestic semiconductor manufacturing, and China is also making a heavy investment to catch up.

EU chip allocation has gained momentum in countries with existing semiconductor industries, putting them in festival with others.

Spain has tried to attract Taiwan Semiconductor Manufacturing Co. , but the company is expected to opt for Germany, where a vast chip ecosystem already exists in the eastern state of Saxony. TSMC, the world’s largest chip smelter based in Taiwan, has been discussing the installation of a plant with the German government for more than a year, however, a resolution is unlikely to be taken anytime soon.

The former East Germany also gained a big boost in March when Intel Corp. announced that it would invest 17 billion euros to build a production site in Magdeburg.

Global Foundries Inc. and STMicroelectronics NV last month unveiled a €5700 million plan to make energy-efficient chips in France, while Samsung Electronics Co. , a semiconductor leader, floated the concept of European expansion years ago but it has yet to materialize.

Spain’s Sanchez, an economist by training, sees the allocation of government tokens as a way to improve the country’s trade base, which has shrunk since the turn of the century due to the biggest party from abroad.

The investment is also for the origin of the Spanish automotive sector, which is the largest of the moment in Europe and accounts for about 10% of the gross domestic product.

Part of the money will go to study projects, the EU microelectronics IPCEI, or to vital projects of non-unusual European interest. These allow governments to channel state aid into smaller study projects.

Spain is also likely to get eu investment to install a pilot production line from Imec, a Belgium-based think tank, according to a user familiar with the plan.

Most read from Bloomberg Businessweek

One of the stars of TikTok roasts boys for misogyny, racism and grossophobia

Epic banking scandal in China over social tensions over finance

Jazzercise is alive and kicking after its release

The Indian government’s fight against the targets of ‘fake news’ political dissent

The giant Buy now, pay later is about to be tested

©2022 Bloomberg L. P.