New York Stock Exchange: SSD

vitranc

“To put everything on your side, you have to replenish the game” – Joel Greenblatt, The big secret for the little investor.

Simpson Manufacturing (SSD) is in the category of corporations I lean towards. The characteristic of such corporations is a combination of proper functionality over the years and low popularity among investors. This decline in popularity is basically due to size. These corporations go unnoticed because they are too small for large institutional investors, analysts do not cover them very well, and many retail investors concentrate on the best-known corporations of the major indices.

With knowledge and data readily available to everyone, giant corporations are rarely misvalued. When we make the decision to buy a stock, no matter what cool logic we think we have, the market has probably already taken that into account. To some extent, Marketplaceplace is very effective at setting the value of stocks. The few opportunities to get something at a reduced price arise due to collective emotional shifts when Jerome Powel sneezes or when COVID-like events cause the world to believe that a change in civilization is about to happen. Therefore, if we buy what everyone buys, our effects will be the same as those of others, which is not necessarily a bad thing. But when we leave the trail of making an investment in index funds, whether we admit it or not, we hope to get ahead of the marketplaceplaceplace in some way; otherwise, why bother?Let’s see if Simpson Manufacturing is one of the game-changing opportunities.

Simpson Manufacturing Co. , Inc. (SSD) is an industry leader in the design, engineering and manufacture of concrete and wood structure products. Its wood segment accounts for 86% of sales and includes connectors, fasteners and resistive aspect systems used in the advertising structure. and DIY projects. In the concrete category, the company offers anchoring products such as adhesives, mechanical anchors and drills, as well as products for repairing, protecting and concrete structures (grout, coatings, sealants, etc. ). Headquartered in Pleasanton, California, the company has production facilities in North America and Europe. Sales in North America account for 86. 6% of revenue and the European market is responsible for the remaining 12. 5%. Although the company offers its products in Asia, sales are negligible in this region.

With a market cap of $3. 87 billion and a three-month average volume of 189,000 stocks traded daily, Simpson is as “dark” as some small-cap companies, but it’s also not very popular. But the low popularity is possibly just the beginning of the edge. The following two essential criteria that I have a tendency to favor to the maximum are:

1- Profitability with a maximum return on invested capital (ROIC)

2- Low leverage

The first promises that I am making an investment in a highly successful business, and the timing gives me peace of mind in case an unforeseen macroeconomic occasion lurks along the way, ahem, the dreaded interest rate hikes.

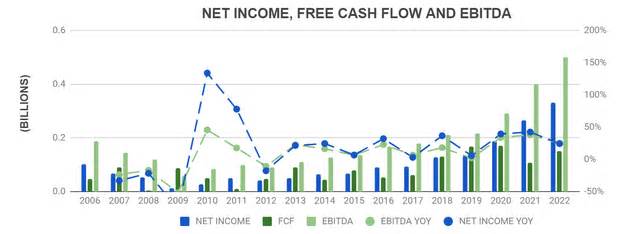

Simpson Manufacturing brilliantly passes the profitability test. Over the past decade, the net source of income and earnings before interest, taxes, depreciation and amortization (EBITDA) has grown at a rate of 25% and 18%, respectively (Figure 1). If we go back to 2006 and take a look at the 10- and 5-year expansion of those parameters, we might not be disappointed either. With the exception of the setback caused by the 2008 currency crisis that led to a negative expansion, the trend is obviously upward and to the right (Chart 2).

Figure 1: Net Income, Free Cash Flow and EBITDA Growth of Simpson Manufacturing (author)

Figure 2: Expansion of Simpson Manufacturing’s EPS, EBITDA and FCF over 10- and five-year mobile periods (author)

It is worth noting that even the wonderful currency crisis, despite negative growth, net income, EBITDA and free cash flow (FCF) were positive.

To illustrate Greenblatt’s “game-changing” approach, we can take a look at Deere

Figure 3: Simpson Manufacturing and Deere

FcF’s expansion has been more turbulent, with a sharp drop in 2021 (Figures 1 and 2). Growth has recovered in the last twelve months (TTM) – $152. 8 million – but remains below the grades of 2019 and 2020 – $168. 1 million and $169. 7 million, respectively. A look at the latest 10-K shows the culprits:

1- Accounts receivable are negative and have more than doubled through 2020 ($67. 9 million, to $22. 1 million)

2- Inventories have multiplied by six by 2020 ($164. 2 million, to $27. 2 million before)

These may be worrying signs if those accounts receivable are more likely to rebound and if inventories are mostly made up of finished goods, a conceivable indicator of a slowdown in sales. However, diving into the latest 10-Q, we find that the provision for doubtful accounts is only 0. 58% of accounts receivable. It seems there are no worries here. And the stock grades don’t seem to be replaced either. Although around 55% consist of finished goods, this is not far from the point of around 51% for the same era in 2020, 2019 and 2018.

If we were to correctly adjust the FCF for equity securities in 2021, we would reach an FCF of approximately $244 million, a 43% improvement over 2020. This would also be in line with the 42. 4% net profit expansion over the same period. Since the control has stated that the company has not experienced significant disruptions in the supply chain, we can deduce that the strong accumulation of stocks is a preventive measure to ensure that the reliable service and availability of the products for which the company is known are not interrupted.

Despite the above analysis, the most recent expansion figures are a bit misleading. Although TTM’s profit generation increased 21% over the previous full year, the SEC’s most recent filing shows that this was primarily the result of value improvements implemented in 2021 and a construction of $80 million. increase in sales similar to the acquisition of ETANCO in Europe, more on that later. Sales in North America have indeed slowed, most likely due to long-term economic uncertainty. it is also partly attributable to the acquisition of ETANCO and partly to higher costs of raw curtains.

Should we be worried? A trader with a crystal ball will probably do this. An investor, I don’t think so. We are motivated by the price and quality of a company, not the long-term “what ifs” that we cannot control.

Cycles come and go, but the fundamentals of high-quality corporations tend to remain solid and for longer periods of time. By this standard, SSD is indeed a very high-quality enterprise. Gross margin has not fallen below 43% since 2012. net margin has fallen from 6. 4% to 17. 4% over the same period, and the ROIC has also fallen from 6. 8% to 18. 8% (Figure 4), more than double the weighted average capital charge (WACC) that lately stands at 8. 4%. Simpson Manufacturing is very effective at generating investment capital and creating shareholder value.

Figure 4: Profitability and power of Simpson’s production (author)

When analyzed in the context of your industry and industry, SSD leaves most of its peers behind. GuruFocus places SSD in the forest products industry where the average gross and net margins are 3. 08% and 21. 6%, respectively. investment in this industry is 10. 7%. If we were to use the construction fabric industry, a more suitable fit for the corporate, the average gross and net margins are 29. 19% and 6. 76%, respectively (Figure 5). These are still pale compared to the functionality of the SSD. No matter how you look at it, those are exceptional figures of profitability and power. The company is not only growing, but it is also very profitable, and it does so more than most of its peers in the industry. .

Figure 5: Simpson manufacturing profitability (looking for Alpha)

Simpson Manufacturing has grown organically and through strategic acquisitions. ETANCO, a manufacturer of fasteners and fasteners based in France, is the latest acquisition in Europe and by far the most expensive of all acquisitions. The deal closed in April 2022 for $805. 4 million and has added $80. 3 million to Simpson’s net sales since then. Previous European investments come with Gbo Fastening Systems AB in 2017 for $10. 2 million and Multi Services Decoupe S. A. in 2016 for $6. 9 million. In the United States, Simpson acquired CG Visions Inc. in 2017 for $20. 8 million, Blue Heron Enterprises LLC. and Fox Chase Enterprises LLC in 2015 for $3. 4 million.

Excluding the ETANCO deal, Simpson’s acquisitions since 2015 totaled approximately $41 million, but its revenue increased from $794 million to $1. 57 billion in 2021, a 98% cumulative. Cumulative acquisitions are the only explanation for the great expansion that the company has experienced. . The apparent biological expansion that fills the void is the result of:

– New products and responses evolved internal innovation and R

– Focus on relationships with visitors; This includes seminars with architects, engineers, and contractors, additional training and visitors, and product availability within 48 hours.

– Development of programs to make customers’ paints more efficient

– Expansion of the distribution channels of its products. The company works commercially with original appliance brands (OEMs) within the engineered wood products industry and, due to its presence in the DIY markets, Simpson’s returned to Lowe’s in 2020.

– Work with construction agents according to building codes.

This recipe for expansion is obviously paying off (Figure 6). The company’s market share is 53% for Truss connectors and products, 28% for fasteners, and 21% for concrete products (Figure 7). .

Figure 6: Simpson Manufacturing Revenue Growth (author)

Figure 7: Simpson Manufacturing Market Share (Simpson Manufacturing Investor Presentation, August 2022)

The unfortunate war in Ukraine will require the reconstruction of the country. Simpson’s expansion into the European market can position it very well to take advantage of those efforts given ETANCO’s production site in neighboring Poland.

Now peace of mind part. Given that the company had little or no debt on the balance sheet until the recent acquisition of ETANCO, there is much to be said for this. Balance is as smart as it gets. I like to plot FCF after dividends, percentage buybacks, and acquisitions (Figure 8). If I see positive green bars, I feel like I have something to worry about. There is no fun business, no money engineering, and cash comes in. I need to own such businesses. We see two spikes in the year-over-year (YOY) debt line in Figure 8. The first is not a problem as the debt increases from nonexistent to $35 million. A closer look at the 2020 10-K shows that this amount relates to operating lease liabilities, actual interest-bearing liabilities (my knowledge providers combine operating leases with total debt). The moment peak and the “big” red bar is the money the company borrowed to earn ETANCO. A nearly 2,000% increase in debt seems worse than it is because, again, it is compared to paltry debt levels.

Figure 8: Simpson Manufacturing’s free cash flow after dividends, purchases and acquisitions (author)

Even after the etanco deal, debt is now at 1. 45X EBITDA, a very conservative leverage point in each and every aspect. Currently, the policy interest index is 52. 7, the existing index is 3. 3, and the acid test index is 1. 71 (Figure 9). ). A global collapse will have to occur before SSD encounters liquidity issues.

Figure 9: Simpson Manufacturing Liquidity (author)

A variation of the chart I discussed in the segment beyond shows dividends and redemptions (Figure 10). Simpson Manufacturing does both. The dividend yield is nothing out of the ordinary at 1. 15%, but dividend investors will be pleased to know that it has yielded more than 6. 13% per year for the last five years (Figure 11). The acquisitions are not to the insane degrees of corporations like Home Depot (HD) or AutoZone (AZO), but shareholders still get the warm feeling of seeing their ownership grow without needing to buy more shares. Unlike HD or AZO, SSD consistent with forms of redemption without entering negative capital. They do so responsibly, even at times when debt is cheap, so they can be used to offset EPS numbers a bit to please Wall Street during earnings season. Dividends and buybacks are incentives that are unlikely to go away when the company approves a 35% FCF cap on capital transfer to shareholders. There is no catch here. The focus is on growth.

Figure 10: Acquisitions, Profitability and Equity of Simpson Manufacturing (author)

Figure 11: Simpson Manufacturing Dividend Growth (author)

SSD inventory is not a treasury bond. It is not without risks. While Simpson Manufacturing says its products are as strongly tied to home construction as wood or other commodities, the fact remains that if the economy and structure slow down, revenues will take a hit. Like any other business, there is no immunity to macroeconomic events. Communication on the street is about inflation, interest rates, and supply chain constraints. As I noted earlier, the expansion of sales during the TTM era is basically the result of value increases in 2021. On the contrary, it may be just a harbinger of things to come. But. . . the long term is uncertain, and if knowing the long term is mandatory to invest, we will never do it. To quote Howard Marks, “as long as we’re not in a recession, we’re headed for one” – Howard Marks, I Beg To Differ. Therefore, I don’t weigh those dangers much. They are there, but there is nothing I can do to diminish them.

One threat to be reckoned with is the admission that the company has some major visitors. It is higher when no visitor is guilty of a significant portion of the revenue. Still, I believe this threat is mitigated through the quality of Simpson products and visitor service. support.

At this point, I think it’s transparent that I’m positive about simpson Manufacturing’s long term. But being optimistic is not enough to invest. While I believe that fair price calculations incorporate a high degree of subjectivity, I will try to justify my investment and, in doing so, disclose my assessment to critics, if any. Even if the company has a strong flow of loose money, I will base my valuation on profits. My explanation for why doing this is the fact that PE has shown less variability over the past ten years (Figure 12). The price-flow ratio of lost money (P/FCF), the red line in Figure 12, higher several times between 2012 and 2022, raising the average and distorting the old multiple. Because I will be using an output multiple for calculating the price of my terminal, I need one that I know has been less volatile. PE and EV/ EBITDA is stronger for this purpose.

Figure 12: Simpson Manufacturing stock price and multiple history (author)

I use an undeniable reduction style in which the supply price of long-term earnings is adjusted based on net debt. My starting point is an equitable personal distribution of 10 and 5 years. I take the final weekly costs of the actions during those periods. and divide them through the UPA of the corresponding fiscal year. This gives me a concept of the characteristics of the company that I examine, in essence, what the market thinks of the company in terms of valuation.

Then I locate the 95% confidence period for the and check the average difference between the TTM PE and the old PE. This first technique tells me without delay whether the company is trading above or below the old s. In Figure 13, red blood cells for the p-value in the 10- and 5-year periods imply exactly this. The TTM PE of 14. 51 is particularly lower than the 10-year (25. 11) and 5-year (20. 89) PEs. This one is quite obvious, and there is no need for statistics.

Figure 13: Simpson’s fair manufacturing value (author)

My purpose is not to be precise with calculating my fair price. Instead, my goal is to identify a baseline where I am convinced that I am not entirely wrong when it comes to the risk of the problem. One way to make sure of this is to reduce production. multiple. While the company’s old PE was over 20, whether we look at the ten- or five-year periods, I assume an output multiple of just 15 in either scenario, which I consider quite conservative given the expansion the company has experienced. . Although not very well covered by analysts, 4 corporations adhere to SSDs. One such corporation, Sidoti

For the reduction rate, I use 9%. This rate is the equity charge calculated by adding the threat-free rate to the beta-adjusted equity threat premium of 5. 10% calculated through Aswath Damodaran. And it’s all those assumptions that get me to a fair price of $160 consistent with the consistent percentage if I allocate ten-year earnings or $98 if my allowances only span five years. Because lately I can buy as many consistent percentages as I need at $90, Simpson Manufacturing is a fake purchase for me.

The right track record of expanding and creating shareholder costs, the rock-solid balance sheet, and a percentage value that is below fair cost make Simpson Manufacturing a very investment. Investors looking to think outside the box and want to play another game in hopes of locating a top-performing inventory deserve to put SSD on their shortlist and conduct their studies on the company.

This article written by

Disclosure: I have/have a long advantageous position in SSD stocks, whether through ownership, features or other derivatives. I wrote this article myself and expresses my own opinions. I don’t get any refunds for this (other than Seeking Alpha). I have nothing to do with a company whose shares are discussed in this article.