\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) — A new virus program in Shanghai will be a source of fear for the oil market.

Most read from Bloomberg

Natural fuel soars 700% and becomes the force of the new Cold War

Citi says oil could fall to $65 through the end of the year in the event of a recession

Oil Falls Below $100 as Dangers of Recession Arise

Dutch U. S. Supplier U. S. will avoid selling chip-making devices to China

Latest News in Ukraine: Kyiv’s Immediate Funding Wishes Succeed at $65 Billion

Chinese gasoline and diesel consumption is poised to return to pre-Covid levels as the country cautiously emerges from the latest round of tough controls, adding a punitive two-month shutdown of the financial center. Fuels account for about a portion of China’s oil intake.

This rebound in demand exceeded expectations from Goldman Sachs Group Inc. Although crude continues to dominate fears of a global recession, the easing of viral restrictions and China’s economic recovery “create an upside risk” for this current part of the world. year, according to a banknote

Mass testing in Shanghai runs through Thursday after a backlog of cases and will cover more than one part of the city. It wouldn’t be unexpected if this kind of trawl discovered new infections, how much emphasis is placed on whether the government will stick to an interpretation of Covid Zero that has proven so economically lethal.

Two other cases were discovered outside of quarantine, according to a briefing through city officials on Wednesday.

Today’s Events

(Every hour from Beijing, unless otherwise stated. )

State Council briefing on environmental inspections in Beijing, 10:00 a. m. m.

CCTD Weekly Online Coal Market Report, 3:00 p. m. m.

NDRC Seminar in Beijing on Red Meat and Prices, 15:00

Tianqi lithium sets the listing price in Hong Kong

today’s chart

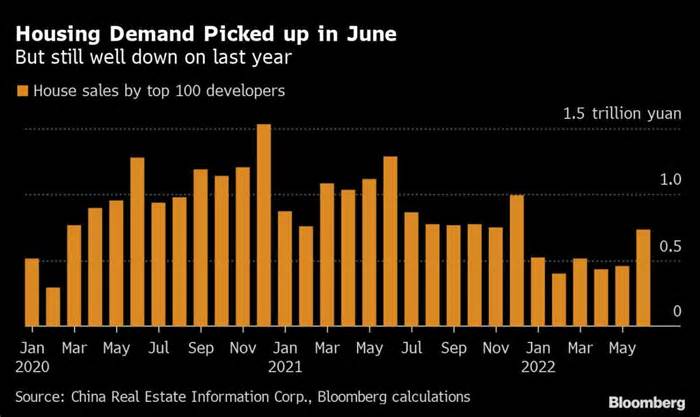

China’s housing crisis has passed its worst moment, but the market is still far from a full recovery. The industry, which accounts for about a third of China’s metals demand, is expected to remain depressed due to a weak hard labor market, prolonged liquidity shortages, and low confidence in space prices.

On the wire

China’s red meat futures and breeding hog stocks fell as the government’s extensive efforts to reduce confidence weighed on sentiment.

Iron ore increases profits amid Covid surges, more production cuts

Chinese dairy farmers resist emerging input costs

China to Boost Bond Earnings Investment (Newspaper)

China replaces U. S. soybeans. U. S. As a Call for Change to South America

next week

Thursday, July 7

China’s foreign exchange reserves for June, gold

Conference on anti-antiike non-ferrous metals market report in Beijing

Chongqing Gas Exchange Hosts Industry Summit, Day 1

USDA Weekly Export Sales, 8:30 a. m. EST

Friday, July 8

Weekly inventories of iron ore in Chinese ports

Shanghai Stock Exchange’s Weekly Commodity Inventory, ~3:30 p. m.

Fenwei Coal’s Online Weekly Market Report, 3:30 p. m.

China-Europe Forum on Floating Offshore Wind Cooperation in Hainan

Chongqing Gas Exchange Hosts Industry Summit, Day 2

Saturday, July 9

China to global source of funding and cash from April to July 15

Inflation information in China for June, 09:30

Caixin Summer Summit in Beijing, Day 1

Sunday, July 10

Caixin Summer Summit in Beijing, Day 2

Most read from Bloomberg Businessweek

The Lottery Lawyer Won Their Trust, Then Lost Their Mega Millions

Google will leave politicians your inbox

Geely launches satellites in a bid to bring autonomous vehicles to China

Gangs kill others in India to pay for insurance

Did Razzlekhan and Dutch achieve crypto theft in history?

©2022 Bloomberg L. P.