(Bloomberg) — The reversal of Saudi Arabia’s plans to increase its oil production capacity has raised questions about long-term demand, but underscores a long-term threat to the kingdom’s oil energy revenues: competing suppliers.

Subscribe now to read the latest news in your city and across Canada.

Subscribe now to read the latest news in your city and across Canada.

Create an account or log in to continue your experience.

Don’t have an account? Create an account

State-owned Saudi Aramco stunned the oil industry on Tuesday by announcing it would press ahead with plans to increase its production capacity by about 8% to thirteen million barrels per day until 2027.

The lack of an explanation for the shift from the company has invited a flood of speculation, notably whether Riyadh has grown more pessimistic about oil consumption as the world shifts toward low-carbon energy. Forecasters such as the International Energy Agency see demand for oil hitting a limit in the next few years.

Yet that’s only part of the equation.

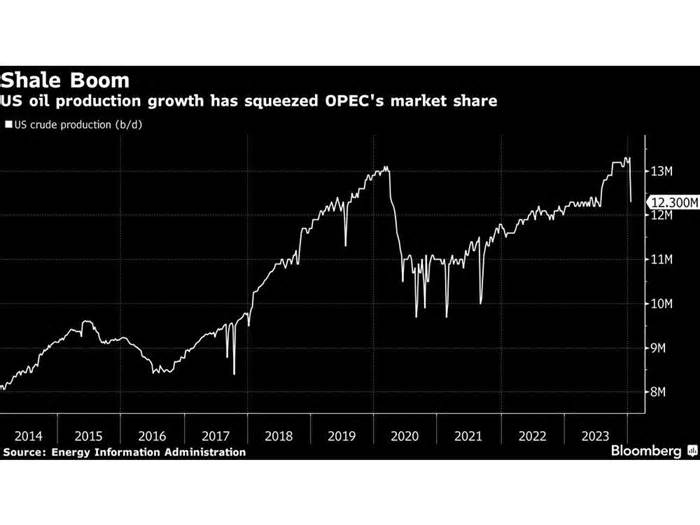

Competing manufacturers draw the attention of the Saudis and their OPEC allies, especially their enemy for much of the past decade: U. S. shale. A flurry of rival sources means Riyadh is already keeping about 25% of its total capacity offline under an OPEC deal, limiting output to a two-year low of nine million barrels in line with the day since July.

Get the latest headlines and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on the way. If you don’t see it, check your spam folder.

The next factor of the Winnipeg Sun’s daily news headlines will soon be in your inbox.

We found a challenge with your registration. Check again

“Riyadh expects balances to weaken in the coming years, primarily in non-OPEC supply,” said Bob McNally, president of consulting firm Rapidan Energy Group and a former White House official. For this reason, he believes that the Saudis “delay upstream expansion projects or separate them permanently. “

The U. S. shale oil revolution triggered a flood of new reserves on global markets and sent crude costs tumbling a decade ago. In 2016, it posed an almost existential risk to producers, forcing the Saudis and Russia to triumph over years of rivalry and shape the alliance. known as OPEC.

Shale drillers fell sharply as the Covid-19 pandemic broke out amid a collapse in global oil demand, and their shareholders’ increased insistence on higher returns meant production was slow to recover.

But in recent years they’ve staged yet another comeback, propelling American output into record-breaking territory above 13 million barrels a day. The deluge is being amplified by other producers too, such as Brazil and the emerging oil play of Guyana.

Amid this wave of new supply, oil costs finally fell 10% last year in London, despite initial expectations of a rebound when the Chinese economy reopened. The market has gone from scarcity to abundance, and Brent crude has largely remained close. to $80 a barrel this year, even as fighting rages in the Middle East.

“There is an expectation in the industry that non-OPEC oil production would come under pressure,” said Martijn Rats, global oil strategist at Morgan Stanley. But instead, it grew enough to meet demand, and “when that happened, the position in the oil market for OPEC oil is under pressure. “

If materials from outside the Organization of the Petroleum Exporting Countries can keep up with consumption growth, then Aramco will have less need to build capacity. Saudi Arabia has already extended its production cuts into the first quarter and Energy Minister Prince Abdulaziz bin Salman has said it can be extended “absolutely”.

“Today’s announcement reflects government expectations that demand for its oil will no longer rise as strongly as previously expected,” said Rats. “In that context, the current level of spare capacity is already sufficient.”

In addition to trends in oil markets, Riyadh’s resolution is also due to domestic pressures.

Saudi Arabia will most likely have a budget deficit of about 4. 3% of its gross domestic product in 2024 and will have more than $46 billion in financing needs, according to Dubai-based Emirates NBD Bank. billions of dollars in tourism, sports and other projects pushed through Crown Prince Mohammed bin Salman to diversify the economy.

Aramco will pay much higher dividends to the government, even if its production is reduced. The company (98% state-owned) has increased its quarterly payout by more than $10 billion to $29. 4 billion over the past two quarters as the government seeks to fund its budget deficit.

The move away from the thirteen-million-barrel-per-day expansion is expected to ease pressure on Aramco’s budget by cutting annual expenses by about $5 billion a year, according to RBC Capital Markets.

—With by Rakteem Katakey.

Postmedia is committed to maintaining a civilized discussion forum and encourages all readers to share their perspectives on our articles. It can take up to an hour for comments to moderate before appearing on the site. We ask that your feedback be applicable and respectful. We’ve enabled email notifications: you’ll now receive an email if you get a response to your comment, if there’s an update to a comment thread you’re following, or if a user you follow comments. Check out our network rules for more facts and main points on how to adjust your email settings.

365 Bloor Street East, Toronto, Ontario, M4W 3L4

© 2024 Winnipeg Sun, a department of Postmedia Network Inc. All rights reserved. Unauthorized distribution or transmission is strictly prohibited.

This uses cookies to personalize your content (including ads) and allows us to analyze our traffic. Learn more about cookies here. By continuing to use our site, you agree to our Terms of Use and Privacy Policy.