“r. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

French pharmaceutical giant Sanofi (SNYNF) has announced that its COVID-19 vaccine will charge less than 10 euros and has also announced its goal to its Pharmaceutical Active Ingredients (API) department in the coming months.

According to a MarketWatch report, Sanofi France President Olivier Bogillot told France Inter radio that the company’s coronavirus vaccine candidate, who is developing GlaxoSmithKline (GSK) in the UK, would likely charge less than 10 euros per injection. , he added that a final value had still been set.

Bogillot also revealed to Radio France Inter that Sanofi sought to continue the IBRO of its API unit, which the company first announced in February. According to Reuters sources, the autonomous company could be priced at between 1 and 2 billion euros.

“The concept is to create a champion of active ingredients at European level,” Bogillot said, adding that the IPO would mean the industry’s “strong dependence” on Pharmaceutical Ingredients in Asia. The new company would rank as the world’s largest API company. with around one billion euros in expected sales until 2022.

It would combine Sanofi’s API promotion and advertising activities with six of its European API production centres: Brindisi (Italy), Frankfurt Chemistry (Germany), Haverhill (UK), St Aubin les Elbeuf (France), ‘jpest’ (Hungary) and Vertolaye. (France).

Philippe Luscan of Sanofi said: “This new entity would help ensure greater stability in the source of medicines for millions of patients in Europe and beyond . . . [it would be agile as an independent company and trigger its expansion” potential, especially through the capture of new sales to third parties and all opportunities in a market that develops at 6% consistent with the year”.

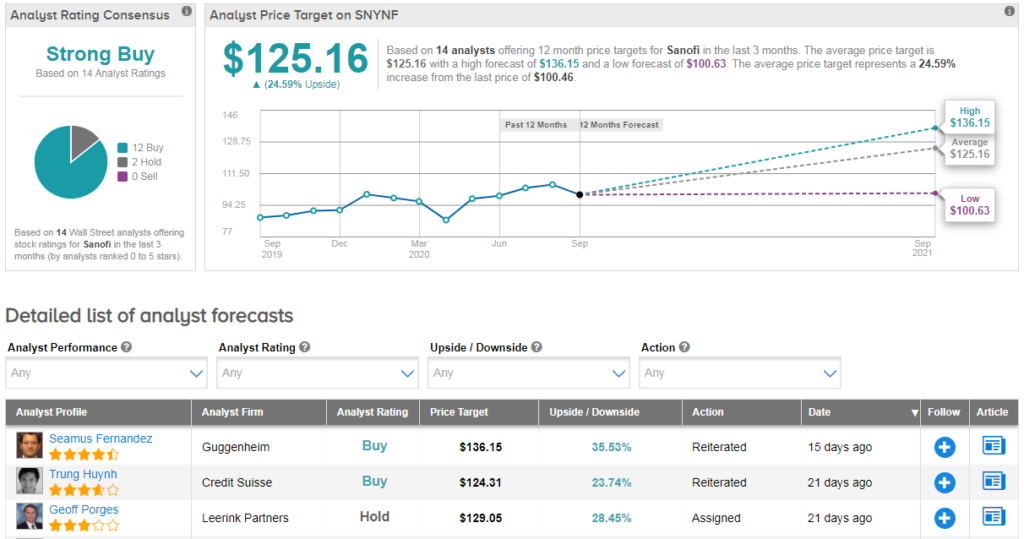

Sanofi inventories have been trading unchanged since the beginning of the year, however, inventory has a bullish Strong Buy Street consensus, with 12 recent buy notes and 2 tenure notes. Meanwhile, the average value target for analysts indicates a prospective increase of 25%. .

SVB analyst Leerink, Geoffrey Porges, has a retention score at Sanofi, but raised its value target after the company announced a smart $3. 7 billion deal for Principia Biopharma.

“This capital deployment through SNY makes us more constructive about the company’s actions,” Porges said, adding that the Principia sclerosis drug (which he developed in conjunction with Sanofi) “adds some other genuine and genuinely extensive long-term pricing engine to SNY’s Portfolio expansion [research] (see SNYNF inventory market research at TipRanks)

Related News: Morgan Stanley appears in Eli Lilly, increases symptoms of PT Australia Offers of $1. 2 billion in Covid-19 vaccine with AstraZeneca, is CSL Trevena Stock an acquisition right now?That’s what you want to know.

Deutsche Bank is optimistic about Dave’s leadership

Sanofi’s Dupixent Regeneron shows sustained benefits for asthma in a 3-year trial

Boeing Dreamliner faces FAA probe due to manufacturing defects: report

Zscaler Benefits: Prepare for Solid Results, Applaud RBC Capital