\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

Russia may try to boost higher volumes of a key oil commodity in Asia, likely by mixing some with crude oil, in a bid to find select markets as European sanctions tighten, according to FGE.

More Russian-made naphtha, a fuel used mainly to make plastics, is expected to head to hubs such as Singapore and Fujairah from February, when EU sanctions take effect, said Armaan Ashraf, global head of herbal fuel liquids at the consultancy. Re-exports from those regions may be common, with some buyers reluctant to import directly from Russia, he said in an interview.

Moscow’s invasion of Ukraine has caused unrest in energy markets this year, and this disruption is expected to worsen in 2023. A European Union ban on peak flows of Russian crude will begin in December, followed by an anti-product measure, adding naphtha, of about two months. Later. While the Energy Information Administration expects Russian crude production to decline due to the restrictions, local refiners will still want to locate outlets for their naphtha.

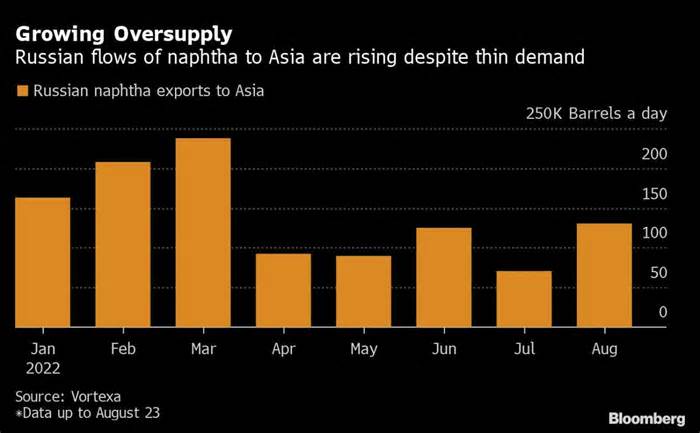

Russian naphtha exports to Asia rose 84 percent in August to about 130,000 barrels between one day and the entire month of July, according to initial data from Vortexa Ltd.

This buildup came despite weak regional conditions, with local plastic manufacturers, primary consumers, suffering with narrow margins and low demand for plastic from China. Lower gas margins also erode the demand to convert naphtha into gas mixtures, plus cutting use.

Reflecting the harsh conditions, naphtha production margins in Asia are negative, at minus $17 a barrel. In addition, immediate time spreads for fuel are in contango, a bearish design that indicates abundance in the short term.

Overall, Russian flows of crude and products may decline when the new EU restrictions take effect, Citigroup Inc. said. in a note. The overall decline is expected to be around 1. 25 million barrels consistent with the day, a figure lower than some other estimates, he said.

Russian naphtha may have already been combined with the country’s Ural crude and shipped to India earlier this year, according to Ashraf. “Mixing full-range heavy naphtha or heavy naphtha in limited quantities can also generate far more benefits than promoting the shipment of naphtha directly. “”He said.

(Adds Citigroup’s outlook for Russian flows in the penultimate paragraph)

More stories like this are found in bloomberg. com

©2022 Bloomberg L. P.