Belarusian government seeks tactics to animate its national forest market

At the Shanghai Cooperation Organization summit, look on the sidelines

ESP: Going back to the 80s? What dizzying inflation, rate increases in the U. S. A stronger medium for emerging market sovereign debt

Belarus increases oil production and plans a non-unusual oil market with Russia

READ FOR A LONG TIME: Can Europe keep the luminaires on this winter?

Slam dunk for The Kremlin’s United Russia in regional elections

MOSCOW BLOG: Raw fabrics fall, but electric power costs high

Czech Republic and Slovakia push for decoupling of decades-long nuclear partnership with Moscow

READ FOR A LONG TIME: Can Europe keep the luminaires on this winter?

INTERVIEW: “We support Ukrainian companies and the needs of the government” – Dimitar Bogov, EBRD

Commodities fall as the market adjusts to the realities of sanctions

GAV DON: The Ukrainian offensive is gaining ground, it is changing the political landscape more

ING: ECB rises through 75 historical basis points, more on the way

Eastern EU governments strive to act on the emerging burden of life

bneGREEN: The Baltic States, with the exception of Russia, agree to aim for a seven-fold increase in offshore wind

Poland and the Baltics threaten to unilaterally ban Russian tourists

Czech Republic imposes national caps on energy prices

Czech Republic and Slovakia push for decoupling of decades-long nuclear partnership with Moscow

Hearings begin in former Prime Minister Babis’ European fraud case

IMF: How Food and Energy Are Driving Global Inflation

Ryanair cancels its Hungarian operations for a tax on the profits of providence

IMF: How Food and Energy Are Driving Global Inflation

Hungarian inflation at 24-year high in August

ING: ECB rises through 75 historical basis points, more on the way

IMF: How Food and Energy Are Driving Global Inflation

ING: ECB rises through 75 historical basis points, more on the way

VISEGRAD BLOG: Putin’s cost-of-living crisis has already sparked mass protests in Europe, will they get worse?

Czech Republic plus connections to LNG terminals

Czech Republic imposes national caps on energy prices

Czech Republic and Slovakia push for decoupling of decades-long nuclear partnership with Moscow

VISEGRAD BLOG: Putin’s cost-of-living crisis has already sparked mass protests in Europe, will they get worse?

Eastern EU governments strive to act on the emerging burden of life

Eastern EU governments strive to act on the emerging burden of life

Slovenia expects solid but lower GDP expansion in the current part of the year

Slovenia’s annual inflation remains solid at 11% in August

bneGREEN: Europe’s once-in-500-year drought threatens energy and food security

Albanian opposition Democrats to investigate allegations that they won $500,000 from Russia

Governments in South-Eastern Europe rush to adopt new anti-crisis packages

VISEGRAD BLOG: Putin’s cost-of-living crisis has already sparked mass protests in Europe, will they get worse?

Albania cuts diplomatic ties with Iran after cyberattack that toppled government sites

Albanian opposition Democrats to investigate allegations that they won $500,000 from Russia

BALKAN BLOG: What Turkey’s Erdogan can offer the Western Balkans

Diplomacy with Germany dashes Bosnia’s hopes of being an EU candidate

HTEC Group acquires Mistral in Bosnia for an engineering base in Southeast Europe

Bulgaria switches electricity to gas to Azerbaijan

Opposition calls for resignation of ‘pro-Russian’ Bulgarian energy minister

ING: ECB rises through 75 historical basis points, more on the way

Eastern EU governments strive to act on the emerging burden of life

bneGreen: The first ecological mosque in southeastern Europe opens in Croatia

Governments in South-Eastern Europe rush to adopt new anti-crisis packages

BALKAN BLOG: What Turkey’s Erdogan can offer the Western Balkans

INA President Resigns After Corruption Scandal

Kosovo’s power crisis worsens after Obiliq TPP unit failure

BALKAN BLOG: Five Days to Keep the Peace in the Western Balkans

Serbian Minister Visits Moscow Amid Unresolved Dispute with Kosovo

Usa. U. S. and Europe launch diplomatic offensive after collapse of Kosovo-Serb assembly in Brussels

Moldovan bank MAIB seeks index in Bucharest

Moldova bans direct flights to Russia after the national airline announced the return to the Moscow route

Inflation in Moldova reaches 34. 3% year-on-year in August

Russian diplomat warns of escalation in Transnistria

Albanian opposition Democrats to investigate allegations that they won $500,000 from Russia

Moody’s confirms Montenegro’s B1 score warns of developing political risk

Politicians funded through tobacco traffickers overthrew my government, says Montenegro’s outgoing prime minister

Montenegro’s former fragmented ruling majority to re-register in the forces

North Macedonia’s foreign exchange reserves continue to grow in August

Governments in South-Eastern Europe rush to adopt new anti-crisis packages

North Macedonian opposition VMRO-DPMNE jeopardizes EU club progress by pushing for referendum on Bulgaria deal

bneGreen: Heavy rains and climate-related flooding replace chaos in Skopje

Moldovan bank MAIB seeks index in Bucharest

Romania’s MedLife Acquires Fitness Generation Company SanoPass

ING: ECB rises through 75 historical basis points, more on the way

Fondul Proprietatea selects banks for Hydroelectric IPO

EuroPride starts in a tense environment in Belgrade

BALKAN BLOG: What Turkey’s Erdogan can offer the Western Balkans

HTEC Group acquires Mistral in Bosnia for an engineering base in Southeast Europe

Serbia expands pressure from the West to allow EuroPride to move forward

Rising tensions between Turkey and Greece are on the “electoral agenda,” according to a turkish component

At the Shanghai Cooperation Organization summit, look on the sidelines

Renault halts Turkish plant due to chip shortage

GUSTAFSON: Russian oil exports: Do sanctions work?

New escalation of the Armenian-Azerbaijani army: verify or control the Russian prestige quo in the region?

At the Shanghai Cooperation Organization summit, look on the sidelines

Armenia calls for military support from Russia

Major clashes erupt on Azerbaijan-Armenia border

New escalation of the Armenian-Azerbaijani army: verify or control the Russian prestige quo in the region?

At the Shanghai Cooperation Organization summit, look on the sidelines

Armenia calls for military support from Russia

Major clashes erupt on Azerbaijan-Armenia border

Discarded American Cars Make Big Business in Georgia

Activists push to reconsider the direction of Georgia’s historic Khada Valley

Inflation relief supports hopes of a rate cut through the end of the year in Georgia

Social media on the former Russian president’s account calls Kazakhstan and Georgia “artificial creations”

At the Shanghai Cooperation Organization summit, look on the sidelines

Iran now has a chance to enrich enough uranium for the nuclear bomb in a matter of weeks, according to the U. N. watchdog.

Albania cuts diplomatic ties with Iran after cyberattack that toppled government sites

Iran insinuates the West wants a nuclear deal more than it did amid a “crippling power crisis”

Kazakhstan: The capital returns to Astana, ending its stage as Nur-Sultan

At the Shanghai Cooperation Organization summit, look on the sidelines

Kazakhstan: Old-fashioned political reset or authoritarianism?

GUSTAFSON: Russian oil exports: Do sanctions work?

Kyrgyzstan: Kumtor, cloak and dagger

At the Shanghai Cooperation Organization summit, look on the sidelines

Survey of Kazakh and Kyrgyz Attitudes towards Russia’s War

China expands vocational training centres to Central Asia

At the Shanghai Cooperation Organization summit, look on the sidelines

Crypto digs up its wings amid tough times in Mongolia

CENTRAL ASIA BLOG: Mongolia worries about possibility of non-compliance

NEO: Why do copper mines want to go blank?

At the Shanghai Cooperation Organization summit, look on the sidelines

Tajikistan. Authorities accentuate war against Ismailis and Muslims

Emerging market debt crisis just around the corner

China expands vocational training centres to Central Asia

At the Shanghai Cooperation Organization summit, look on the sidelines

Turkmenistan: thank you for your postponement of service

Turkmenistan: the value is fair

Ukraine says Kremlin takes advantage of influx of migrants from Central Asia to strengthen military

At the Shanghai Cooperation Organization summit, look on the sidelines

COMMENTARY: SCO Samarkand Summit: Dialogue and Cooperation in an Interconnected World

China expands vocational training centres to Central Asia

CENTRAL ASIA BLOG: Did the Taliban take over the Uzbek island in a border clash?

Download pdf version

Download pdf version

Download pdf version

Download pdf version

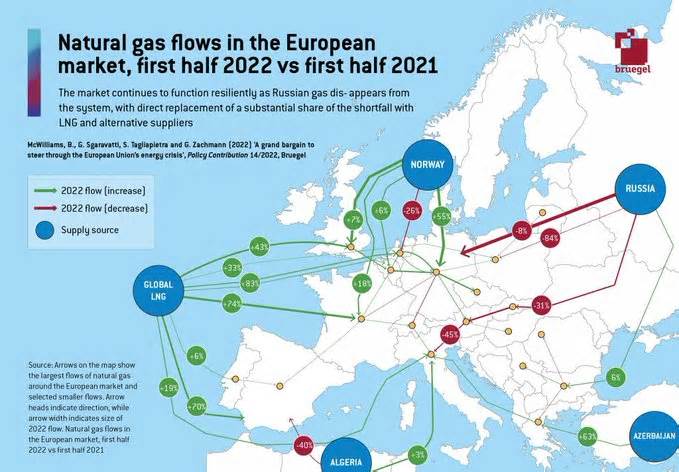

Europe is facing a primary energy crisis this winter that may cause lighting devices to faint. The EU rushed to come up with a 0-emissions plan until 2050, but as a result, it dismantled too much generation capacity and exposed itself to Russia’s risk of reducing out of fuel supplies.

In addition to the shortage of gas, real bad luck created a huge storm. Germany’s ill-timed decision to close its coal and nuclear power plants, the unrest of France and the United Kingdom with their nuclear-power plants and a scorching summer. Reducing water levels in hydroelectric reservoirs has helped reduce Europe’s ability to produce electricity this winter.

As bloodless weather approaches, Europe has stockpiled enough fuel to have a mild winter, but Europe’s electric power formula is in a delicate balance, with many countries relying on a few giant manufacturers to export electric power, creating vulnerabilities. If a giant supplier like Germany were to run out of fuel, the resulting power outages and voltage drops could spread to the entire continent.

“The European energy formula faces unprecedented physical and institutional constraints. So far, the political backlash has been excessively focused on the national point and may undermine the goals of calming energy markets over the next 18 months and achieving ambitious decarbonisation targets,” the Bruegel think tank said in an article that also looked at the consequences for the European Green Deal Goals.

no room for manoeuvre

Europe had a total installed generation capacity of 970 GW at the end of 2021, which could produce a total of 3,628 TWh of electric power if operated at full capacity. Actual production was 5% lower, as the stations operated at 95% capacity. capacity of the year: the year when Russia began to decrease the fuel source and caused a slight energy crisis.

But Europe does not have enough production capacity to meet all its own needs. It is a net importer of electric power in 2021, earning a maximum of an additional 1. 8 TWh from Norway and Sweden. The two Scandinavian countries exported 29 TWh in 2021 to the rest of Europe, basically to Finland, the Baltic States and component to the United Kingdom, since some European countries also export electricity.

Finland is in the final test phase of a new 1. 7 GW nuclear power plant that is expected to come online in 2023 and will have its own deficit of 21 TWh to 9. 5 TWh. This will allow Norway and Sweden to export another 10 TWh to the rest. of Europe, if the water levels in Norway’s gigantic hydroelectric reservoirs allow it.

The difference between what Europe produces and what it consumes is not great, but the challenge with the electricity sector is that the source and demand for electricity will have to correspond exactly to each other. If not, in what so-called “frequency incident”, the force plants are closed, otherwise the apparatus can be seriously damaged.

Some countries are net exporters and others are net importers, but the deficit between the two is very unevenly distributed. The largest importer of electricity in Europe is Italy, which imported 31 TWh in 2021 and is expected to import 30 TWh this year. followed by Hungarian imports of 8. 7 TWh, which achieved 9. 1 TWh this year. The family’s challenge is Austria, which imported 3 TWh in 2021, but that figure will reach 8. 1 TWh this year, according to Swiss electric power company Burggraben and the European Network of Transmission System Operators (ENTSO-E).

Together, those 3 countries will have to import a total of 47. 3 TWh of electricity in 2022, which is more than the net 1. 8 TWh that the EU imported last year in total. It is also well beyond the 27 TWh that Norway and Sweden have exported to the whole of Europe.

Proximity also plays a role, as electrical power does not move well over long distances, so it is necessary to be close to the electric power generator, which increases the dependence on Scandinavian exporters.

To make matters worse despite emerging tensions with Russia, Germany is shutting down nuclear and coal-fired power plants. (122 TWh) of coal-fired power plants, Berlin recently said it would keep a reactor and 8 GW (61 TWh) of coal-fired power plants as a reserve.

In 2021, Germany net exporter of electricity promoting 27 TWh to the so-called Nordic pool, however, if the plan to close all nuclear and coal plants were implemented, it would have to import 130 TWh, or 69 TWh if it used todo. su reserve. In total, Austria, Hungary, Italy and Germany are expected to jointly import about one hundred TWh of electricity, according to calculations by bne IntelliNews.

While the overall Formula of European Electric Power is almost balanced between demand and supply, this organization highlights very large disparities within Europe at the regional level. This shortfall would be covered internally within the EU, in addition to some imports and ongoing new capacity investments. , however, this year the Russian-induced fuel crisis will push the EU’s electric power formula to the limit of what it can withstand because there is very little redundancy in the formula.

With those problems, Germany was the first to move into the reputation of “warning” about the EU’s three-tier energy crisis system, as the effect of cutting off even a small part of the electric power generation mix produced with Russian fuel may just have a significant effect on.

The European Commission has also worked to avert the crisis and in May published its updated REPowerEU plan in which it had already incorporated an increase in the strength of coal (105 TWh) and a reduction in fuel strength (-240 TWh) without derailing the EU. meteorological objectives.

While 22% of Europe’s electricity is produced through fuel-powered power plants, the EC’s plan to increase fuel input by 15% could theoretically only require 120 TWh of electricity, according to calculations by bne IntelliNews. That would solve the problem.

However, although European Commission President Ursula von der Leyen had first called for relief to be mandatory across the EU, after strong resistance from members of Europe’s periphery, namely Spain, Portugal and Greece, the plan was greatly diluted to be voluntary, with childbirth and exemptions for 17 of the 27 members.

Perfect storm

With the European electric power formula so finely balanced, a better typhoon has developed. Europe’s willingness to invest in blank energy options while dismantling polluting turbines has led to a profound imbalance between energy source and demand. A higher-than-expected rebound in global energy demand after the peak of the COVID-19 crisis, as well as some bad policy decisions and forgetfulness about energy security.

Italy shut down its nuclear power plants in the 1990s and never replaced the lost capacity. This has made it one of the largest importers of electricity in Europe. Its network has enough capacity to cover its own domestic demand. The power plants it has are heavily dependent on Russian gas, as the government has never bothered to diversify its fuel source and has never invested in renewable energy. Despite its long coastline, Italy even has 1 MW of offshore wind turbines.

Austria has invested in hydropower, but this year’s long, hot summer has severely reduced its ability to generate electricity and the country’s generation capacity is not enough to meet domestic freight demand. Austria depends on neighboring Germany for the energy it lacks. .

It wouldn’t be a problem, but in 2020, Germany abandoned its six nuclear reactors by cutting four GW of electricity from the grid, equivalent to 32 TWh of electric power, or about 4. 5% of the 700 TWh traded. in Europe year, according to the operators of the European grid electric power transmission formula (ENTSO-E).

Germany has been a net exporter of electric power, however, reforming its electric power sector will make it a net importer of electric power until 2023. German shortages are a challenge for Germany, but it is an even greater challenge for Italy, Austria and Luxembourg, all of which have relied on German electricity exports to cover their own deficits.

Germany has to keep two of its six reactors in reserve and, despite discussions about restarting its 16 coal-fired power plants, only one or two can be used because the others are “too old” or lack fuel; once coal was imported. but the import ban came into force on 10 August and has been very effective.

Germany had planned to use herbal fuel to plug the hole, but now it is no longer an option, it will end up with an electric power deficit and will have no way to upgrade it if the fuel source is too low. This will cause breakdowns. only in Germany, but in several countries in central Europe.

“The fact is that 20 years of the German Energiewende have systematically reduced its manageable electric power generation functions (reliable frequency) to the point where herbal fuel wants to save the day, and we are suffering to achieve this,” said Alexander Stahel, an expert in energy and raw materials. expert, he said in a twitter thread.

Hungary, like Austria, has invested heavily in fuel-fueled power plants and relies even more on Russian fuel to operate them because it produces little of its own fuel. The Budapest government has refused to sign the force sanctions imposed on Russia, with the economy minister saying the economy “simply wouldn’t possibly work” without Russia’s supply of force.

Corrosion problems have led France to shut down many of its nuclear power plants, increasing the need for fuel for electric power generation.

“France is the champion of nuclear energy. Its fleet of 57 reactors can deliver 450 TWh consistent with the year (62 GW installed). But that’s not the case,” says Stahel. Our forecast is 59% or 315 TWh based on EDF forecasts. “

Nuclear power plants operate at around 95%, but this year the relief took another 135 TWh of electricity from Europe’s generation capacity. France will go from exporting more than 19% of the electricity it produced in July 2021 to charging 12% of its electricity wishes in July 2022.

Slovakia has also invested in nuclear power and completed two of the 3 reactors despite significant resistance from the anti-nuclear lobby. A third reactor is 95% complete but not yet connected to the grid, leaving Slovakia with a defect in the first part of this year.

Belgium is one of the European countries that has invested in renewable power and has an offshore wind farm, but it is still very deficient in its nuclear power plants, part of which are reaching the end of their useful life and will soon have to be replaced.

Norway is one of the main exporters of hydropower, but this summer has been so hot that water levels in reservoirs have dropped so much that it has reduced their capacity to produce hydropower. The same heat also hampered the use of coal-fired power plants, as the intensity of the rivers decreased so much that coal barges can only be half-loaded, otherwise they would not be able to navigate the canals.

no gasoline

The scarcity of production capacity makes the European electricity sector dependent on Russian gas. In the case of Germany, only 15% of the generation capacity is based on gas-fired power plants, of which the maximum is based on renewable energies, it is this 15% that supplies the excess of flexible electrical energy at times of maximum demand.

Without it, the formula collapses just when maximum force is needed. This leads to a “frequency incident” when the balance between electric power generation and desire demand are coordinated and dissolved in a very narrow corridor. If this balance is lost, the Formula is turned off so as not to damage the equipment. To this balance has been put a total formula covering more than 20 countries, which Ukraine joined the day before the war with Russia began. Renewable energies do not adapt to this balance because they are not reliable

The clash with Russia has already affected the reliability of the European electric power formula, as the number of frequency incidents has increased in the past two years. There were 33 hours of frequency incidents in 2020, which exceeded the hours in 2021.

“Well, in 2021 alone, the European network experienced two major incidents, classified as ‘scale 2’ incidents, for which the final reports had to be ready through an ENTSO-E expert organisation,” Stahel explains. The continental network cannot adapt the load to production. “

Too many countries rely on electricity imports to cover their deficits. There is simply not enough production capacity in Europe for the continent’s energy security. Cutting off the supply of Russian fuel to a few countries may have consequences on electric power that will reverberate across the continent. .

Even before invading Ukraine on February 24, Russia was manipulating European markets for herbal fuels. It drastically reduced exports after the summer of 2021 and did not fill Gazprom-owned garages in the EU. Since spring 2022, Russia has used its remaining materials as leverage to pressure individual countries to reduce sanctions on monetary transactions and technology. By early July 2022, Russia was shipping a third of previously forecast volumes, leading to a more than tenfold increase in fuel costs in the EU.

Germany is the centerpiece of the puzzle and the replacement of the 32 TWh of nuclear becomes a real headache.

“As almost all fuels are affected, the short-term elasticities of the fuel replacement source are about to run out. For example, coal-fired electricity generation in the EU increased from just 82 TWh in the current quarter of 2021 to 95 TWh. in the current quarter of 2022 because capacity was limited and coal costs tripled. Instead, the requested discounts, whether genuine and expected, now play a large role in cleaning up the market,” says Bruegel.

The expansion of coal-based power generation across the EU produced another thirteen TWh of electric power, a third of the nuclear generation missing in Germany.

The option to cut demand doesn’t work either, as the government’s decision to rush to offer subsidies for rising fuel expenditures runs counter to efforts to combat the crisis.

Despite rising fuel prices, thanks to price regulation in peak domestic markets and subsidies already provided by governments, prices have increased tenfold, but demand fell by only 7% in the first part of this year. The elasticity of demand in the fuel sector is in fact very low. Since governments are very reluctant to rate consumers for political reasons, reducing the demand for fuel for marketing mechanisms is almost impossible, so Europe is burning more fuel than it should.

“While it is imperative to continue with vulnerable households, the overall result has been that governments have spent cash in a race to consume more fuel,” Bruegel says. Italy has not reduced its demand at all, leading to significant amounts of fuel in transit through Austria to meet this demand. If Italy had reduced demand by only 3 percent, its tanks would be 80 percent complete now, not 63 percent currently, Bruegel concludes.

The European fuel market is a complex formula that is effective enough to transport fuel across the continent.

Gazprom cut off europe’s supply of the Nord Stream 1 pipeline indefinitely in early September, as Europe’s fuel transmission formula is stretched to the breaking point.

Bruegel says the formula faces 4 main coordination problems: filling storage; discounts on fuel consumption; new offer; and ensure a continuous supply of fuel where it is needed to the fullest.

“The 4 spaces require the intervention of the national government, with coordination problems leading to a less secure and sustainable system,” says Bruegel, who goes on to say that this is not happening.

One of the biggest changes of the last year is that LNG has gone from being another fuel to ensure the proper functioning of the formula and a buffer against external shocks to one of the main fuel resources and that has boosted its ceiling value.

“Before the crisis, Belgium imported moderate volumes of LNG, normal volumes of fuel from the Netherlands and Russian fuel through Germany during the winter months to meet peak demand. Trade with the UK fluctuated in reaction to demand. As the crisis unfolded, Belgium increased its LNG imports to their maximum capacity and boosted pipeline imports from the UK. As a result, Belgium has become a major net exporter to Germany, an important aid as Russian fuel flows are cut off,” says Bruegel.

prizes and money

The electric power formula is already in crisis. Faced with the prospect of freezing homes with the first snowfalls, most European governments focused on their own populations and threw cash into the challenge of reducing demand. Hundreds of billions of euros have already been spent on aid programs and will remain more if costs continue. The efforts made so far threaten to fragment the European electricity market and may lead to large overinvestment in redundant generation capacity, which will also undermine investment in new renewable capacity, which is the long-term solution to the existing crisis.

“Subsidizing energy consumption instead of reducing demand has been a common and misguided approach. Governments are threatening that energy subsidies will be unsustainable, erode confidence in energy markets, slow down sanctions against Russia, and increase the burden of transitioning to the grid. “zero,” Bruegel said.

Even before the blackouts occur, wild price fluctuations have already wreaked havoc on the electric power sector. The European electricity market is highly coordinated, but the activity of buying and selling electricity is essential to keep generation capacity and demand online at all hours of the day: it remains a local activity and exposes small investors to large losses. Since September 2021, almost 30 UK energy suppliers have filed for bankruptcy. in the Czech Republic, which filed for bankruptcy in October 2021, while several energy suppliers said they would withdraw from the French market, and Planet Oui activated an accelerated safeguard procedure in January 2022.

It also costs a lot of extra money. Market volatility has increased margin needs for traders. Typically, source contracts are signed well before delivery dates so that demand and source can match. Central counterparties (CCPs) that facilitate those transactions require a percentage of the contract as a down payment. However, this percentage is more than 80% of the contract price, creating a liquidity challenge that drives up prices for everyone. If volatility worsens, banks may simply avoid offering credit to cover those prices, creating a liquidity crisis that could the banking sector, Bruegel says.

Several major players in public have already been in trouble. The German government is preparing to bail out its main app company, Uniper, with a €15 billion bailout; the Elysee announced an allocation of 10,000 million euros to finalize the nationalization of Électricité de France (EDF); Already in early July, CEZ, the largest application in the Czech Republic, signed a credit agreement with the country’s Ministry of Finance for up to 3,000 million euros, offering liquidity to the company.

In the face of rising energy prices, governments have also poured money into the challenge for consumers. When prices began to rise in the summer of 2021, when Gazprom cut off fuel supplies, European governments rushed to grant subsidies, but in the meantime, this spfinding has become structural and huge. Since September 2021, government interventions have been between 0. 1 and 3. 6% of GDP and have reached a total of around €230 billion in the first part of this year. This figure is expected to double by the end of this year. The cost of fuel and electricity traded in the EU has risen from around 1% of GDP in 2020 to more than 10% of GDP based on August 2022 value levels, according to Bruegel.

At some point, the burden of fuels like LNG and the subsidies that governments distribute to their other peoples become unsustainable: it is less expensive to shut down part of their economy than to pay their citizens’ fuel and electric bills.

Check the box to get the loose e-magazine in your inbox every month

Get notified when a new IntelliNews podcast is added

Your subscription includes:

Your subscription includes: