After a recovery in July, stocks and bonds retreated and posted negative returns in the third quarter. Any hope of lower interest rates has faded as central banks have reaffirmed their commitment to fighting inflation. The Federal Reserve, the European Central Bank and the Bank of England raised interest rates during the quarter. Emerging markets underperformed their evolved counterparts. Raw materials have sometimes declined.

U. S. stocks U. S. prices fell in the third quarter. The communications sector, which comprises telecommunications and media stocks, was among the weakest sectors of the quarter, along with real estate. The consumer discretionary and energy sectors proved to be the most resilient.

In July, the market had begun to consider the option of an interest rate cut by the US Federal Reserve. The US (Fed) in 2023, given considerations about slowing growth. However, hopes were dashed at the Jackson Hole central bankers’ summit in August, where the Fed reaffirmed its commitment to fighting inflation. This caused stocks to fall in the current part of the quarter. The Fed raised the federal budget rate through 75 base issues (bps) to 3. 25% in September; the third consecutive accumulation of 75 foundational issues.

The Federal Reserve’s measure of inflation (the central index of non-public inbound spending) increased in August, on an annual (y/y) basis, from 4. 7% to 4. 9%. Knowledge of GDP showed that the U. S. economy was not yet strong. The US is in technical recession with GDP falling by -0. 6% year-on-year in the second quarter after contracting by -1. 6% in the first quarter. However, other data showed resilience, such as the August report on nonfarm payroll, which showed 315,000 new jobs were added that month.

Eurozone stocks experienced extra-sharp declines in the third quarter amid the ongoing energy crisis, emerging inflation and the resulting fears about economic growth prospects. All sectors posted negative returns, with the biggest declines in communications, real estate and healthcare services. The actions have been marred by concerns about potential liabilities, such as U. S. litigation. The U. S. government has come under pressure from EM bond yields.

The European Central Bank raised interest rates in July and September, raising the deposit rate to 0. 75% and the refinancing rate to 1. 25%. Annual inflation in the euro domain is estimated at 10. 0% in September, down from 9. 1% in August.

Energy prices continued to be the main contributor to inflation. Nord Stream 1, the main fuel pipeline supplying fuel to Europe from Russia, was shut down for maintenance in July. It temporarily returned to service before Russia shut it down in early September. it will put more pressure on electric power producers, many of whom will have to buy herbal fuel from more expensive sources, and has intensified considerations about possible energy shortages this winter. The news also sent the euro to its lowest point in 20 years against the US dollar. .

GDP figures showed that the euro-dominant economy grew by 0. 7% quarter-on-quarter in the current quarter. However, forward-looking signals have signaled a weakening economy. a third consecutive month below 50. (THE PMIs are in the survey knowledge of companies in the production and service sectors. A reading below 50 indicates a contraction, above 50 expansion signals. )

UK stocks fell in the third quarter. A key occasion of the quarter was the election of Liz Truss as leader of the Conservative Party and therefore as Prime Minister. The new government announced a budget package in September that did not win well through markets and sent the pound to a record low against the US dollar.

Sterling’s weakness had already been a feature of the quarter, especially after the U. S. Federal Reserve hit the quarter. The U. S. government warned that it would “continue” when it comes to raising interest rates. After expectations in July that the U. S. maximum rates will beshort-term money flows, such as those presented through the UK’s large-cap components.

Large core multinational customers and electric corporations performed better. These spaces are better positioned to deal with a “stagflationary” economic environment, where expansion is weak or slowing while inflation is peaking or rising. The very strong dollar has also been positive for confidence in those markets. segments since those corporations derive much of their source of income from abroad.

Conversely, fears about the effect of emerging energy spending on discretionary customer finishing have weighed heavily on retailers, travel and leisure, homebuilding and other locally run businesses. The same considerations that contributed to an episode of excessive weakness in sterling. At the end of the era it exacerbated some of those finishes.

After emerging in July and August, the Japanese stock market followed the slump in global stock markets in September to end the quarter down 0. 8%. Aside from a brief era in late July, the yen almost frequently weakened against the US dollar, gently breaking the 140 point for the first time since 1998.

At the beginning of the quarter, market events were overshadowed by the shocking assassination of former Prime Minister Shinzo Abe on July 8. Abe, who resigned in August 2020 as Japan’s longest-serving prime minister, was shot dead while delivering a crusade speech in Nara. two days before the national elections to the upper house.

For its part, the first estimate of GDP showed an annualized expansion rate of 2. 2% quarter-on-quarter, below consensus expectations. The detailed breakdown has been interpreted more definitively with some resilience of capital inflows and expenditures.

The Bank of Japan kept its policy unchanged and the interest rate differential with the U. S. remained unchanged. UU. se widened considerably after successive rate hike decisions through the U. S. Federal Reserve. U. S. This spread has been a vital element in the stable weakening of the yen so far in 2022. The Ministry of Finance intervened directly in the foreign exchange markets when it was observed that the yen depreciated during the day, towards 146 against the US dollar. This was the first direct intervention of its kind in favour of the yen since 1998. By the end of September, the yen had already weakened again, last month to 144. 6 per dollar.

The data showed that inflation in Japan continued to rise, with an overall rate reaching 3. 0%, while the base rate, new foods and energy, reached 1. 6%. In addition to political events and macroeconomic data, the main influence on individual stocks was here from earnings announcements for the March-June quarter, which ended in August. Although earnings momentum slowed compared to the previous quarter, overall effects again beat expectations and profit margins appear to have been resilient so far, despite emerging charge pressure.

Asia-Japan stocks were weaker in the third quarter on investor considerations of emerging inflation, emerging interest rates and fears of a global slowdown. The war in Ukraine and ongoing tensions between China and Taiwan also weighed on sentiment for the quarter.

China was the weakest index market in the quarter due to considerations on emerging interest rates, as countries around runaway inflation from the global war. This is despite the knowledge published in September that it appears that Chinese factory activity expanded in August. February 19 across China has also weakened sentiment, raising fears of additional lockdowns as the country continues to pursue a zero-covid policy.

Stocks in Taiwan and South Korea were also lower. In Kong, the percentage fell sharply as investors continued to sell riskier assets, such as stocks, to protect government bonds amid the risk of further interest rate hikes and an economic downturn.

India ended the quarter in positive territory, considerations about the speed of interest rate hikes by the US Federal Reserve. U. S. confidence weakened toward the end of the quarter. Equity costs in Thailand, Singapore and Malaysia were weaker in the third quarter, while Indonesia ended the era. in positive territory.

Emerging market (EM) stocks posted negative returns in the third quarter amid slowing growth, higher inflationary pressures and emerging interest rates.

Poland was the market place for the weakest index, with Hungary and the Czech Republic also among the biggest declines, while the Russian war in Ukraine escalated and sparked an energy crisis in Europe, which in turn helped boost inflation. a significant margin. The collapse of the real estate market has not only influenced investor confidence, but the imposition of Covid-related closures in major cities has had a negative impact on domestic demand.

Growth-sensitive North Asian markets such as South Korea and Taiwan have been affected by deteriorating global trade prospects. Colombia also performed poorly due to falling commodity prices, while the Philippines and South Africa, where considerations about the energy scenario weighed on sentiment. , also lagging behind the index.

Turkey is the most productive market. Despite inflation above 80%, the central bank cut interest rates twice in the quarter and the economy continues to grow strongly. India and Indonesia also posted positive returns above those of the broader index. Polls anticipated October’s presidential election and took a step forward in expansion and inflation. The knowledge showed that the economy grew strongly in the current quarter, while the CPI inflation rate declined for two consecutive months.

The increase in market volatility in the third quarter continued, as central banks and investors continued to struggle with persistent inflation amid slower growth.

The Federal Reserve added 75 basis points to existing rates in September, raising the rate to between 3. 0% and 3. 25%. This is the fifth interest rate of the year to date, following rate hikes to 1. 75% in June and 2. 5% in July. Chairman Jerome Powell said the Fed’s outlook remained unchanged since the Jackson Hole meeting.

The UK budget announcement accelerated the sell-off as investors questioned the credibility of the government’s fiscal framework. With the gilt market suffering significant losses, the Bank of England intervened by temporarily buying gilts over the long term. minimum of $1. 03 in the last days of the month before recovering some of your losses.

In a statement, Gov. Andrew Bailey said the BoE is “closely” following developments in money markets.

The ECB raised interest rates through 75 fundamental issues in September, following a 50 basis point hike in July. The CPI of euro dominance reached an all-time high of 10% year-on-year. %

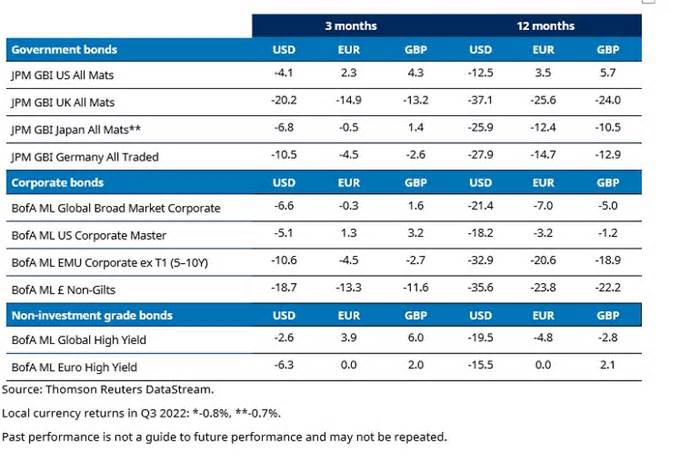

Government bond yields were higher and credit spreads were wider in the global market, putting a heavy burden on market yields. Prospects for economic expansion.

In global credits, yields remained subdued as the market recession continued. The quality of the British pound investment and superior performance were the least efficient. European investment grade and outperformance, as well as emerging market credits, performed better, but only in relative terms, as yields remained negative. Investment quality bonds are the highest quality bonds, according to what we decide through a credit rating agency; high-yield bonds are more speculative, with a credit rating below the quality of the investment.

Emerging-market currencies weakened as investors turned to the U. S. The U. S. government is fearing a recession. The currencies of Central and Eastern Europe combined in opposition to the euro.

Convertible bonds have been well protected against strong headwinds in the equity market. The Refinitiv Global Focus Index lost only -1. 7% over the 3 months, resulting in a very low share of 25%. After a higher August for the number one markets, September some other somber month for new issuances. For the entire third quarter, only US$14 billion worth of new convertibles entered the market.

The S index

Among commercial metals, the values of aluminum, copper and nickel fell. Zinc price declines were more moderate in the quarter, while lead values rose. Within the valuable metals component, the value of gold and silver declined in the quarter. In agriculture, higher wheat and corn prices helped offset falling prices for cotton, sugar, coffee and cocoa.

The price of investments and the source of income derived from them can fall and accumulate and investors probably would not see the amounts invested in the first place.

Schroders is a world-class asset manager with 38 locations in Europe, the Americas, Asia, the Middle East and Africa.

Past functionality does not guarantee long-term functionality and may not be repeated. The price of investments and the source of income derived from them can fall and accumulate and investors may not recover the amounts invested in the first place. All investments involve threats, adding the imaginable threat of loss of principal.

To the extent located in North America, this content is published through Schroder Investment Management North America Inc. , a wholly-owned oblique subsidiary of Schroders plc and an SEC-registered advisor offering asset control products and clients in the United States and Canada.

For all other users, this content is through Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registration number 1893220 England. Authorised and regulated by the Financial Conduct Authority.

Schroders uses cookies to personalize and enjoy the site. By choosing “Accept and continue”, you agree to all categories of cookies. When you choose “Manage Cookies”, you have the option to settle for only the categories of your choice.

Please note that certain types of cookies are mandatory for browsing our online page and therefore cannot be disabled. These mandatory cookies do not collect any non-public data about you. For more information about the cookies we use and how they do so, please see our “Cookie Policy”.