n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — The Philippines is reviving efforts to get corporations to help fund infrastructure ranging from airports to bus lanes, now valued at $43 billion, in a bid to stand out as one of the stars of Asia’s expansion in limited fiscal space.

Most on Bloomberg

The U. S. has spent only about $2 trillion. Enough of that.

Supreme Court Rules Trump Can Appear on Presidential Ballot

Wall Street’s DEI Retreat Has Officially Begun

China cancels Premier Li’s briefing, ending years of convention

Chicago Moves Forward with Project to Redevelop Vacant Downtown Towers

President Ferdinand Marcos Jr. ‘s administration needs to push forward more than 100 projects in the personnel sector to ease pressure on the government’s budget and foreign borrowing, Ma said. Cynthia Hernandez, who leads the company in public-people partnerships.

“The government doesn’t have a monopoly on ideas,” Hernandez said in an interview Friday. “The personal sector can simply have more capacity for generation and knowledge. “

These privately funded projects come with the operation of a Japanese-funded subway in the capital, which is still under construction, and the improvement of airports at tourist sites. The government is also now more open to unsolicited proposals from companies, Hernandez said.

The previous government of President Rodrigo Duterte liked to finance projects through external loans rather than public-private partnerships, as it sought to take advantage of lower borrowing costs. The Marcos government has reinvigorated the PPP program as it balances infrastructure goals with fiscal consolidation.

Grupo San Miguel wins $3 billion airport contract in the Philippines

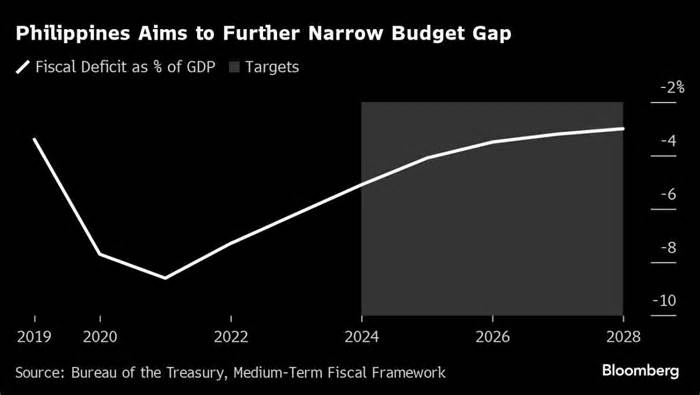

Marcos plans to keep annual infrastructure spending at around 5-6% of gross domestic product during his term, but his government faces a tight fiscal zone after pandemic-related spending drove the budget deficit to a record high in 2021.

The budget hole narrowed to 6. 2% of GDP last year, and the administration’s goal is to increase it to 3% by 2028, when the president’s term ends.

The desire to tap into private sector financing for infrastructure projects is all the more pressing as the Philippines would lose out to concessional loans with lower interest rates if it managed to achieve the prestige of an upper-middle-income country next year, according to Hernandez.

“The staff sector is willing to invest in bankable and viable projects, but we want to get the job done,” he said.

Government infrastructure projects that leverage corporate finance may simply be a primary driver of expansion for the Philippines and can also stimulate banks by stimulating loan applications, said Grace Lim, senior economist for Asia and Asia at UBS Investment Bank Global Research.

“When it comes to large-scale investments, when they start to take off and when they start contributing to GDP through the investment route, they have a tendency to be dispersed,” Lim said.

The government is targeting a 6. 5-7. 5% economic expansion this year, after recording the fastest-growing expansion in Southeast Asia in 2023 thanks to physically powerful intake and investment.

Most read Bloomberg Businessweek

Amazon’s Humanoid Robots Offer a Vision of an Automated Workplace

Private Equity Green Star, all with one database

The Royals of Monaco whose agreements have jeopardized the palace gates

Chocolatiers discover a new recipe: less chocolate

Key takeaways from Businessweek’s survey of Monaco’s royal family

©2024 Bloomberg L. P.