FerreiraSilva

Petroleo Brasileiro S. A. (NYSE:PBR) gained significant momentum in October as the market attracted buyers that the final results of the presidential race between President Jair Bolsonaro and his leftist rival, former President Luiz Inacio Lula da Silva, could be closer than expected. expected. (in favor of Lula).

In addition to the weakness in the energy markets in the third quarter, we, the market, were also involved in Lula assuming the presidency, as Barron’s warned: “A left-wing government would be bad news for Petrobras, which would probably become a tool of the government. “rather than a driving force of shareholder returns. »

However, fund managers in emerging market portfolios remain confident in either candidate, given the blows to Brazilian stocks in 2022. UBS (UBS) argued that the MSCI Brazil index could gain “up to 15 percentage issues over the next 12 to 18 years. “months. “

The world’s largest asset manager, Blackrock (BLK), is also positive for the Brazilian market “regardless” the outcome of the election, as he explained:

We believe Brazil can become the economic force it obviously has the potential to be. As an investor, the issue is that the next government, whoever wins, maintains fiscal prudence and institutional integrity.

As a result, the CBA also rose about 25% from its September lows to its recent highs, attracting buyers who were confident in their prospects, despite the specter of a global economic downturn.

Our research indicates that the huge NTM dividend yield of 33% CBA will need to be thoroughly evaluated to determine if it can be maintained at existing levels. It doesn’t bode well for the safety of your dividend payments.

We have also noted that we are concerned about value structures that imply that the market has downgraded the CBA’s rating despite its likely low valuations. more unexpected global recession than expected.

As such, it is fitting that investors who sit on large profits from PBR’s Covid fund consider reducing their exposure and turning to other battered stocks.

We are reviewing our Maintain to Sell PBR.

Energy markets continued to come under pressure in the third quarter, despite the recent rally after OPEC announced its 2 million barrel production cut consistent with the day. In addition, the IMF and World Bank have seriously warned that they see developing dangers in their 2023 forecasts, even when they revise them.

As a result, we think cyclicality in energy markets may once again hang out with investors, thinking that structural constraints on the source can help mitigate demand for headwinds.

OPEC also cut its forecast outlook for October 2022 as it sees increased dangers of destruction. Its revised outlook suggests that “daily oil expansion demand is expected to shrink to 2. 64 million barrels consistent with the day,” down nearly 15% from September’s projection of 3. 1 million. In particular, he also said that “the dangers are skewed to the downside, the slowdown in global economic expansion, if it continues, will most likely lead to a decline in oil demand in the coming months. “

We therefore urge investors to take a hard look at revising the CPF consensus estimates, as lower oil costs can only affect their profitability.

Adjusted EBITDA margins PBR consensus estimates (S)

Even bullish consensus estimates predicted that Petrobas would post a decline in profit margins through fiscal year 24, specifically because of its loose money margins (FCF).

Therefore, those estimates may be revised if energy costs continue to weaken due to the looming global recession, leading to a compression in value.

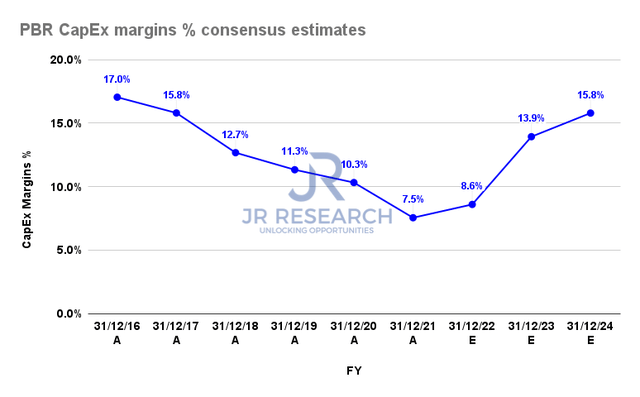

CapEx DAB margins (S

In addition, Petrobas’ CapEx needs are also expected to further encroach on its FCF margins, as noted above. the future.

Consensus estimates of adjusted EBITD for CBA and consistent dividend with consistent percentage (S)

It’s critical for investors that Petrobas won’t be able to maintain its dividend bills for FY22 through FY24 as its earnings normalize (but still be more consistent than before COVID). Even bullish analysts on Street expect Petrobras to post a consistent dividend. with a constant percentage (DPS) of $1. 82 during the EX24, particularly below the EX22 estimate of $5. 91.

ACB Term dividend yield consensus estimates (S

We postulate that additional revisions to your EPS estimates may result in a downward revision of your DPS estimates. Based on existing estimates, its future dividend yields are expected to fall particularly to just 13. 1% in FY24. As a result, the market has downgraded the CBA despite posting such large returns in 2022 in anticipation of those headwinds.

We therefore urge investors to ask themselves whether they believe Petrobras can continue its existing dividend bills as more headwinds loom, further weakening underlying energy prices.

PBR Price Chart (Weekly) (TradingView)

We postulate that the market has given a number of cautionary signals on the PBR medium-term chart, suggesting a short tension in its intermediate resistance.

As a result, ACB’s upward purchases of existing securities will likely come under even more pressure as energy market expectations weaken further.

In addition to our assessment that your DPS estimates may be lower, which would affect your valuation, investors deserve to capitalize on the recent rally to reduce their exposure.

As such, we are reviewing our Hold to Sell PBR.

We help you access low-risk hotspots, making sure you can leverage them with a higher chance of good fortune and profit on your next wave. Your club also includes:

24/7 to our style portfolios

Daily tactical market research to refine your market wisdom and emotional roller coasters

Access all our movements and beneficial ideas

Access all our cards with access points

Real-time chat support

Real-time buy/sell/hedge alerts

Sign up now for a risk-free 14-day free trial!

This article written by

I am a JR, senior and founder of JR Research and the Ultimate Growth Investing Marketplace service. Our team is committed to providing more clarity to investors in their investment decisions.

Our market service focuses on an action-based approach to valuing expansion and generation stocks, supported by a basic analysis. In addition, our general SA online page deals with the movements of sectors and industries.

Our discussion basically focuses on a thesis in the short or medium term. While we hold long-term stocks, we also take advantage of the right opportunities to take advantage of short- and medium-term fluctuations, taking advantage of long (directionally bullish) or short (directionally bearish configurations) stocks.

My LinkedIn: www. linkedin. com/in/seekjo

Disclosure: I have/do not hold any stock, options or derivative positions in any of the corporations discussed, and I do not intend to initiate such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I don’t get any refunds for this (other than Seeking Alpha). I don’t have any business dating a company whose shares are discussed in this article.