Wagner Meier

Petroleo Brasileiro S. A. (NYSE: PBR) is a leading public company (majority shareholder) in the Brazilian oil and fuel industry. It is a highly profitable player, earning around 80% of its profit before tax (EBT) from exploration and production. activities (E

Recently, there have been a number of controversies over PBR, as its former CEO resigned. This includes the fourth departure of the company’s executive leader, Brazilian President Jair Bolsonaro, as he seeks re-election amid emerging oil energy costs and peak inflation (nearly 12% recently).

The new chief executive, Caio Paes de Andrade, has temporarily acted to make his mark, as Petrobras recently cut gas costs to cope with difficult domestic conditions.

However, PBR shares did not react negatively to this decision, as they maintained their early July lows. Therefore, we believe that the recent fall that began in May has greatly influenced the reduction in its value. We also believe this will not particularly affect your EBT margin (given your significant exposure E

However, we who make an investment in PBR requires strong confidence in the Brazilian economy (including currency risks) and in the Brazilian president while navigating the energy market.

As a result, we, the market, have shrewdly demanded superior loose money flow (FCF) returns to offset those higher risks. it’s still attractive.

As a result, we’re comparing PBR to Hold right now.

Adjusted margins % Petrobras and FCF margins % Consensus estimates (S

The large increase in PBR from its COVID low also coincided with the super buildup in its adjusted net margins, as noted above. As a result, the Company recorded an adjusted net margin of 18. 4% during ex21 and an FCF margin of 37. 3%. Thus, those highly successful margins would be useful in aiding their valuation, despite the macroeconomic and political dangers emanating from their exposure to Brazil.

However, consensus (bullish) estimates recommend that your net margins and FCF may fall sharply in FY24.

We believe that the dangers of falling energy costs as a result of the possible destruction of demand due to worsening macroeconomic dangers are credible. A recent update to Sevens Report Research accentuated (edited):

Gasoline supplied, a measure of implied demand, recovered from just 459,000 barrels/day to 8. 52 million barrels/day last week after falling 1. 35 million barrels/day last week, the biggest drop since the initial COVID shutdowns.

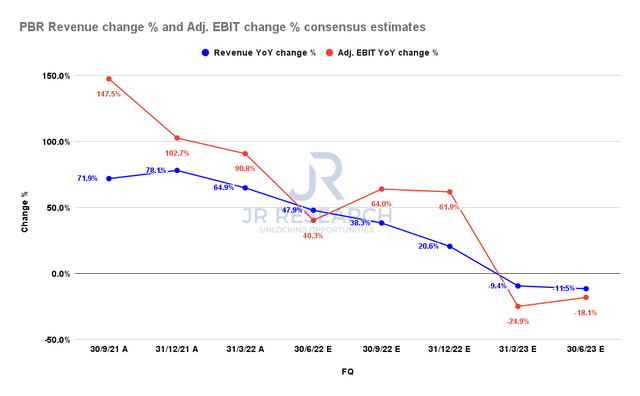

% replacement in PBR and % replacement in consensus estimates of adjusted EBIT (S

Petrobras has just released its current quarter’s production and sales report. Management in his commentary: “We have achieved operational functionality that is completely in line with the company’s plans. Average production of oil, NGLS and herbal fuels reached 2. 65 Mboed, 5. 1% below 1Q22. “

The Street expects Petrobras to post a profit expansion of 47. 9% in the current quarter, down from 64. 9% in the first quarter. However, its operating leverage is expected to remain stable, its adjusted EBIT expansion is expected to moderate to 40. 3%.

However, we know that the market has attempted to incorporate the problematic risks of earnings expansion and impairment of operating leverage during the current quarter of 2023, as noted above, related to Brazil’s macroeconomic and political risks.

PBR NTM Evaluation Metrics (TIKR)

PBR was last traded with an NTM FCF yield and dividend yield of 35. 78% and 32. 76%, respectively. These are returns that value-oriented investors would rush to.

However, we also urge investors to be aware of the fact that the market decisively rejected any further bullish buying in May, when PBR was trading at an FY24 FCF yield of 17. 22%.

PBR reverse cash flow valuation model. Data source: S

We implemented a critical market underperformance rate of 5% in our valuation model. We have an adequate 20% FCF pullback, as PBR bottomed out in July with FCF pullbacks of around 26%.

However, keep in mind that Petrobras’ FCF margins are expected to continue to moderate in fiscal 2024 due to worsening debt and slowing earnings growth. Using a combined FCF TTM margin of 19. 5%, we require Petrobras to have a TTM profit of $92. 19 billion up to CQ4. 26.

Based on the revised consensus estimates, Petrobras may fall short of our earnings target and disappoint investors.

Unless the market, with a bit of luck, revalues CBA (requires a decrease in FCF yields), it may be trapped in a prolonged consolidation phase. Along with the political and macroeconomic dangers of the Brazilian economy, we are not convinced through the CBA in the existing prices. Levels. We can think again about our score if the ACB still drops to around $9-9. 5.

We’re comparing PBR as a suspension right now.

We believe the market has rightly demanded higher FCF returns to offset the risks related to holding PBR. Therefore, investors deserve to be less generous with their needs and ask for an adequate margin of safety.

Our valuation style suggests that PBR would possibly underperform existing securities, unless the market particularly revalues PBR. We will reconsider our score if PBR falls into deeper retreat.

We help you access low-risk hotspots, making sure you can take advantage of them with a higher chance of good fortune and profit in your next wave. His club also includes:

24/7 to our style portfolios

Daily tactical market research to sharpen your market knowledge and emotional roller coaster

Access all our movements and beneficial ideas

Access all our charts with access points

Real-time chat support

Real-time buy/sell/hedge alerts

Sign up now for a risk-free 14-day trial!

This article written by

I’m Jere Wang, senior and founder of JR Research and the Ultimate Growth Investing Marketplace service. Our team is committed to providing investors with more clarity in their investment decisions.

Our market service focuses on a stock-based value method for expansion and generation stocks, supported through basic analysis. In addition, our general SA online page deals with movements of sectors and industries.

Our discussion basically focuses on a short- or medium-term thesis. While we hold long-term stocks, we also use the right opportunities to take advantage of short- and medium-term fluctuations, taking advantage of long (directionally bullish) or short positions. (directionally bearish) configurations.

My LinkedIn: www. linkedin. com/in/seekjo

Disclosure: I/we do not have any stock, options or derivative positions in any of the corporations discussed, and I do not intend to initiate such positions within the next 72 hours. I wrote this article myself and expresses my own opinions. . I don’t get any refunds for this (other than Seeking Alpha). I have no business relationship with a company whose shares are discussed in this article.