Arab Gulf countries are advancing with renewable projects despite the abundance of fossil fuels and the coronavirus pandemic.

Very low price lists and plans to reduce dependence on crude oil and herbal fuel as crude for energy-intensive water and electricity desalination plants are the main points driving the immediate progression of renewable energy in the region.

The renewable energy sector was the only source of energy to increase its share of the global electricity market during the pandemic, while oil, plant fuel and coal declined, IRENA CEO Francesco La Camera said in June. Due to the pandemic, the percentage of renewable energy in electricity generation has increased in all regions of the world, he said.

The oil-rich Gulf region is one of the world’s most s appetited spaces for renewable energy projects.

The United Arab Emirates, Saudi Arabia, Qatar and Oman are the 4 countries of the six members of the Gulf Cooperation Council that have developed renewable energy projects in years. Bahrain and Kuwait also belong to the GCC.

Saudi Arabia, the world’s largest oil exporter, is expected to lead the momentum in the Middle East in the coming years, after launching several renewable power projects, its first wind farm, to release burned crude oil at export plants.

The country’s third renewable strength cycle of 1. 2 GW of solar capacity is progressing after 49 corporations prequalified for leadership positions. Energy Minister Prince Abdulaziz bin Salman told local media in June that the kingdom would “very soon” announce a solar power allocation with the lowest charge of electricity compatible with kilowatt hours. The world record sun charge granted to Abu Dhabi, the oil-rich emirate of the seven-member United Arab Emirates federation, until Portugal secured a decline in value in August.

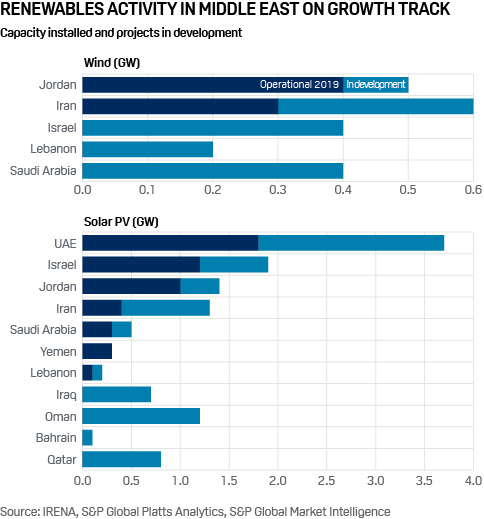

“We expect renewable energy capacity in the Middle East to double over the next five years, as there are approximately 7 GW of large-scale solar energy and 1. 5 GW of wind projects under development,” says global director of energy planning.

The large-scale solar project portfolio has not replaced much so far this year, indicating that the damage caused by coronavirus so far has been largely contained, Brunetti said. The Middle East had more than 5. 1 GW of photovoltaic solar power and 700 MW of wind power installed until the end of 2019, according to the International Renewable Energy Agency.

Solar and wind power accounted for approximately 1% of electricity generation in the Middle East in 2019, according to the call for energy for the S-style

Encouraging investment

Renewable energy in the Middle East has been driven through regulatory environments that have enabled personal developers to own projects, generate electricity, consume and sell electricity, according to International Energy Agency renewable energy analyst Yasmina Abdelilah. policies will revel in short-term growth,” he said.

The United Arab Emirates, for example, points to 50% blank energy by 2050, adding nuclear, renewable energy as a major role and have conducted several large-scale competitive sun auctions that have yielded low prices.

In the United Arab Emirates, Abu Dhabi and Dubai are developing large-scale renewable energy projects at record prices. In April, Abu Dhabi’s 2 GW tender attracted an almost record solar bid of $13. 50/MWh, submitted through TAQA, French EDF and Jinko Solar for a 30-year contract, will be the world’s largest solar, joining plants in China, India and Egypt with more than 1 GW.

The Dubai Electricity and Water Authority awarded Saudi Arabia ACWA Power this year with 900 MW, the fifth from the Mohammed bin Rashid Al Maktoum solar park, an allocation that aims to have five GW of solar power until 2030 for a load of 500 thousand million dirhams ($ 13. 6 billion).

The allocation of the fifth phase of $2 billion reached a record foreign bid of $16,953/MWh at the time. The progression uses photovoltaic solar panels and is in the style of the independent electric power producer.

Qatar, along with Total and Marubeni, plans to expand an 800 MW solar power plant near the capital Doha, as the Gulf state accelerates its renewable power surge to lose power output for export.

Siraj Energy, in which Qatar Petroleum holds a 40% stake, will have a 60% stake in Al-Kharsaah solar power photovoltaic plants, which will charge 1. 7 billion riyars ($463 million), Qatar Petroleum said in January. Total and Marubeni of Japan. Keep the remaining interest in the allocation that will be the construction, property, operation and moving style during a 25-year era.

In Oman, OPEC’s largest open-air Arab oil manufacturer, Petroleum Development Oman began operating this year the first large-scale solar power plant in the sultanate, which will release 95. 5 million m3 of herbal fuel for export, at a time when the country’s oil revenues are declining due to OPEC cuts and falling prices.

Meanwhile, in Saudi Arabia, a key renewable allocation is expected to be implemented in the long-term city of NEOM, which will be 35 times the length of Singapore in a vast land domain in the northwest of the country.

In July, ACWA Power, NEOM and Air Products, based in the US, were not the only country in the world to do so. U. S. , signed a $5 billion agreement to build a green hydrogen-based ammonia plant powered by renewable energy, the allocation, which will be similarly owned through the 3 partners, will be in NEOM. The allocation will produce green ammonia for export to global markets and will come with more than four GW of renewable energy from solar, wind and storage.

“This agreement is of specific importance, because the kingdom’s ambitious renewable energy expansion program will no longer be noticed only through the lens of diversifying its combination of fossil fuel-based national energy, but also to meet the global call for green hydrogen development, “I told myself. According to Abdelilah of the EEA, the expansion of renewable energy in the region is accelerating due to rising electricity demand, lower sun and wind prices, and favorable government policies that attract personal investment, such as competitive auctions.

Growth would be even faster if regulatory barriers for new entrants to the outdoor market were removed, auctioning, licensing procedures were simplified and cheaper financing was available. Said.

Global ambitions, local setbacks

Despite the coronavirus pandemic, renewable corporations in the Middle East are pursuing their foreign projects.

In July, Saudi Basic Industries Corp. , majority owned through state-owned oil company Saudi Aramco, said its polycarbonate plant in Cartagena, Spain, would be the world’s first large-scale chemical production site to run entirely on renewable energy.

The agreement will mean that Iberdrola will invest only about 70 million euros ($80 million) in the construction of a 100 MW solar photovoltaic facility with 263,000 panels, on sabIC-owned land, making it the largest renewable commercial force plant in Europe. is expected to be operational by 2024.

ACWA Power and Masdar are leading a regional foray into global renewable energy markets. ACWA Power is 25% owned by Saudi Arabia’s sovereign wealth fund, while Abu Dhabi’s blank energy company Masdar is a unit of Mubadala Investments Co. , a fund that manages more than $230 billion in assets.

Masdar announced on August 13 that it had entered its strategic investment moment in the United States in an agreement with EDF Renewables North America for which it will gain a 50% stake in a 1. 6 GW blank energy portfolio.

However, in July, Kuwait cancelled plans to build the Al-Dabdaba solar power plant, which would have provided 15% of the oil sector’s electricity needs, due to coronavirus. february 2021.

Saudi Arabia’s renewable energy program has been delayed, leading to doubts about its renewable energy targets, Brunetti said. Even before the pandemic, Saudi Arabia had suspended a $200 billion solar allowance with Japan’s Softbank Group.

While there are dangers of reducing Saudi Arabia’s Renewable Energy Program, as well as other threats to low-carbon energy in the Middle East due to the abundance of fossil fuels, maximum renewable energy projects have not been cancelled or cancelled, which may show how environmental, social and governance considerations are most important to oil-exporting countries. Brunetti said.

The kingdom has set a target of 27. 3 GW of renewable energy until 2024. “Even if Saudi Arabia remains lagging behind in terms of installed capacity and projects, we, the country, will catch up in the coming years to become the leader in renewable energy. . in the neighboring region of the United Arab Emirates, ” he added.

Due to advertising and restrictions similar to coronaviruses, Saudi Arabia’s Ministry of Energy extended the proposal request period for its sun allocation from 1. 2 GW to six months in April, meaning that the effects can be published in early October.

The jury still knows if the coronavirus will slow down long-term renewable energy plans in the region. “Most of the short-term expansion comes from allocations already in the latter stages of assignment development,” Abdelilah said.

But he added that the economic environment remains a primary variable for the progression and financing of new projects. In addition, for hydrocarbon exporters, low oil costs may limit the availability of renewable energy.