“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

The omio multimodal platform (formerly GoEuro) has raised $100 million in complex investments to help its activities cope with the coronavirus crisis. It also indicated that it was considering possible mergers and acquisitions in the sector most affected.

New and existing berlin-based start-up investors participated in the newest convertible ticket, or does not reveal any new names. The list of returning investors includes: Temasek, Kinnevik, Goldman Sachs, NEA and Kleiner Perkins. Omio’s company has now raised about $400 million in total since its inception in 2013; past accumulation was a $150 million circular in 2018.

To help the most recent increase, Kinnevik CEO Georgi Ganev said: “We are very inspired by the speed and power with which Omio has adapted to an unprecedented crisis for the global travel industry. The control team delivered temporarily and we can see the robustness of the well-diversified business style in the markets and modes of transport. We look to the future to lead Omio on his way to suit the must-see destination for travelers around the world.”

While COVID-19 has generated headwinds for tourism and the global world: foreigners are discouraged through the government’s express quarantine requirements and the primary requirement for others to maintain social distance, meaning that some types of vacations or activities are less exciting or even achievable. Omio, however, is positive: it reports a partial resumption of reserves this summer in Europe.

In Germany and France, it indicates that reserves are above 50% of the pre-COVID-19 point at this stage, despite “marginal” marketing spending during the crisis period.

Its activity is probably greater located than others in the box to adapt to the settings in the way other people move and spend their holidays, as it addresses various shipping modes. The aggregation platform covers flights, trains, buses and even ferry routes, allowing users to temporarily compare other shipping modes for their planned trip.

More recently, Omio has added car sharing and car rental to its platform, particularly through a partnership with rentalautomobiles.com. Therefore, since travelers in Europe have adapted to live with COVID-19, by choosing to make more local trips and/or avoid public shipping when they spend holidays, you are in a good position to comply with the conversion call through your associations with terrestrial networks. and shipping providers.

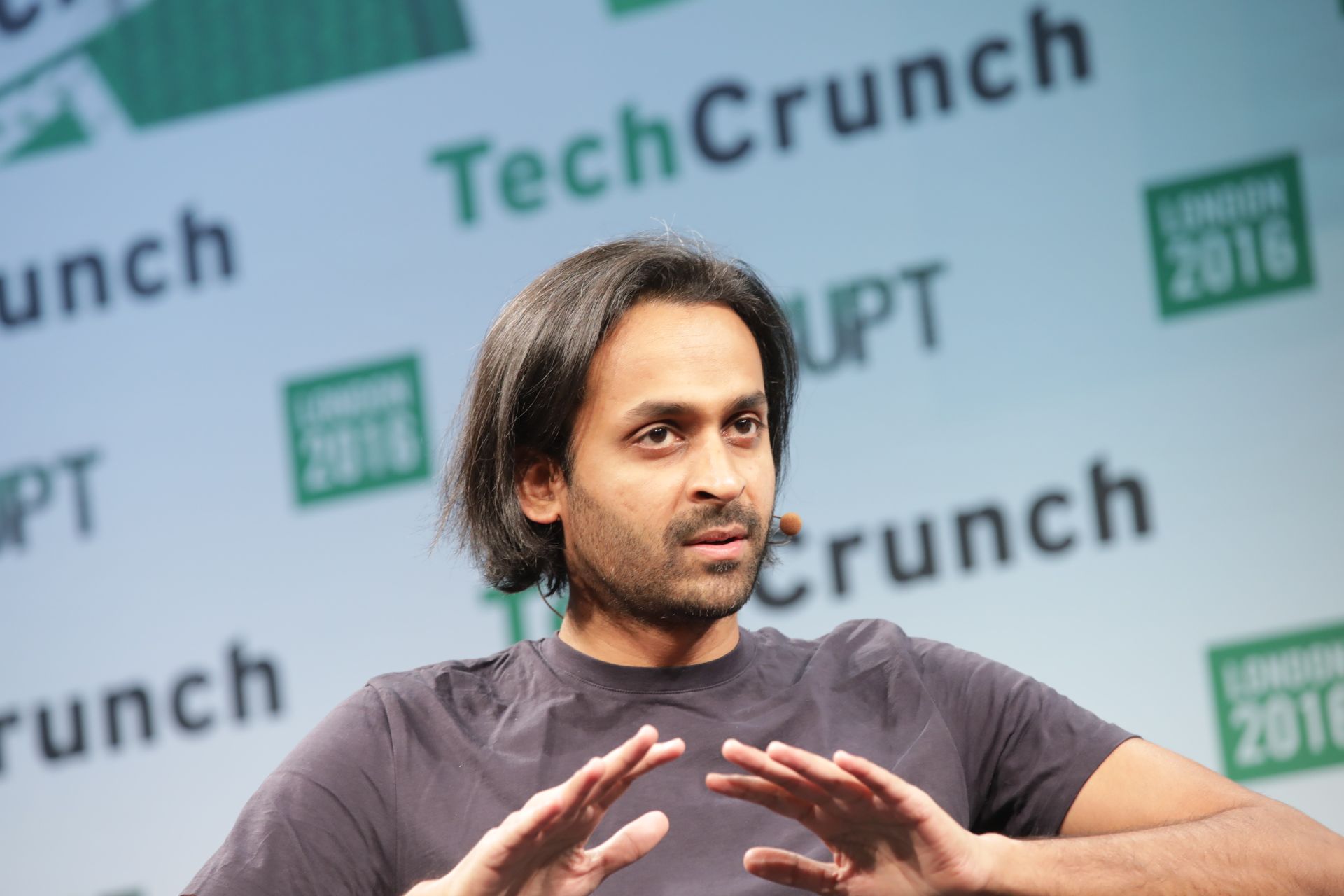

“This diversification of not relying on a single mode of transportation has helped the company return much stronger, because we don’t rely, for example, on the plane or bus,” CEO and founder Naren Shaam told TechCrunch. “Diversification has helped us.”

“People will go much more to smaller areas, explore the countryside a little more,” he predicts, suggesting the existing dilution of the tourist orientation he sees, away from the same old tourist destinations in favor of a wider and rural combination of places. – augurs a broader shift towards a more varied and sustainable type of being there to stay.

“It’s not just about airport to airport,” he says. “People where they need to pass, and it’s much more distributed across geographic areas, where other people need to explore. A platform like ours can accelerate this behavior because we serve not only flights, but also trains, buses and even ferries, etc. ,, you can succeed in any destiny with us.”

Direct booking through the Omio platform is imaginable when you have existing partnership agreements (so not universally in all directions, although you can still provide information on management plans).

Its combination of multimodal reserves extends to 37 countries in Europe and North America, where it was introduced earlier this year. Last year, it acquired Rome2Rio, expanding its global flight and shipment planning stock. The great vision is “all shipments, from start to finish, in a single product”, as Shaam says: implementing it means proceeding to build partnerships and integrations in your presence in the market.

When asked that the new investment will give Omio enough leeway to overcome the current coronavirus crisis, Shaam told TechCrunch: “What is unknown is the duration of the crisis. But as we can see if the crisis lasts a few years, we will. Through that. “

He says construction will help the company get out of the “stronger” crisis by allowing Omio to spend to tailor its product to meet customer conversion demand, such as switching to floor transport. “All of those things, we can use this capital to shape the long-term of how the industry actually interacts with customers,” he suggests.

Another industry replacement that was triggered through the coronavirus is the customer’s expectation of data. In short, other people expect a lot more information in advance.

“We have assumptions about what comes back [after the crisis]. I think it will be much more data-centric, especially when I go out COVID-19. Customers will seek to explain in the short term the fundamental data about the spaces in which I can, I deserve to be quarantined, I deserve to wear a mask inside the train, etc.,” he says.

“But this will lead to a type of customer behavior in which they are looking for more data and corporations will have to provide this data to satisfy the wishes of future customers. Because customers are getting used to having applicable data at the right time. So this is not a knowledge sale of the whole dataArray … is when I get to the station, what do I do?

“Each of them is almost hyperlocal in terms of data and this will lead to a replacement in customer behavior.”

Omio’s initial reaction to this desire to get more data was the launch of a hub, called Open Travel Index, where users can search for data on restrictions similar to express destinations to help them plan their trip.

However, he admits that it is difficult to keep up with the needs that can be replaced overnight (in a recent example, the UK has added France to a list of countries from which returning travellers will have to be quarantined for two weeks, resulting in a wild streak of dozens of tourists looking to exceed the 4am deadline to return to British soil).

“It’s a product we present for about a month and a part that tells you, if you’re founded in the UK, where you can move to Europe,” he says. “We want to update it more temporarily because the data settings are very, very temporary, so now it’s up to us to figure out how to keep up with the consistent settings in the data.”

Discussing other adjustments to COVID-19, Shaam highlights the shift to programs that accelerates through the public fitness crisis, a trend that repeats itself in several sectors, of course, not just in travel.

“More than a part of the direct shipping industry has been booked for a kiosk at a station [before COVID-19]. This will lead to a transparent replacement with others who feel uncomfortable at the touch of a kiosk button,” he adds, arguing that the Replace will create more products for industry customers.

“If you believe in the type of customer products that the world of apps/web has created, you may believe they deserve to come from the reports of traveling customers,” he suggests. “So I think it’s the things that will come in terms of customer habits and it’s up to us to make sure we’re driving this replacement as a company.”

“We’re making a big investment in some of the other adjustments we’re seeing, in terms of days before departure, flexible rates, more safe-type products so you can cancel,” he adds. “We’re also looking to help consumers know if they can go.

“We’re making a strong investment in routes so you can connect modes of transport, not just flights, so you can travel longer distances with just trains. And we’re also in talks with all our suppliers to tell you right, how we can help you come back, because not all suppliers are state monopolies. There are many small and medium suppliers in our products and we have to bring them back as well, so we’re also making an investment there.”

With regard to mergers and acquisitions, Shaam says expansion through acquisition is “definitely on the radar for us.” Although it also says it’s the most sensible on the priority list right now.

“We actively pulled out our ears. More now, advancing, than hunting backwards, because for the last 4 months, believe me what we’ve been through as a travel agency, I just sought to stabilize this scenario and take us to a solid position,” he says.

“We’re still at COVID-19. The scenario is not yet over, so our main goal is to invest a lot in adjustments in the customer’s habit in our commodityArray. All the acquisitions we’ll make are more opportunistic, based on [factors like] costs and what’s in the industry.

“But more of our capital and my time and everything will be much more to build long-term transportation. Because it will replace so much more for so many millions of consumers who use our product today.”

There are still many paintings to be made about Omio’s main proposal, i.e. linking herbal travel studies with consumers by combining a varied combination and the diversity of service providers to reduce the burden of making travel plans and expanding to more trips that other people wish to make in the future.

“No one brings herbal studies to consumers. Consumers only need to move from London to Portsmouth. They don’t say “London train to Portsmouth.” They do it today because that’s what the industry forces them to do: allow the product to be painted where you can look for all modes of transport, anywhere in Europe, a click to buy, everything is an undeniable cell ticket, and all the products are used in the application: it is the great engine of the industry”, adds Shaam.

“In the most sensible part of that, it has adjustments in floor transport, application adjustments, sustainability adjustments, which is a very sensible aspect, even before COVID-19, which we can help further drive the replacement of that. These are the most important opportunities for us.”

Uncertainty remains obviously a constant for the industry now that COVID-19 has become a terrible “new standard.” So, even with an unforeseen summer holiday in Europe, it remains to be noted what will happen in the coming months as the region passes from summer to winter.

“Overall, the overall business perspective we’re adopting is more cautious,” Shaam says. “We just don’t know. Nothing at all about COVID-19, nobody knows, basically. I’ve noticed a number of reports in the industry, but no one knows. So, in general, our attitude is cautious. Array And that’s why we were surprised by our increase during the summer. We didn’t even expect this kind of expansion with near-zero degrees of marketing spending.”

“We’ll adapt,” he adds. “Variable business prices are high, so we can easily accumulate and decrease our assets, which is helping us adapt. And let’s see what happens in winter.”

In the United States, where Omio showed up a little before the COVID-19 crisis, he says it’s a very different story, with no accumulation of reserves. “It’s no wonder, given the stage there,” he said, stressing the importance of government interventions to help spread the virus.

“Governments play a very vital role here. Europe has done a greater task compared to many other parts of the globalArray … But entire economies [in the region] have tourism,” he says. “Hopefully, total [European] countries deserve that they no longer close because the systems are resilient enough to identify local spikes in cases and close it very temporarily and can act accordingly. It’s the same as us as a company. If there is a moment, we know how to react because we use this terrible word aArray. So those learnings and applying them temporarily, I think, will help stabilize the industry as a whole.”