Toronto, Ontario–(Newsfile Corp. – April 4, 2024) – Omai Gold Mines Corp. (TSXV: OMG) (OTCQB: OMGGF) (“Omai Gold” or the “Company”) is pleased to announce the positive effects of its first Preliminary Economic Assessment (“PEA”) of the Wenot Project, one of two gold deposits at its wholly-owned Omai assets in French Guiana. The PEA supports an initial open-pit mining situation for an average production of 142,000 ounces of gold. consistent with one year over a 13-year shelf life, with a maximum annual production of 184,000 ounces. Total production from Wenot is estimated at 1,840,000 ounces of payable gold. A spot gold price sensitivity of $2,200/oz supports an after-tax net supply cost. of 5% (“NPV”) of $777 million, an internal rate of return (“IRR”) of 24. 7% and a payback consistent over a 3. 5-year period.

Elaine Ellingham, President and Chief Executive Officer, commented: “We are incredibly pleased with this first economic assessment for the new Omai, which at this time only incorporates our Wenot open-pit deposit. This PEA is a vital step forward as it turns our successful exploration systems into a benchmark production situation showing physically powerful economic progression, prospects for Omai to become a full-scale gold manufacturer again, thanks to the many benefits of an abandoned project, adding access to smart roads, a close professional workforce and strong government for re-progression. “

“Although we did not include the adjacent Gilt Creek deposit in this economic study, we are confident that it will contribute to an overall long-term mine plan. Since Gilt Creek would be an underground mine, it would have required significant additional engineering, time and cost, and our priority of identifying a benchmark valuation for our shareholders. We have accelerated the progress of this task over the past two years, and we are pleased to deliver those tangible results.

PEA Highlights for Wenot Open Pit Mine

Click here to see a three-dimensional style of the Wenot open-pit deposit.

Omai’s CEO continued, “We are pleased with the effects of the PEA as they identify the possibility of a single ‘superwell’ for the Wenot deposit. We add that Omai has exceptional potential to expand the mine plan and stimulate the economy: 1) At Wenot, there are known gold zones along the course and in intensity that are expected to accumulate mineral resources within and outside the engineered PEA. pit; 2) Upon completion of engineering studies and incorporation of the adjacent Gilt Creek deposit, the Omai mine plan could be prospectively expanded. a mine life of more than 20 years; and 3) through the advancement of paints in two high-grade zones close to the surface, there is the possibility of feeding the processing plant with higher grades during the first few years, which would especially increase profitability. Omai will move forward with engineering and authorization work towards a preliminary feasibility study (“PFS”). With those goals in mind, we look forward to continuing our work to advance the Omai project in 2024. “

The monetary and operational parameters of the AEP are presented in Table 1 below.

Note: The PEA is initial in nature and includes Inferred Mineral Resources that are too geologically speculative to apply the economic considerations that would allow them to be classified as Mineral Reserves, and there is no certainty that the PEA will be realized. The Mineral Reserves have not demonstrated economic viability.

Table 1. Financial and operational parameters of the preliminary economic assessment

1 Total money prices include mining, processing, surface infrastructure, transportation, G

Financial Analysis & Sensitivities

The allocation generates accrued after-tax loose money of $1. 067 billion and an average annual loose money of $112. 5 million over the 13-year life of the generating mine.

Figure 1. After-Tax Cash Flow Over the Life of the Mine

PEA monetary research is particularly influenced by gold value, operating costs, and capital costs, as shown in Table 2. For example, with gold’s benchmark of US$1,950/oz, Wenot’s allocation generates an after-tax NPV. of $556. 4 million and an after-tax NPV of $556. 4 million. Discount rate of 5% with an after-tax IRR of 19. 8%. However, a cumulative sensitivity of 10% in the gold value reference case of $2145/oz has fiscal NPV effects of $728. 2 million and an after-tax IRR of 23. 7% with a payback era of 3. 6 years from the start of production.

Table 2. PEA Sensitivities to Gold Price, Operating Costs (Opex) and Capital Costs (Capex)

Gold Price Sensitivities

Operating Expense Sensitivities

Investment Sensitivities

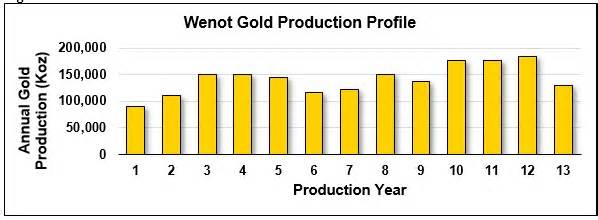

Gold Production

Annual production over the life of the Wenot mine is expected to average 142,000 gold with a peak annual production of 184,000 Array for a total payable gold production of 1,840,000 Array.

Figure 2. Wenot’s Production Profile

Investment Costs

Initial capital prices are estimated at $375. 2 million, and life-of-mine maintenance prices are estimated at $172 million. Included are contingencies of $54 million and $18 million in initial capital and maintenance pricing, respectively. These estimates were based on existing prices and quotes obtained from potential local suppliers, and other estimates are based on benchmarks and experience of operations.

Most of the initial capital prices of $375. 2 million include: $100 million for processing plant apparatus and buildings plus $75 million in indirect prices for the processing plant structure, $46 million for mining and surface preparation apparatus, $45 million for public works and infrastructure, $33 million. $20 million for capitalized pre-clearing, $20 million for owner pricing and $54 million for contingencies.

Most of the $172 million in sustaining capital includes: $139 million for mining equipment, $9 million for tailings and water treatment, $6 million for processing plant apparatus and $18 million for contingencies.

Cash Costs

The total monetary charge, adding royalties, is estimated to be $41. 00 per tonne processed or $916/oz of payable gold. The overall maintenance charge is estimated at $1,009/oz of gold payable. Similar or consistent relationships, with productivity derived from benchmarking and industrial practices.

Table 3. Total Monetary Costs

Mineral Resource Estimation

The PEA applies only to the Wenot open pit deposit and excludes the adjacent Gilt Creek deposit. Management believes the Gilt Creek deposit, which would require underground mining, is interesting enough to incorporate into a larger mine plan. However, in order to speed up and simplify the existing PEF, it has been excluded.

On February 8, 2024, the Company announced an updated Mineral Resource Estimate (“MRE”) for Omai’s assets in Guyana (Wenot and Gilt Creek deposits). Its main points are an overall indicated MRE of 1. 985 million ounces of gold averaging 2. 15 g/t Au and an inferred MRA of 2. 279 million ounces averaging 2. 26 g/t Au.

The PEA is based on the Wenot deposit, with an indicated MRE of 834,000 ounces averaging 1. 48 g/t Au and an inferred MRE of 1,614,000 ounces averaging 1. 99 g/t Au. The pit design used in the PEA does not include 58,600 ounces of Indicated Mineral Resources and 456,900 ounces of Inferred Mineral Resources, representing approximately 21% of Wenot’s overall MRE ounces (Figure 5). These excluded MRE ounces are hosted in narrow veins or remote areas with an intensity that results in a maximum extraction rate. However, it is expected that at least some of the recently excluded mineral resources are likely to be incorporated into long-term economic scenarios through further drilling.

Figure 3. 3D style of the Wenot and Gilt Creek deposits, owned by Omai Gold, Guyana

Omai’s mineral resource estimates are presented in Table 4. The notes accompanying the 2024 MRE are presented below the table and summarize the economic and technical assumptions.

Table 4. 2024 Mineral Resource Estimates (January)

Notes accompanying the 2024 Mineral Resource Estimate:

1. Mineral resources that are not mineral reserves have not demonstrated economic viability. 2. The mineral resource estimate would likely be greatly affected through environmental, permitting, legal, title, tax, socio-political, marketing or other applicable matters. The inferred mineral resource in this estimate has a lower confidence point than that applied to an indicated mineral resource and is not worthy of transfer to a mineral reserve. Rather it is expected that the majority of inferred mineral resources can also potentially be converted to indicated mineral resources through continued exploration. 4. Mineral resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) standards, the CIM Mineral Resources and Reserves Standards, Definitions (2014) and the Mineral Resources Guidelines. Best Practices (2019) lists through the ICM Standing Committee on Definitions and Reservations. followed through the CIM Council. 5. Wenot strand line gold tension assays were pooled into 1. 5 meter lengths and then capped at between 10 and 25 g/t. Gilt Creek Wireframe gold tension assays were pooled into 1. 0 meter lengths and then capped between 12 and 40 g/t. 6. Wenot’s mineral resource estimate incorporates 9,840 assay effects from 603 diamond drill holes totaling 87,323 m of mineralized strand structures. The Gilt Creek mineral resource estimate incorporates 7,056 assay effects from 46 diamond drill holes totaling 27,997 m of mineralized chord structures7. Score estimation was performed with ID3. 8 interpolation. The apparent density of Wenot bead stress was decided from 30 in-situ stops in the samples. The obvious density restricted by the golden cord was decided from a stop at 28 sites in the samples. 9. The Wenot gold process recoveries used were 92% for alluvium/saprolites and 92% for transitional/fresh rocks. The recovery of the Gilt Creek gold procedure used was 92%10. The value of the gold used was US$1,850/oz11. Open pit mining prices used through Wenot in US dollars were $2. 50/t for mineralized curtain extraction, $1. 75/t for waste extraction, $10/t for process of alluvium/saprolite, $14/t for the fresh/transitional rock procedure and $2. 50/t for the General and administrative prices. Gilt Creek underground operating prices, in US dollars, were $60/t for mining, $15/t for procedures, and $7/t for general and administrative pricing. 12. At Gilt Creek, MRE blocks were tested for geometric and slope continuity. Isolated/orphan and single block width blockchains have been removed to report only mineral resources with a moderate prospect of economic extraction. 13. The slopes of the Wenot wells were 45°.

Mining

The mapping domain is made up of discrete topography. The domain, topography, and climate lend themselves to the traditional open-pit mining operations proposed for assignment, similar to the old operations. No underground mining is planned at this time, the prospect of underground mining progression at the Gilt Creek deposit will be assessed in the future.

The Wenot mining operations will feature a single giant open pit mine with five- and five-degree hard rock ramp slopes and 30-degree saprolite slopes that will be mined with traditional mining equipment in two phases of setback. To improve mining selectivity and reduce dilution, two additional bench heights and two sets of mining apparatus will be used. The mineralization will be extracted using a five m top bench with 150 mm diameter blast drills and a fleet of five m3 bucket excavators and 35 t rigid body haul trucks. The waste rock and saprolite will be extracted in 10 m upper benches using two hundred mm diameter blast drills, 22 m3 hydraulic bucket excavators and 177 t transport trucks. The main mining devices will be purchased through a lease contract. Various support equipment will be needed, such as excavators, graders, tankers and light vehicles for maintenance, personnel transportation and mine monitoring. The saprolite surface cover, which is expected to be loosely excavated and will not require blasting, is up to 60 m thick and undercuts the upper component of the 440 m deep open pit.

The open pit mine will have an average mineralization production rate of 9,000 tpd over a 13-year mine life. A total of 322. 3 Mt of waste rock is expected to be extracted, adding 2. 6 Mt of saprolite mineralization and 38. 5 Mt of new rock mineralization. for an overall extraction ratio of 7. 8:1, with an average grade of 1. 51 g/t Au containing 1. 99 Moz Au. The total amount mined will reach a maximum of 110,000 tpd.

The mineralization can be delivered to the number one crusher or placed in a nearby stockpile. Waste rock is transported to a waste storage facility or used in the structure of tailings dam levees.

Figure 4. Design of the Wenot Open Pit Mine (Two Phases)

Metallurgy & Processing

On average, 9,000 tpd of mineralized gold will be processed at the Omai processing plant. The processing plant will consist of a closed-loop semi-autogenous mill with a curling mill and a closed-loop ball mill with cyclones (SABC circuit). The first crushing will consist of a rotary crusher for hard mine operation (“ROM”). A gravity circuit, which precedes leaching, will extract gold from the cyclone’s bottom flow, while the cyclone’s residual stream is thickened and processed in a multi-process. reservoir carbon (CIL) or carbon slurry (CIP) leaching formula circuit. The gold will be extracted from the charged coal, concentrated by electrolytic extraction, and processed as gold bars in a gold room.

Omai Gold’s processing plant will be designed to be a compact facility with grinding and reagent receiving racks attached. Processing plant amenities will include a laboratory, plant maintenance workshop, and security, private, and control offices.

Metallurgical data

The expected metallurgical functionality for the processing of Omai’s mineral resources is based on a two-pronged verification: (i) a comprehensive testing program through Lakefield Research (now SGS Canada) that was completed in 1990 on drill cores representing seven mineralized zones, and (ii) the processing of 80 million tonnes of mineralized curtains over 12 years through Omai Gold Mines Limited (OGML) of the Fennel and Wenot holes, as well as alluvial areas.

During operations from 1993 to 2005, ROM hard rock was crushed in a gyratory crusher and crushed by a mixture of SAG generators and ball generators (SABC designation). The smooth mineralized curtain was combined by a backhoe with the crushed hard rock. For loose gold, gravity-based methods were used, adding spiral, Nelson centrifuge and table. Gold leaching was traditional with a slight concentration of processing reagents, followed by air spray leaching through CIP gold and, coal mining, electrolytic mining, and electricity. Refining in furnaces. Historical gold rates ranged from 92% to 94%.

Metallurgical tests at Lakefield included grinding tests which indicated that the adhesion rate of paints is very high for hard rock compounds, ranging from 19 to 25 KWh/t. As expected, the working rate is very low (~6 KWh/t) for saprolite. Gravitational concentration tested for diorite and saprolite compounds and a really extensive proportion of gold (~30%) was recovered. A series of popular 48-hour lever tests were performed on each compound, with the effect of pre-crushing the samples until 90% passed -200 mesh. The effects indicated superior gold mining, 92% to 97% in the hard rock samples, with only a small effect due to mill size.

Carbon Pulp Tests (CIPs), which represent the recovery of mined gold released as leaching from a processing reagent complex, were also tested. Carbon gold recovery was the best for all compounds. Flocculation and thickening tests indicated that moderate functionality can be expected in pre-leaching. thickening, which is a key parameter when processing soft foods and saprolites.

While the procedure history can be used as the basis for the design of the new Omai procedure, the evidence-based features for the procedure updates will be for crushing-mill, gravity concentration, leaching, and gold recovery (CIL vs. Omai). CIP). Since crushing-grinding is the most energy-consuming step, the low-energy intensity features, adding a second stage of crushing and high-pressure grinding rollers (HPGR), will be to cope with load and sustainability factors.

Access and infrastructure

The Omai assignment is located approximately 165 km south of the city of Georgethe, the capital of Guyana, and is available via a main highway connecting the city of Georgethe to Brazil, approximately 350 km south of the assignment. This road is paved for the first 90 kilometers to the town of Linden (population ~45,000). Linden is the second largest city in Guyana and was established for bauxite mining. When Omai was in production, about 90% of the workforce lived in Linden, and Linden is expected to once again be a source source for much of Omai’s workforce. The road from Linden has recently been widened and paved. It is expected that by the end of 2024, there will be a paved road connecting the town of Georgethe, via Linden, with the hinterland of 8 km from the Omai allocation. The Omai Mining Road ends on the east bank of the Essequibo River, where a public ferry carries passengers and cars across the river.

The Omai site is largely deforested and has an extensive network of dirt roads that offer access to the property’s maximum spaces. The site includes a series of giant warehouses dating back to the mining era. The Omai camp consists of two giant warehouses that have been converted into offices, living quarters, drill core logging facilities and garage, and a workshop. Two bunkers provide additional accommodation, and the camp currently houses 60 workers.

The extraction and processing infrastructure will be located at the Omai site. The assignment will require the structure of the following infrastructure: a 9,000 tpd processing plant, space, a truck workshop and warehouse, a new campground, a surface water control, service and haul road facility, and an initial tailings control facility. An existing runway will be used for emergencies and urgent transport.

Tailings & Water Management

The tailings impoundment plan will take advantage of existing amenities and features on the Omai property, adding the existing 350-acre tailings facility and the dewatered Fennel open pit mine. The sedimented tailings will be recycled back to the treatment plant and the excess water will be treated for discharge. According to ancient evidence (GMO), the herbal degradation of the residual reagents of the procedure will facilitate compliance with strict release criteria and only one remedy will be required for the removal of suspended solids.

Personnel

During the construction of the mine, it is estimated that there will be approximately 250 more people over a constant period of 18 months, in addition to the workers that would be needed for pre-surface dismantling in the 12 months prior to the production phase. the life of the mine. During the production of the Wenot open-pit mine, the average number of workers in the mine and processing plant is estimated at 439 more people. The schedule will be two shifts of 12 hours per day, 7 days a week.

Next Steps

The positive effects of the PEA justify advancing the task to the next stages of the Array. Recommended paint systems to advance the task to the pre-feasibility point include:

Qualified Persons

PEA and mineral estimation were conducted in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definition criteria incorporated by reference in National Instrument 43-101 Disclosure Standards for Mineral Projects (“NI 43-101”) (2014) and CIM Estimation Best Practice Guidelines (2019).

The PEA and mineral resource estimate, as well as verification of disclosed data, were overseen through Eugene Puritch, P. Eng. , FEC, CET, President of P.

Elaine Ellingham P. Geo. es a Qualified Person (QP) as explained through National Instrument 43-101 “Disclosure Standards for Mineral Projects” and has reviewed the technical data contained in this press release. Ellingham is not independent for the purposes of NI 43-101.

About Omai Gold Mines Corp.

Omai Gold Mines Corp. owns a 100 percent interest in the Omai exploration license, which includes the former Omai generating gold mine in Guyana, and a 100 percent interest in the adjacent Eastern Flats mineral rights. dated NI 43-101 Mineral Resource Estimate (“MRE”) on February 8, 2024, including 2. 0 million ounces of gold (indicated) and 2. 3 million ounces (deducted) 1. Once the largest generating gold mine in South America, Omai produced more than 3. 7 million ounces of gold between 1993 and 2005. Mining ceased at a time when the average value of gold was less than US$400 per ounce. As a derelict project, Omai benefits from smart road access and a wealth of ancient knowledge that provides information on the geology and gold mineralization of the area, as well as metallurgy, recoveries from old procedures, and many other applicable mining parameters. The Company’s first economic study, a Preliminary Economic Assessment (“PEA”), is set forth in this press release. up.

For more information, please visit our online page www. omaigoldmines. com or contact:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is found in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This press release presents forward-looking statements or data (collectively, “FLI”) within the meaning of applicable Canadian securities legislation. FLI is relying on expectations, estimates, projections and interpretations as of the date of this press release.

All statements, other than statements of fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, the FLI can be known by using statements that come with words like “seeks,” “believes,” “anticipates,” “plans,” “continues,” “budgets,” “schedules,” “estimates,” and “expects. ” . “, “plans”, “intends”, “allocations”, “predicts”, “proposes”, “prospective”, “objectives” and diversifications of those words and expressions, or by statements that certain actions, occasions or effects “may” , “may”, “could”, “should”, “could”, “will be taken”, “will occur” or “will be achieved”. FLI includes, but is not limited to, statements relating to the effects of the PEA of Omai, adding production estimates, operating prices, capital prices and money prices, valuation measures and assigned rates of return, as well as money allocations, as well as expected permit needs and allocation design, adding facilities processing and tailings, infrastructure development, steel recovery, life of mine and allocation production rates, the option to obtain better profitability of the allocation and optimize the design, prospective schedules for obtaining permits and financing required. long-term effects or occasions.

FLI is designed to help you understand existing perspectives on control over your short- and long-term prospects, and may not be suitable for other purposes. FLI, by its nature, is based on assumptions and involves known and unknown risks, uncertainties and other issues that could possibly cause the Company’s actual effects, functionality or achievements to be materially different from the Company’s long-term effects, functionality or performance. or expressed achievements. or implicit through them. FLI. Although the FLI contained in this press release are based on what control believes, or is believed at that time, which are conservative assumptions, the Company cannot assure shareholders and potential clients of the Company’s securities that the effects actuals will adjust to those FLI. , as there may be other points that cause the effects not to be as anticipated, estimated or expected, and neither the Company nor any other user assumes responsibility for the accuracy and completeness of those FLI. Except as required by law, the Company does not undertake or assume any obligation to update or revise the FLI contained herein to reflect new occasions or circumstances, unless required by law. required. Unless otherwise indicated, this press release has been prepared based on data available as of the date of this press release. Therefore, you should not place undue reliance on the FLI or the data contained therein.

The assumptions on which FLI is based, among others, include the effects of exploration activities, the Company’s monetary condition and general economic conditions; the ability of exploration activities to meet mineralization expectations; accuracy of geological modeling; the Company’s ability to undertake additional exploration activities; possible adjustments in allocation parameters or economic evaluations; the legitimacy of the name and property rights in the transfer; the accuracy of key assumptions, parameters or strategies used to estimate MREs and in the PEA; the Company’s ability to discharge required approvals; geological, mining and exploration technical problems; failure of devices or processes to function as intended; advances in the global economic climate; steel prices; exchange rates; environmental expectations; network and non-governmental actions; any effects of COVID-19 on the task; and the Company’s ability to obtain the required financing. The dangers and uncertainties relating to Omai Gold’s business are discussed in more detail in disclosure documents filed with securities regulators in Canada, which can be obtained at www. sedarplus. ca. In addition, if one or more hazards, uncertainties or other issues materialize, or if underlying assumptions prove incorrect, actual effects would likely differ materially from those described in FLI.

Non-IFRS Financial Measures

Omai Gold has included certain non-IFRS monetary measures in this press release, such as initial capital expenditures, sustaining capital expenditures, general monetary prices, and all maintenance prices, which are not measures identified under IFRS and do not have a standardized meaning prescribed through IFRS. . As a result, those measures would possibly not be comparable to similar measures reported through other companies. Each of those measures used is intended to provide more data to the user and should not be considered in isolation or as a replacement for the measures listed in accordance with IFRS. The non-IFRS monetary measures used in this press release and not unusual in the gold industry are explained below.

Total Cash Costs and Total Cash Costs Consistent with the Ounce

Total money prices reflect the cost of production. The total money prices reported in the PEA include mining prices, processing prices, general and administrative mine prices, off-site prices, refining prices, transportation prices, and royalties. The total money prices consistent with the ounce are calculated as the general monetary prices divided by the ounces of gold payable.

All-inclusive maintenance prices and all-inclusive maintenance prices consistent with the ounce

All-inclusive holding prices and all-inclusive holding prices consistent with the ounce reflect all expenses required to produce one ounce of gold from non-consistent conditions. The all-inclusive maintenance prices reported in the PEA come with the general monetary prices, maintaining the capital and closing prices, but exclude the company’s general and administrative expenses. All-inclusive maintenance prices consistent with the ounce are all-inclusive maintenance prices divided by the payable gold ounces.

Included in the table below is a description of the significant portions of the charges that make up the non-IFRS forward-looking monetary measures of overall money prices and the overall maintenance of prices consistent with the payable ounce of gold produced.

Cautionary Note for U. S. Investors

Omai Gold prepares its data in accordance with the needs of applicable Canadian securities laws, which differ from the needs of United States securities laws. Terms relating to mineral resources in this news release are explained in accordance with National Instrument 43-101, the rules set out in the CIM Mineral Resources and Mineral Reserves Definition Standards, followed by the Canadian Institute of Metallurgy and MiningArray Petroleum on May 19, 2014. , as amended (“CIM Standards”). The United States Securities and Exchange Commission (the “SEC”) followed amendments effective February 25, 2019 (the “SEC Modernization Rules”) to its disclosure regulations to modernize disclosure requirements of mineral properties for issuers whose securities are registered with the SEC under the U. S. Securities Exchange Act of 1934. Following the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of “mineral resources measured”, “indicated mineral resources” and “inferred mineral resources”, which are explained in a substantially similar way. terms of the corresponding CIM standards. Additionally, the SEC has modified its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding CIM standards.

U. S. investors are cautioned that while the above terms are “substantially similar” to the corresponding definitions in the CIM Standards, there are differences in the definitions in the SEC Modernization Rules and the CIM Standards. Accordingly, there can be no assurance that the Mineral Resources that Omai Gold can report as “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101, would be the same if Omai Gold had prepared the NI 43-101 Mineral Resource Estimates. The standards followed according to the SEC Modernization Rules. Under Canadian securities laws, estimates of “Inferred Mineral Resources” would not possibly form the basis of feasibility studies or other economic studies, in limited cases permitted through NI 43-101.

Figure 5. Wenot Deposit showing pit layout and mineral resources outside the pit

Kenorland Minerals focuses on early- and late-stage exploration in North America. The Company holds a net smelter return royalty of 4% on the Frotet allocation in Quebec, owned by Sumitomo Metal Mining Canada. The Frotet assignment welcomes. . . LEARN MORE