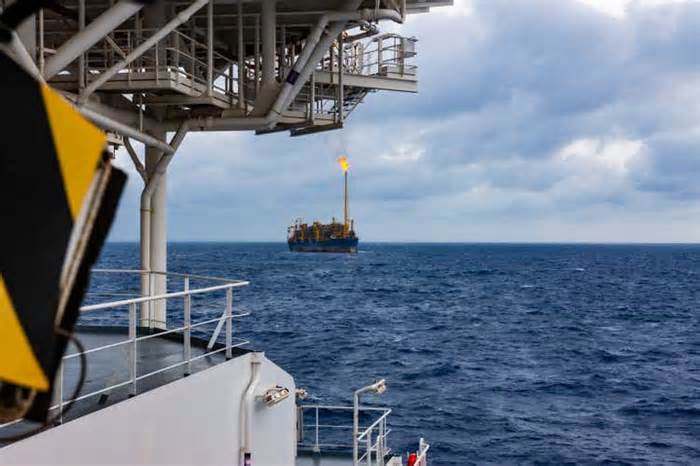

Ranimiro Lotufo Neto/iStock Getty Images

Oil States International, Inc. (NYSE:OIS) is a small-cap oilfield corporation (or SFO) that has underperformed its peer segment:

Data via YCharts

The existing value still provides a smart opportunity for SFM exposure, especially in the offshore segment, which accounts for the bulk of oil states’ EBITDA. Oil states deserve to have more clues than mega-companies like Schlumberger (SLB), which have already appreciated a lot. Beyond the bullish cycles, OIS also lagged behind Schlumberger and the biggest names. This is not surprising, as Oil States also includes other SFM providers and is therefore further down the chain of capital expenditure sources E

However, in the last bullish cycle until 2014, OIS finally overtook Schlumberger, despite a subsequent peak:

Data via YCharts

As the investment cycle unfolds over the next few years, we may see a repeat of this scenario. Often, the marginal supplier whose capacity is activated last would get the most productive price. in its 80% decline so far this year, you may also need to take a look at the next wave of smaller OFS games, to which OIS belongs.

On the threat side, Oil States has modest leverage and a sufficiently good policy of its interest expenses. This means there is little urgency for the company if earnings improvement is delayed by one or more quarters. Bankruptcy is on the table even if the effects remain stable in 2022. This allows OIS to have compatibility with the option profile, with few drawbacks and the option of significant profits, all in the context of a favorable industry trend.

I have already described my thesis on oil services, so this segment can also be an update of my previous writings:

Schlumberger: Even if OPEC fills the void, SLB still wins.

Oil services: energy still at reduced prices despite the rally.

The key issues are that SFO is highly cyclical, like the entire oil industry, but also peaks later in the cycle. This has to do with the long delays between decisions to budget capital expenditures E.

API

This disconnect is explained through the new philosophy of “capital discipline”, the E firms.

However, much has been replaced in 2022 with the Russian-Ukrainian war, and energy security has begun to change the ESG narrative in Europe:

Offshore Engineer

It is likely that not all companies in the sector will increase production. In particular, U. S. shale, which has been closely watched as the world’s largest manufacturer since 2014, might start to realize that it is no longer successful in boosting its business. The EIA, for example, revised down its forecast for U. S. shale production. According to the related article:

[Inflation] and origin chain delays that began in the current quarter have particularly deteriorated the outlook for U. S. crude oil production growth. U. S. This month, Enverus Intelligence Research cut its forecast for U. S. production growth. functionality of recently drilled wells in the Permian Basin. “

To paraphrase Alice in Wonderland, it’s possible that U. S. shale is in the wild. If you will soon have to run as fast as possible, just to stay still. Of course, there will be a wonderful differentiation between the other basins or the quality of the spaces of the E corporations.

However, beyond U. S. shale, there are already signs that upstream activity is recovering. Looking at some of the major ones, such as Shell (SHEL), Exxon (XOM) and Chevron (CVX), capital spending may have already bottomed out in 2021. :

Data via YCharts

National oil companies (or NOCs) have also announced capital spending increases. For example, Saudi Aramco (ARMCO):

CEO Amin Nasser said that while crude costs have been hit by economic uncertainties during the period, the company believes demand will continue to grow for the rest of the decade. Nasser also said Aramco would be an exception to the “lack of global investment in our sector” as oil and herbal fuel production continues to rise.

Abu Dhabi’s national oil company, ADNOC, also announced investments for the coming years.

While Aramco and ADNOC are indicative of deepwater investments, significant expansion investments are also expected from Petrobras (PBR). During its third quarter presentation, PBR highlighted its production progression plans and the portfolio of incoming FPSOs (floating production, garage and offload):

Petrobras Third Quarter Presentation

Even if U. S. shale is not allowed to do so. While the U. S. continues to show “moderation,” NOCs and big ones aren’t necessarily on the same page and are starting their long-term production plans again. As we approach the end of 2022, we are already hearing from various resources that this investment “attracts” E

Revenue expansion [year-over-year] accelerated to 28%, the highest rate of expansion since 2011, more than a decade ago. year. The evolution of activity and turnover confirms the beginning of a new phase of the global expansion cycle, which will be promoted through the foreign and offshore markets. . .

We expect investment expansion to be sustainable, bolstered through long-term trajectory demand, multi-year capacity expansion plans, declining operating break-even costs, and favorable commodity costs. Growth will be simultaneous in North America and overseas markets. It started first in the North American market and we are already seeing the next phase of expansion with an acceleration of pace, in offshore and overseas markets, which is very visible in the third quarter. . .

International markets will be boosted through a sequential increase in activity in the Middle East as capacity expansion projects begin to take hold. Global offshore activity will continue to strengthen, offset through the technique of seasonality in the Northern Hemisphere, while onshore activity in North America will moderate its expansion trend. . .

[We] are very constructive in the deepwater market in the future. The recent FID pipeline (final investment decision) that has been blessed in recent months, the pipeline that is set in 2023 according to WoodMac is at $170 billion FID, which will be the highest in the last 10 years since 2011. And the mobilization of projects in deepwater basins continues.

In short, Schlumberger envisions a multi-year expansion cycle, driven through offshore markets. Schumberger’s expectation of some moderation in offshore activity in North America is consistent with U. S. shale considerations. Already discussed.

Let’s also take a look at Halliburton (HAL), the big player in the industry. CEO Jeff Miller on the third-quarter earnings convention call:

Looking ahead, I see activity expanding around the world, from the smallest to the largest countries and producers. I expect the most powerful expansion spaces to be the Middle East, led by Saudi Arabia, but with significant increases in activity. elsewhere, Brazil, Guyana and many others have also signalled a commitment to develop their activity.

Halliburton’s portfolio is more oriented to North American lands than Schlumberger, so the perspective on U. S. shale is more likely to be a North American land. The U. S. economy would likely differ, though the two industry leaders seem to agree on the strong offshore outlook.

Beyond service corporations, we can also seek confirmation from engineering corporations that will deliver those incremental FPSOs. A major player in this area is SBM Offshore N. V. (OTCPK: SBFFF), which commented in its second quarter results:

We have seen stable expansion with the award of FPSO ONE GUYANA, which takes our order book to a record high of over $31 billion. . .

The market outlook in our classic FPSO industry is very positive with 33 potential rewards through 2025. These customers have stepped up in recent years. Global oil demand has recovered considerably, while the source has been affected by a lack of investment over the past decade.

SBM Offshore sees a stable FPSO order book at nine consistent with the year, up from just 3 in 2020:

Introducing SBM at Sea

Paradoxically, offshore wind, while competing with fossil fuels, is positive for corporations like SBM Offshore because the offshore installation experience overlaps. This also applies to oil states, as they are also exposed to offshore wind.

So, to recap so far, despite the strong outlook for U. S. shale, foreign and offshore investments are returning. The renewed focus on energy security seems to have gotten rid of some regulatory barriers to new investments in fossil fuels, but governments are not abandoning choice either. The marine industry can derive great advantages from the dual demand for deepwater oil and offshore wind.

SFM percentage costs are still far away E

Data via YCharts

In previous bullish cycles, it also peaked after E.

Despite being a small-cap company, Oil States is, in fact, a global supplier of manufactured goods and hubs for the drilling, completion, submarine, production and infrastructure sectors of the oil and fuel industry, with additional sales to commercial and military customers. . Oil States is headquartered in Houston, but outside the United States also has services in the United Kingdom, Brazil, Singapore and other countries.

The corporate operates in 3 segments:

Submission to oil states

The Smart Offshore Products segment is the largest, accounting for 52% of profits and 59% of EBITDA. Although the segment produces some short-cycle products in onshore areas, the main drivers are investments in deep-sea equipment, such as FPSOs, offshore platforms, or subsea facilities. Therefore, OIS materials are an intelligent exposure to SFM in deep waters.

Well sites are a smaller segment serving U. S. shale. U. S. (80% of segment revenue) and Gulf of Mexico and overseas markets (20% of revenue). The problem generation segment derives 87% of its revenue from the U. S. shale market. In the U. S. , two smaller segments are not as similar to offshore segments, they are expected to generate stable returns, assuming shale activity remains stable.

Oil States has a large visitor base and only markets to end users such as electronics companies.

Historically, FPSOs are well correlated with the EBITDA margin of oil states with a sure delay:

Rystad; Offshore Magazine; In Search of Alpha; Author’s calculations

EBITDA is adjusted to reflect the 2014 turnover of the historic business, now known as Civeo Corporation (CVEO). Oil States’ EBITDA is also connected to the global number of offshore platforms:

Baker Hughes; In Search of Alpha; Author’s calculations

It is therefore encouraging to see FPSO orders returning, with increases expected at least until 2026:

Submission to oil states

According to the OIS presentation, in the third quarter $5700 million in orders for 3 FPS units (floating production system) were recorded, adding two new Petrobras constructions. Oil States expects six FPS awards in the fourth quarter of 2022, with an estimated total of $8700 million. from Brazil, Angola, Norway and Canada on the high seas.

WPS rewards over the constant 2023-26 period are expected to average $23 billion consistent with the year. Of this amount, 46% comes from projects in Latin America, 14% from North America and 11% from projects in Australasia.

As for offshore platforms, there has been an uptick since 2020:

Baker Hughes; Author’s calculations

However, offshore platforms around the world have been much stronger than U. S. land platforms. Which makes sense because investments in short-cycle shale have traditionally been more volatile.

Based on Oil State’s onshore service offerings, the limitation of U. S. onshore platforms is limited to the U. S. The U. S. government in recent months is necessarily bad news. Speaking of its smallest segment, Downhole Technologies, which covers 87% of shale, Oil States claims that the lateral lengths of shale wells are lengthening:

Submission to oil states

Many shale upstream presentations also emphasize longer lateral lengths as a positive thing, as this implies higher production with the same number of drill rigs. However, at the same time, this means increased intensity and full contact costs, which is positive for operators. For oil states However, this is good news as longer lateral lengths mean greater demand for complete consumables sold through OIS.

Finally, when comparing the commercial case of OIS, it should be noted that the company also has an offshore wind offer:

Submission to oil states

My non-public view is that offshore wind globally has been a gloom (too much ESG hype but little tangible contribution to energy demand), and I argued that wind operators would also suffer from emerging installation costs:

Ørsted A/S: Headwinds are likely to persist (OTCMKTS: DNNGY).

However, a number of offshore wind projects are in the works, and that’s not going to replace them anytime soon. Operators may struggle with their capital budgets, but Oil States is on the silver lining of this factor, as it will get higher costs for the parts it supplies. While many asset managers still retain their ESG investment mandates, the provision of offshore wind from oil states may also make it more suitable for some of those generalist investors in the future.

So, to recap here, Oil States is well placed to take advantage of the resurgence of offshore capital spending. Most of the company’s profits are similar to deepwater projects and the pipeline is very solid. OIS offerings also work well. Finally, the company also has some exposure to offshore wind, which, justified or not, continues to increase.

Valuing OIS is not simple because most of the positive market developments I mentioned are separated by a few quarters, so they are not taken into account in analysts’ estimates. However, first, let’s take a look at OIS’s earnings and EBITDA. Revenues have already bottomed out:

Data via YCharts

I expect quarterly revenue to return to the 2018-2019 run rate of $250 million, or about $1 billion consistent with the year. By the way, the oil states’ sales in 2014 would be minimal.

EBITDA has also come out of a hole:

Data via YCharts

Currently, EBITDA margins are around 10% to 11%, which would mean an EBITDA run rate of $100 million consistent with the year. However, oil states, such as SFOs in general, have maximum leverage consistent with the year. 2012-2022, a percentage point consisting of earnings accumulation translates into a 2% accumulation in EBITDA.

If we achieve a 30% to 40% increase in the profit execution rate, the EBITDA margin will achieve 15%, which would still be lower than the 20% margins seen prior to 2014. So, as a short-term goal, I see $1 billion in annual profit/$150 million in EBITDA as can be achieved.

According to a similar organization adding Technip (FTI), NOV Inc. (NOV), Oceaneering (OII), Baker Hughes (BKR) and SLB, I would say that a commercial price (or EV)/EBITDA of 10 is unreasonable:

In Search of Alpha; Author’s calculations

So, my ultimate goal for OIS is $1. 5 billion in EVs. That would translate to about $14 per share, a merit on where the stock is trading recently.

To put those numbers in a consistent perspective, OIS was trading between $14 and $18 consistently with a constant percentage in 2019, and in 2018 it was in the $30 range. The number of consistent percentages has also been solid since 2018, so it’s not just a dilution effect. In 2014, the SIB was, of course, more than $60.

Wall Street’s average value target for Oil States International, Inc. It’s $9, which is in line with June 2022 highs, and the main target is $11.

The threat of being here is obviously that of a fall in oil prices. With emerging expectations of a recession in the US, the US is not expected to be able to do so. With the US in 2023 (arguably Europe already one), this is not an insignificant threat to rule out.

However, the fortunes of oil states will ultimately depend on long-cycle offshore investments. These are multi-year, multibillion-dollar projects that won’t be canceled just because of a cyclical slowdown in oil costs in 2023. Petrobras, ADNOC and others execute a long-term strategy, they do not bet on short cycles. With exposure to Brazil and other hotspots, oil states are confident in their pipeline for years to come. Passive promotion in the power sector when oil costs fall can drive OIS stocks down, but those events can also be seen as buying opportunities.

The threat of the moment you want to address is debt and liquidity. A leveraged deepwater driller like Transocean (RIG) will also take advantage of the macroeconomic trends I mentioned, however, Transocean has a lot of debt, which legitimately increases the threats of trouble. However, this is not the case OIS. La oil state debt is not top and maturities do not mature before 2026:

Submission to oil states

The most productive component is that the 2026 notes that make up the bulk of debt have a constant interest rate that will not be affected by emerging market interest rates. The notes imply an annual interest expense of $5. 5 million (total interest expense identified for the first nine months of 2022 was approximately $8 million), and this is more than adequately covered through EBITDA. Based on loose money (i. e. after capex), Oil States is also positive.

Oil States International, Inc. es a small-cap oilfield facilities corporation that is heavily positioned to take advantage of macro-power trends and the resurgence of deepwater activity. Valuation is not expensive and the dangers are limited.

As a small cap in an already volatile sector, Oil States International’s percentage value would likely revel in significant short-term volatility, but in the long term, it would come to reflect the core value.

This article written by

Disclosure: I have/have a long position in the shares of OIS, SLB, RIG, IEZ, ONG, XOM, whether through ownership of shares, features or other derivatives. I wrote this article myself and express my own opinions. I don’t get any refunds for this (other than from Seeking Alpha). I don’t have any dated business with a company whose actions are discussed in this article.

Additional disclosure: My articles, blog posts and comments on this platform do not constitute investment recommendations; However, my non-public reviews are explicit and for informational purposes only. I am not a registered investment advisor and none of my writings deserve to be considered. as an investment council. While I do my best to make sure I provide correct factual data, I cannot ensure that my articles or messages are error-free. You deserve to exercise your own due diligence before acting on data. contained therein.