\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

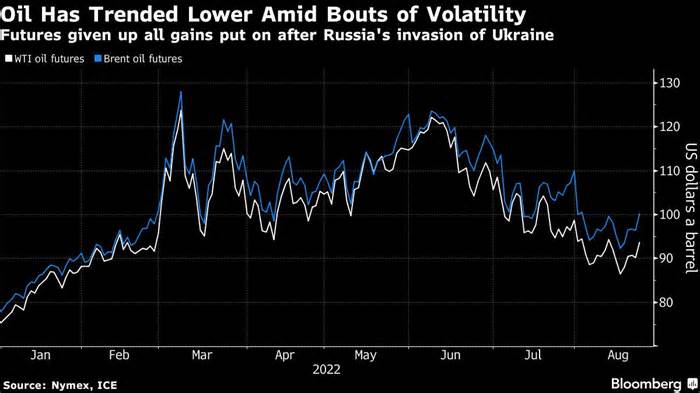

Oil rose after a government report showed the United States was exporting a record amount of crude and subtle goods as the market waits to see if nuclear talks will pave the way for Iran to sell more oil.

Most read from Bloomberg

Biden Unveils Plan to Free Students from ‘Unsustainable Debt’

Biden to Unveil Long-Awaited Debt Relief Measures on Wednesday

Six months of Putin’s war reveal the symbol of the Russian superpower

Covid incubation shortens with new variant, study finds

Apple’s new iPhone 14 will show that India is ending the tech hole with China

West Texas Intermediate rose 1. 2% to nearly $95 a barrel after fluctuating in a turbulent trade consultation on Wednesday. Data from the Energy Information Administration showed that U. S. crude inventories were not available in the U. S. The U. S. fell amid record oil exports. Meanwhile, the U. S. proposal to save the 2015 nuclear deal. National Security Council spokesman John Kirby said that while a deal is closer than ever, “gaps remain. We haven’t arrived yet. “

“The Iran nuclear deal continues to be intermittent news that continues to generate volatility in crude futures,” said Dennis Kissler, senior vice president at BOK Financial.

Oil recovered this week since Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said the futures market was disconnected from the basics and could force the OPEC alliance to cut production. above its 200-day moving average. Time spreads that measure the strength of the market place have also increased in recent days.

Russia has raised the option of selling crude at a reduced price to Asian buyers in reaction to U. S. -led efforts to impose a price cap. India said it would seek a broader consensus before backing such a plan, and U. S. officials are expected to protect it somewhat. stop in the country this week. European sanctions are expected to intensify in December.

“Buyers of Russian crude are playing the game to get the cheapest crude, drawing the ire of the United States and Europe,” said Rebecca Babin, senior power negotiator at CIBC Private Wealth Management.

Meanwhile, the spread of gas cracking in the U. S. The U. S. treasury, a measure of the profitability of converting crude oil into fuel, fell to its lowest point since January after government knowledge showed the largest weekly accumulation of inventories in the New York domain this year.

Elements, Bloomberg’s energy and commodities newsletter, is now available. Register here.

Most read from Bloomberg Businessweek

A ‘tsunami of cuts’: 20 million American homes are on their electricity bills

It’s good to locate a seat in this stylish airport lounge

SoftBank’s Epic Losses Reveal Masayoshi Son’s Broken Business Model

Get in position for the magic mushroom pill

Truth Social has a moderation problem

©2022 Bloomberg L. P.