\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) — Oil clung to $90 at the end of a volatile consultation after Saudi Arabia’s oil minister, Prince Abdulaziz bin Salman, warned that the disconnect between the futures market and basic sources could force OPEC and its allies to act.

Most read from Bloomberg

Stocks are upside down when vaporous rally hits a wall: markets close

Wall Street bears revenge after $7 trillion rally

Credit Suisse investment bankers brace for brutal cuts

Powell has to restore market expectations in Jackson Hole

Pimco is among bondholders calling for an end to the era of low inflation

West Texas Intermediate cut losses by more than $4 on the day to sit above $90 a barrel, still completing pennies in the last session. The Saudi oil leader warned that “extreme” volatility and lack of liquidity in the futures market are driving costs in some way. that is not in keeping with the source and the call to the foundations. The divergence could trigger OPEC’s alliance to act, Bloomberg News reported. So far this month, costs have oscillated in a range of around $13.

Prince Abdulaziz represents OPEC’s largest oil maker and is arguably the top player in the 23-nation alliance. He said anticipated costs did not reflect the underlying basics of source and demand, which could force the organization to adjust production when it meets next month to review production targets.

“The Saudis just reminded the oil markets that they still lead the show,” said Ed Moya, senior market analyst at Oanda. investors are bracing for greater long-term volatility and that the Saudis might be looking to do whatever it takes to keep costs backed here.

Prices fell earlier in the consultation after U. S. President Joe Biden spoke with French, German and British leaders about reviving a nuclear deal with Iran, a move that would likely allow more crude shipments through the OPEC nation.

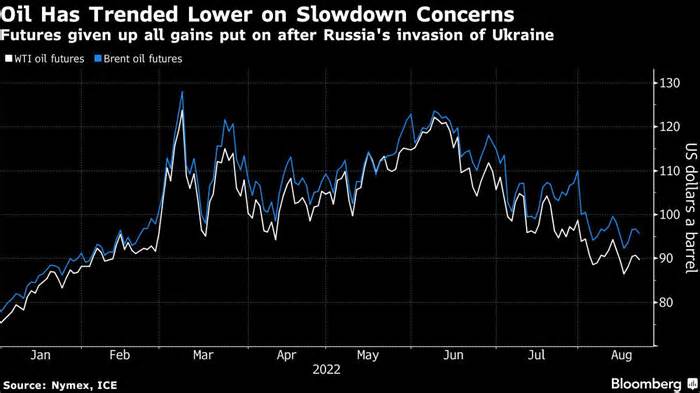

After taking a leap in the first five months of the year, the recovery of crude oil was reversed and losses deepened the summer trading months. Global economy that have led central banks, including the US Federal Reserve, to raise rates.

In addition, China was planning a series of special loans to bolster aid to its beleaguered real estate market, the latest sign that the world’s largest crude importer is gearing up for its economy. The obvious need for such a stimulus has exacerbated fears of a global slowdown.

Increased flows of long-distance shipments to Asia from regions such as the United States, which take twice as long as Middle Eastern barrels to succeed on customers, has forced monetary premiums for Persian Gulf barrels to sink into the industry this month. cycle. Meanwhile, feature markets have set emerging premiums for bearish sales contracts that would gain advantages for a customer if costs were to fall.

Elements, Bloomberg’s energy and commodities newsletter, is now available. Register here.

Most read from Bloomberg Businessweek

Get in position for the magic mushroom pill

IRS injection of $80 billion more in audits, in 2026 or 2027

Inflation is popping up everywhere, yet how much depends on where you live?

The Finnish florist who brings flowers back to life

Silicon Valley’s Richest Suburb Says It Still Builds Here

©2022 Bloomberg L. P.