Tatiana Dyuvbanova

On the back of the market that includes Carnival Corp. ‘s quarterly report. (CCL) In a negative light, Norwegian Cruise Line Holdings (NYSE:NYSE:NCLH) made an announcement to start the week. The market continues to look back on the cruise industry in the long term looks much more positive. My investment thesis is ultra optimistic in the sector with some other industry resolution to remove absolutely all Covid restrictions that in the past prevented real bookings and travel.

On October 3, Norwegian made the final resolution to remove Covid restrictions. The cruise line announced the elimination of all Covid-19 testing, masking and vaccination needs effective October 4, 2022.

It wasn’t until early September that the cruise industry began rolling back Covid restrictions, adding that regardless, it allowed unvaccinated visitors to board ships with tests. The company is now aligning its policies with those of other organizations where the airline and hospitality sectors have already noticed their revenue exceeding 2019 peak levels.

The cruise industry is not yet exempt from Covid restrictions depending on other regions with more restrictive government policies than the United States. Norwegian has a long list of destinations with other requirements, adding Australia as follows:

Source: NCL. com

The good news is that countries like Canada have already gotten rid of the restrictions that now often identify North America. However, several other countries have restrictions, but airlines have seen record travel because those willing to spend more money now have the opportunity to redirect their travel to a domestic goal.

The sector had already noticed a strong indication of a stockpile once some Covid restrictions were lifted in early September. Bookings are expected to increase now with the removal of restrictions for unvaccinated passengers.

According to analyst Truist C. Patrick Scholes, Norwegian has already noticed a massive increase in bookings. He noted that the cruise line saw bookings increase by up to 40% in the initial three-week period, and that luxury reaped maximum benefits due to high-income passengers less affected by a near-global recession. The analyst assigned a target price of $19 to the stock.

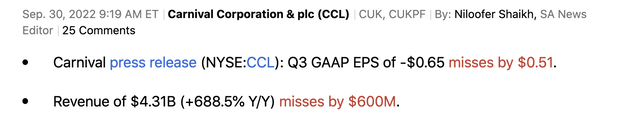

On Friday, Carnival reported effects that disappointed the market. However, the market was stuck in the search for pullback, but there was a positive indication of the future.

The cruise line reported earnings of $4. 3 billion that missed earnings estimates by a margin of $600 million.

Source: alpha research

For those looking for the demise of the cruise line, it was the best title. Shares fell more than 20% on Friday, a peak sign that Carnival wasn’t going into the Covid era when the summer quarter wasn’t responding to analysts. ‘ estimates across a wide margin.

The key here is that the other people promoting the stocks weren’t actually paying attention to detail. The FQ3’22 reported was for the era ending on August 31 with strict Covid restrictions still in place. to provide a recent negative check to board a ship.

The retrospective numbers were horrible, but the prospective numbers were very positive. Carnival recorded only about two months of bookings under Covid tranquility policies when the company announced its effects on September 30. Not surprisingly, the company made the following positive announcements in the earnings post:

Since we pronounced the easing of our protocols last month, we have noticed a significant improvement in reserve volumes and are now well ahead of the highest levels of 2019. We plan to further capitalize on this momentum by renewing our efforts to generate demand. Expansion of long-term profits, while leveraging short-term tactics to temporarily capture costs and reserves in the meantime.

Cumulative advance bookings for the full year 2023 are above the old average and at particularly high prices, compared to 2019 outflows, normalized for CFCs.

During the earnings call, Chief Financial Officer David Bernstein falsified the details of the reservation.

So keep in mind that what we are talking about here is to accelerate the position of the ebook or ebookings that took position in mid-August with relaxed protocols. And ebooking patterns, as we have indicated, have accelerated. In fact, our North American brands have risen up to 30% through 2019 in recent weeks.

Essentially, bookings were suffering due to strict Covid restrictions, however, numbers increased when policies were relaxed in early September. A further removal of all restrictions in the U. S. is expected to be lifted. The U. S. -Canada expansion results in an additional accumulation of reserves in 2023 at costs above 2019 levels.

Norwegian had revenue of just $6. 5 billion in 2019. Analysts already forecast that 2023 revenue will reach $8. 0 billion with a big jump to $8. 7 billion.

The market might have some indigestion with the existing results, but the long term is obviously brilliant. In fact, the earnings estimate for 2024 is much closer to just $8. 0 billion at the end of last November and estimates continue to rise.

Inventory may be trading near the lows now, but analysts don’t seem to be wondering if Norwegian will eventually break EPS targets of $1 and $2 anytime soon after the higher leverage lately.

The main conclusion of investors is that investors who observe the bad figures are related to the cruise industry. Norwegian is expected to provide strong hints of higher earnings at the Oct. 4 investor event.

Investors take advantage of this weakness to buy stocks.

If you’d like to learn more about the most productive way to position yourself in undervalued stocks that are incorrectly priced in the market during the 2022 sell-off, join Out Fox The Street.

The service provides style portfolios, daily updates, industry alerts, and real-time chat. Sign up now for a 2-week threat-free trial to start locating the next inventory that is likely to generate the best returns in the next few years without taking on the oversized threat of high-flying inventories.

This article written by

Stone Fox Capital introduced the Out Fox The Street MarketPlace service in August 2020.

Disclosure: I have/do not hold any stock, options or derivative positions in any of the corporations discussed, and I do not intend to initiate such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I don’t get any refunds for this (other than Seeking Alpha). I don’t have any business dating a company whose shares are discussed in this article.

Additional disclosure: The data contained in this document is provided for informational purposes only. Nothing in this article should be construed as a solicitation to buy or sell securities. Before buying or promoting stocks, you conduct your own studies and draw your own conclusions or consult an advisor. The investment comes to risks, adding the loss of principal.