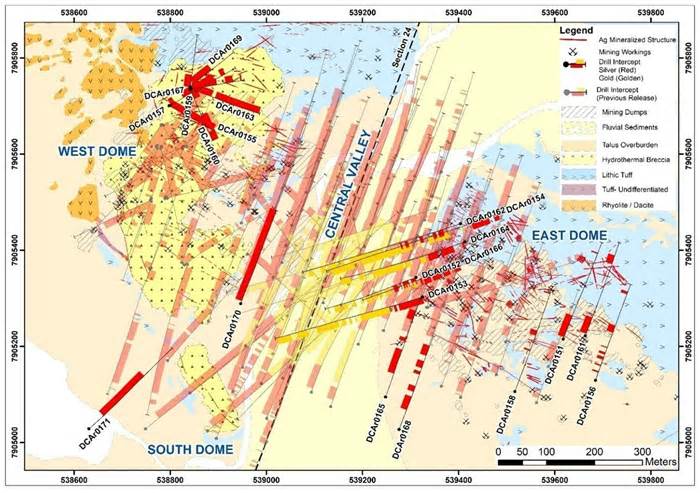

VANCOUVER, BC, May 30, 2023 /CNW/ – New Pacific Metals Corp. (“New Pacific” or the “Company”) (TSX: NUAG) (NYSE American: NEWP), in collaboration with its local Bolivian partner, announces an investigation effects of the first 21 drilling wells on its first quarter 2023 drilling program at its Carangas silver-gold project, Oruro Department, Bolivia (the “Carangas Project” or the “Project”). The effects and detailed specifications of the boreholes are indexed in Tables 1 and 2 and Figure 1.

The first quarter of 2023 drilling was a continuation of the 2022 drilling crusade at the Cangas project. First, 15,000 meters of diamond drilling was planned, filling the spaces drilled in 2021-2022 and ending beyond the spaces drilled in the past. This drilling program began as planned in January 2023 and was expanded based on encouraging effects and is now complete. A total of 17,623 meters were drilled in 39 wells until the end of April 2023. Each of the 39 wells intercepted mineralization. To date, the research effects of the first 21 holes have been gained and the remaining holes are being completed.

DCAr0171 intercepted a wide diversity of silver-containing mineralization measuring 205. 6 m (76. 8 m to 282. 4 m) with a grade of 123 g/t Ag, 0. 44% Pb and 0. 84% Zn, of which 77. 6 m (126. 1 m to 203. 7 m) graded 242 g/t Ag, 0. 71% Pb and 1. 30% Zn. This extension gap was drilled through the river sediment canopy southwest of the south dome and reaches a shallow silver mineralization that remains open to the southwest beyond the west dome drilled in the past, central valley, east dome corridor.

DCAr0170 drilled at the western boundary of the Central Valley near the western dome and intersected a wide diversity of argentiferous mineralization measuring 292. 8 m starting near the surface (9. 2 m to 302 m) with a grade of 58 g/t Ag, 0. 39% Pb and 0. 84% ZnArray of which 80. 39 m (9. 2 m to 89. 59 m) have a grade of 173 g/t Ag, 0,77 % Pb and 1,08 % Zn.

DCAr0154 intercepted a silver mineralization period measuring 93. 7 m (69. 5 m to 163. 2 m) grading 50 g/t Ag, 0. 20% Pb and 0. 53% Zn, of which 13. 05 m (72. 4 m to 84. 45 m) grading 280 g/t Ag, 0. 36% Pb and 0. 83% Zn. At intensity, several periods of gold mineralization were intersected, represented through 233. 66 m (500. 24 m to 733. 9 m) with a grade of 0. 65 g/t Au and 107. 1 m (774. 24 m to 881. 34 m) with a grade of 0. 84 g/t Au This hole was drilled to verify the eastern extent of gold mineralization in intensity and the gold periods in this gap imply that the mineralization of Gold remains open to the east.

DCAr0151 intersected a period of argentiferous mineralization measuring 66. 76 m beginning near the surface (6. 14 m to 72. 9 m) with a grade of 55 g/t Ag and 0. 31% Pb, and a momentary argentiferous period of 3. 63 m (266. 13 m to 269. 76 m) law 215 g/t t Ag, 0. 45% Pb and 0. 54% Zn. This hole drilled into the upper component of the East Dome.

The Company engaged RPMGlobal Canada Limited to obtain technical services in connection with a National Instrument 43-101 – Mineral Project Disclosure Standards (“NI 43-101”) Mineral Resource Estimate Report for the Cangas Project. RPMGlobal Canada Limited Qualified Person (as explained in NI 43-101) completed their on-site stopover at the end of March 2023. Resource estimation will begin once research effects have been obtained from all boreholes and resource estimation is expected to be finalized in the third quarter of 2023.

The assignment technical team is lately conducting detailed surface geological mapping and sampling to refine drilling targets on induced polarization (“PP”) load capacity anomalies beyond spaces drilled in the past (Figure 2). Resumption of drilling activities in the current part of 2023. These PP load capacity anomalies demonstrate a geophysical signature similar to that observed in the Central Valley drilled zone that hosts most of the silver and gold mineralization discovered in the Cangas allocation.

Figure 1 Carangas Project Drill Plan Map and Simplified Geology

Figure 2 Geological mapping spaces on PP chargeability anomalies

Table 1 Summary of drilling intersections

Hole_ID

profundidad_desde

Profundidad_hasta

Intervalle_m

Ag_g/t

Ago_g/t

Pb_%

Zn_%

Cu_%

AgEq_g/t

DCAr0151

6. 14

72,90

66,76

55

0,31

0,04

0,01

67

233. 25

234,49

1. 24

130

0,03

0. 03

0. 02

134

266. 13

269,76

3. 63

217

0,45

0,54

0,06

254

DCAr0152

6. 00

47,78

41,78

42

0,40

0,25

0,01

63

69,25

125,28

56. 03

21

0,38

0. 94

63

140. 14

148,35

8. 21

11

0,37

0,92

53

177,30

213. 11

35,81

9

0,03

0,44

0,82

0,03

54

242,70

302,00

59. 30

sixteen

0,18

0,21

0,58

0,03

57

311,78

315,92

4. 14

1

0,97

0,01

0,07

73

325. 27

365. 29

40. 02

6

0,51

0,08

0,27

0,03

56

378,20

422. 32

44. 12

5

0,59

0,01

0,04

0,04

53

436. 71

483,92

47. 21

2

0,61

0,01

0,04

0,02

49

510,00

517,50

7,50

0,78

0,03

58

523,50

531,90

8:40 a. m.

6

1. 15

0,01

0,04

0,09

99

576. 10

597. 17

21. 07

1

0,01

0,03

0,82

31

650,00

682,82

32,82

25

0,22

0,05

0,02

0,08

51

697,84

748,00

50. 16

3

0,89

0,01

0,03

0,13

81

787,50

802. 42

14. 92

ten

0,87

0,01

0,41

115

DCAr0153

2. 14

138,37

136. 23

26

0,22

0,56

0,01

53

150,80

165,36

14. 56

7

0,62

1. 19

0,02

67

191,45

356,50

165. 05

6

0,27

0,34

0,80

0,01

63

380,74

386,00

5. 26

6

0,61

0,01

0,07

0,06

59

409,00

422,00

13:00

19

0,14

0,15

0,28

0,15

58

440,70

464,00

11:30 pm

8

0,40

0,02

0,04

0,16

55

482. 22

610. 15

127,93

5

0,59

0,02

0,03

0,04

53

659. 52

720,90

61. 38

6

0,30

0,04

0,21

0,17

53

755,70

833. 67

77,97

4

0,08

0,07

0,51

0,02

31

DCAr0154

4:30 pm

43. 16

26,86

14

0,37

0,09

28

69,50

163,20

93,70

50

0,20

0,53

0,02

75

included

72,40

85,45

13. 05

280

0,36

0,83

0,01

319

209,50

219. 25

9,75

6

0,09

0,97

0,60

61

289,95

368. 36

78. 41

4

0,17

0,22

0,40

36

378. 10

408,00

29,90

5

0,16

0,17

0,33

32

452,00

460. 12

8. 12

5

0,10

0,13

0,36

28

500. 24

733,90

233,66

8

0,65

0,01

0,13

59

747,00

756,50

9. 50

2

0,41

0,00

0. 01

32

774. 24

881. 34

107. 10

5

0,84

0,01

0,01

Sixty-five

DCAr0155

1,84

137,25

135,41

11

0,37

0,37

0,01

35

DCAr0156

24h00

28. 28

4. 28

22

0,82

0,07

0,07

56

44,58

48,60

4. 02

38

1,87

0,07

0,01

97

65,00

74,00

9. 00

45

0,47

0,02

59

81,37

88. 10

6,73

25

0,61

0,02

0,01

44

102,50

105,00

2,50

26

0,19

0,05

0,01

34

150,85

173,50

22. 65

4

0,48

0,12

0,01

23

270,45

278,80

8. 35

56

0,39

0,04

0,01

70

DCAr0157

3. 23

15:42

12. 19

18

0,29

0,02

0,01

29

41,97

139. 12

97,15

sixteen

0,56

0,03

34

159,50

172. 32

12. 82

1. 01

1. 34

0,01

76

DCAr0158

125,00

129,50

4,50

31

0. 14

0,50

0,01

52

172,45

187,38

14. 93

27

0,21

0,30

0,01

44

240. 38

241,84

1. 46

62

0,07

0,12

68

273,50

275,00

1,50

57

0,15

0,15

0,06

72

299,00

303,00

4. 00

67

0,10

0,11

0,06

79

DCAr0159

5,00

39. 10

34. 10

35

0,57

0,03

53

DCAr0160

6,70

28. 20

21. 50

31

0,26

0,02

0,01

39

75,50

109,89

34. 39

23

0,27

0,04

0,01

33

125,00

152,00

27:00

19

0. 36

1. 32

0,02

77

DCAr0161

6,90

57,90

51,00

59

0,16

0. 05

0,01

67

153,50

155,00

1,50

116

0,09

0,06

0,04

125

225,50

252,50

27:00

18

0,05

0,11

0,01

24

DCAr0162

75,47

79,39

3,92

31

0,76

1. 27

97

97,20

125,35

28. 15

31

0,21

0,65

0,02

61

136,27

154,20

17. 93

9

0,31

0,78

0,05

50

207,50

225,00

17:50

5

0,04

0,47

0,54

39

287. 10

304. 31

17. 21

7

0,18

0,53

0,72

0,02

62

321. 22

329,88

8,66

3

0,08

0,40

0,96

53

392,87

399,50

6. 63

18

0,56

0,13

0,19

0,08

77

427,45

600. 35

172,90

14

0,97

0,06

0,02

0,09

94

631. 12

645. 17

14. 05

6

0,81

0,01

0,02

0,06

70

658. 20

663,95

5,75

1. 29

0,01

93

673,67

717,87

44. 20

2

1. 08

0,00

0,01

0,05

85

734,00

754,50

20. 50

2

0,71

0,01

0,01

0,03

57

796,40

819,70

11:30 pm

1

0,84

0,03

0,02

63

DCAr0163

5,60

59,50

53. 90

22

0,46

0,05

0,01

38

70,00

197,25

127,25

37

0,63

0,12

0,01

60

included

137,40

149. 30

11. 90

123

0,82

0,24

0,01

156

included

179,90

195,90

16. 00

198

0,55

0,23

0,01

222

DCAr0164

7,50

19:50

12:00

14

0,13

0,22

25

77,65

164,60

86. 95

12

0,14

0,48

0,02

34

187,00

252,97

65,97

4

0,03

0,31

0,48

31

271,90

308,60

36,70

5

0,15

0,44

0,74

0,01

54

373,80

406. 63

32,83

6

0,07

0,12

0,48

0,02

33

423,40

628. 10

204,70

8

0,64

0,03

0,08

0,04

61

683,50

713,75

30. 25

2

0,61

0,01

0,02

0,05

52

767,00

821. 24

54. 24

6

1. 61

0,00

0,01

0,14

135

DCAr0165

72,27

144,80

72,53

21

0,21

0,76

53

170,20

180,70

10. 50

7

0,05

0,45

0,01

24

235,56

263,40

27,84

6

0,30

0,81

42

DCAr0166

1,00

53. 10

52. 10

13

0,25

0,27

30

65,00

69. 00

4. 00

56

0,18

0,55

80

88,00

146,90

58,90

19

0,26

0,75

53

162. 01

236,80

74,79

ten

0,03

0,29

0,50

0,01

38

251,50

314,87

63,37

6

0,16

0,53

0,96

0,01

67

330,78

347. 08

4:30 pm

4

0,02

0,22

0,48

0,05

33

390,77

414,50

23. 73

3

0,22

0,08

0,18

0,04

31

419,00

428,00

9. 00

1

0,61

0,00

0,03

0,01

47

451,90

466,57

14. 67

2

1. 05

0,09

0,27

0,03

92

476,70

485,65

8,95

ten

2. 54

0,05

0,07

0,04

199

511,70

515,56

3,86

14

1. 49

0,03

0,03

0,14

136

611,50

620,90

9:40 a. m.

7

0,15

0,03

0,76

0,06

50

700,70

709. 15

8. 45

1

0,10

0,01

1. 01

0,01

43

774. 75

785,80

11. 05

4

0,72

0,00

0,03

0,18

75

791. 20

798. 10

6,90

2

0,32

0,00

0,02

0,24

51

DCAr0167

5,00

73. 30

68. 30

25

0,56

0,06

44

98,30

119. 00

20. 70

ten

0,66

0,11

33

140,00

143,91

3,91

9

1. 16

0,09

0,01

46

DCAr0168

62,75

104,80

42. 05

18

0,30

0,58

47

120,80

138,60

17. 80

33

0,16

0,61

59

175,87

186,00

10. 13

19

0,12

0,35

34

197. 30

219. 44

22. 14

8

0,36

0,71

0,01

44

237,70

269,80

32. 10

28

0,97

1. 37

0,08

109

DCAr0169

14. 80

74,67

59,87

31

0,82

0,06

57

DCAr0170

9:20 a. m.

302,00

292,80

58

0,39

0,84

0,02

99

included

9:20 a. m.

89,59

80,39

173

0,77

1. 08

0,05

236

DCAr0171

76,80

282,40

205,60

123

0,02

0,44

0,84

0,02

167

included

126. 10

203,70

77,60

242

0,01

0,71

1h30

0,03

310

311,35

406. 35

95,00

9

0,36

0,92

0. 02

57

Remarks:

1.

The drilling location, elevation, azimuth and dip of the well are shown in Table 2.

2.

The interception of the perforation is the duration of the core and the law is weighted according to the duration. The actual thickness of the mineralization is unknown due to the initial level of exploration without good enough drilling data.

3.

The calculation of silver equivalent (“AgEq”) is based on the long-term median of the August 2021 street consensus commodity value forecast, which is $22. 50/oz for Ag, $0. 95/lb for Pb, $1. 10/lb for Zn, $3. 40/lb for Cu, and $1600/oz for Au. The formula used for the calculation of AgEq is: AgEq = Ag g/t Pb g/t * 0. 0029 Zn g/t * 0. 00335 Cu g/t * 0. 01036 Au g/t * 71. 1111. This calculation assumes a recovery of one hundred percent.

4.

A limit of 20 g/t AgEq is implemented to calculate the length-weighted intersection. Samples with less than 20 g/t AgEq may sometimes be included in the mineralized intersection consolidation calculation.

Table 2 Summary of wells in the Carangas discovery drilling program

agujero_id

Abscissa

ordinate

Altitude

profundidad_m

Azimuth (°)

Hollow (°)

Objective

DCAr0151

539617. 75

7905215. 10

4013. 81

300,00

20

-45

OF

DCAr0152

539311. 30

7905343. 30

3911. 21

821,00

252

-75

CV

DCAr0153

539324. 98

7905302. 65

3917. 54

836,00

252

-67

CV

DCAr0154

539487. 76

7905479. 04

3921. 69

900,00

249

-66

CV

DCAr0155

538797. 69

7905700. 86

4063. 33

140,00

120

-40

WD

DCAr0156

539684. 64

7905129. 41

4036. 00

302,00

20

-45

OF

DCAr0157

538799. 21

7905701. 13

4063. 35

206,00

60

-40

WD

DCAr0158

539517. 04

7905105. 86

3969. 15

323,00

20

-45

OF

DCAr0159

538841. 19

7905736. 01

4068. 83

152,00

7

-40

WD

DCAr0160

538841. 30

7905734. 87

4068. 79

152,00

156

-40

WD

DCAr0161

539663. 65

7905221. 91

4023. 46

293,00

20

-45

OF

DCAr0162

539403. 94

7905455. 30

3924. 08

848,00

252

-67

CV

DCAr0163

538842. 50

7905735. 25

4068. 85

200,00

110

-40

WD

DCAr0164

539412. 79

7905417. 33

3930. 76

821,00

252

-70

CV

DCAr0165

539247. 76

7905094. 61

3908. 82

302,00

20

-45

OF

DCAr0166

539400. 87

7905371. 39

3935. 30

848,00

247

-75

CV

DCAr0167

538843. 04

7905735. 85

4068. 79

152,00

81

-40

WD

DCAr0168

539276. 07

7905026. 84

3910. 53

302,00

20

-45

OF

DCAr0169

538841. 68

7905740. 16

4068. 79

152,00

50

-40

WD

DCAr0170

538946. 49

7905288. 56

3905. 72

302,00

20

-45

WD

DCAr0171

538631. 00

7905028. 49

3905. 09

420,00

48

-59

South Dakota

Note:

1. La coordinate of the drill is WGS1984 UTM Zone 19S

2. The coordinates of the bar mass are decided with GPS Real Time Kinematics (RTK) hollow DCAr0036 which is via portable GPS

3. CV – Central Valley; WD – West Dome; ED – East Dome; SD – South Dome

The Company maintains a strict standard of safety, quality assurance and quality for all facets of its exploration program on the Carangas allotment. Drill core is logged, photographed, and split on-site through the company and stored in secure conditions until shipped in sealed bags via New Pacific labor force in corporate vehicles, directly from assignment to ALS Global in Oruro, Bolivia for preparation, and ALS Global in Lima, Peru for geochemical research. ALS Global is an ISO 17025 accredited laboratory independent of New Pacific. All standards are first analyzed through a multi-element ICP suite (ALS code ME-MS41) with specified ore grade limits for silver, lead and zinc, then analyzed using ALS code OG46. Other silver standards that exceed specified limits are analyzed by gravimetric investigation (ALS code of GRA21). Gold is analyzed first via ICP and then via an AAS-end stack assay (ALS code Au-AA25). Certified reference materials, various types of blank patterns, and duplicate patterns are inserted into general sequences of drill core patterns before they are sent to the laboratory for preparation and investigation. The overall ratio of quality patterns to pattern sequences is approximately twenty percent.

The clinical and technical data contained in this press release have been reviewed and approved by Alex Zhang, P. Geo. , Vice President of Exploration (the “Qualified Person”), who is a Qualified Person for purposes of NI 43-101. The Qualified Person has verified the data disclosed herein employing popular verification procedures, adding the sampling procedures, preparation, safety and investigation underlying such data, and is not aware of any significant hazards and uncertainties or limitations of the verification procedure that could affect reliability. or confidence in the data discussed in this paper.

New Pacific is a Canadian exploration and progression company with valuable metals projects in Bolivia. The company’s flagship project, the Silver Sand Silver Project, published the effects of the inaugural Preliminary Economic Assessment (the “AEP”) in January 2023. The PEA examination shows an after-tax NPV (5% reduction) of US$726 million with an IRR of 39%, supported by total silver production of 171 million ounces over the 14-year life of the mine. project, a resource drilling program of more than 50,000 meters completed in 2021-2022. The third project, the Silverstrike Silver-Gold project, underwent a 6000-meter discovery drilling program in June 2022.

For information, please contact:

The effects of the PEA assessment of the Silver Sand project are initial in nature and are intended to provide an initial assessment of the project’s economic prospects and progress options. PEA’s mining schedule and economic evaluation come with assumptions and are based on indicated and inferred mineral resources. The Inferred Resources are considered to be too geologically speculative to have implemented the economic considerations that would allow them to be classified as Mineral Reserves, and there is no certainty that the economic tests of the Project described herein will be completed or that the effects of the PEA will be realized. The mineral resource estimate would likely be particularly affected by geological, environmental, legal, title, sociopolitical, marketing or other issues as applicable. The Mineral Resources are not Mineral Reserves and have no demonstrated economic viability. Additional exploration studies will be required to prospectively improve the classification of the inferred mineral resources to consider them as complex long-term studies. AMC Mining Consultants (Canada) Ltd. (mineral resource, mining, infrastructure and money analysis) was contracted to conduct the PEA in collaboration with Halyard Inc. (metallurgy and processing) and NewFields Canada Mining & Environment ULC (tailings management, water and waste). ). The Qualified Persons (as explained in NI 43-101) for the EEP are Mr. Wayne Rogers P. Eng and Mr. Mo Molavi P. Eng, Principal Mining Engineers of AMC Mining Consultants (Canada) Ltd, Mr. Andy Holloway P. Eng. , Process Manager at Halyard Inc. , and Mr. Leon Botham P. Eng. , Principal Engineer at NewFields Canada Mining & Environment ULC. This is in addition to Ms. Dinara Nussipakynova, P. Geo. , Principal Geologist at AMC Consultants (Canada) Ltd. , who estimated mineral resources. All such Qualified Persons have reviewed the technical content of the January 9, 2023 press release related to the Silver Sand Project deposit and have approved its publication. The PEA is based on the updated estimate of Mineral Resources for the Silver Sand Project, which was reported on November 28, 2022 and has an effective date of October 31, 2022. The threshold implemented for reporting the mineral resource confined in the pit is 30 g/t silver. The assumptions made to derive a cut-off grade come with extraction prices, processing prices and recoveries and were received from comparable commercial situations. The style is exhausted by ancient mining activities. Mineral Resources are capped through optimized pit shells at consistent $22. 50 silver value per ounce, 91% silver metallurgical recovery, 99% silver profitability, $2 surface mining charge . 6/t, US$16/t processing charge, US$2/t G&A charge and 44-47 degree slope angle. Key assumptions used for pit optimization for PEA mining include a silver value of $22. 50 consistent with the ounce, 91% silver metallurgical recovery, 99% silver profitability, surface mining charge of US$2. 6/t, additional extraction charge of US$0. 04/t (consistent with 10m bank), processing charge of US$16/t, tailings deposit of $0. 7/t consistent with charge, G&A rate of $2/t, 6. 00% royalty, 92% mine recovery, 8% dilution and a grade of 30 g/t cut silver.

Certain of the emails and configurations contained in this press release constitute “prospective mailings” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “prospective configurations” within the meaning of the laws of applicable Canadian provincial values. . Any or form that expresses or leads to discussions related to long-term predictions, expectations, beliefs, plans, projections, goals, assumptions, or occasions or form (often, but not always, using words or expressions such as “hope,” “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “goals”, “goals”, “forecasts”, “objectives” , “budgets”, “schedules”, “potentials” or diversifications thereof or indicating that certain actions, occasions or effects “might”, “could” Array “would”, “could” or “should” be taken, happen or be achievedArray or the negative form of any of those terms and similar expressions) are not old facts and would possibly be s or a prospective form. Such s include, but are not limited to, s relating to: the expected timing of grading and final results of the project’s inaugural mineral resource estimate; expected timeline for the project mapping program; the exploration, drilling, development, structure and other planned activities or achievements of the Company; time to receive authorizations and regulatory approvals; estimates of the Company’s capital revenues and expenditures; and other long-term plans, objectives or expectations of the Company.

Forward-looking statements or data are subject to a variety of known and unknown dangers, uncertainties and other problems that may cause actual events or effects that differ from those reflected in the forward-looking statements or data, including, but not limited to, hazards related to: global economic and social impact of COVID-19; fluctuation in inventory prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange hazards, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties related to the availability and prices of mandatory financing in the future, environmental hazards, operating and political conditions, regulatory environment in Bolivia and Canada; the dangers related to network relationships and corporate social responsibility, and other points described in the “Risk Factors” section of the Company’s Annual Information Form for the fiscal year ended June 30, 2022 and its other public documents. This list is not exhaustive of the points that may be only forward-looking statements or data of the Company.

Forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and control reviews as of the date of this news release which, considered as moderated through control, are inherently subject to significant business, economic and competitive uncertainties. . . and contingencies. These estimates, assumptions, beliefs, expectations and characteristics include, but are not limited to, those that are similar to the Company’s ability to conduct its current and long-term business, including: the duration and effects of COVID -19 in our business and our workforce; progression and exploration activities; the timing, scope, duration and economic capacity of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; stabilization of the political climate in Bolivia; the Company’s ability to discharge and hold a social license over its mineral properties; availability and charge of inputs; production and market value; exchange rates; tax levels; the timely receipt of the mandatory approvals or permits, adding the ratification and approval of the mining production contract with COMIBOL through the Plurinational Legislative Assembly of Bolivia; the ability of the Company’s Bolivian spouse to convert the exploration licenses for the Carangas Project to AMC; the ability to meet existing and long-term obligations; the ability to unload timely financing on moderate terms, if necessary; existing and long-term social, economic and political conditions; and other assumptions and points sometimes relevant to the mining industry.

Although the forward-looking statements contained in this press release are based on what control considers to be moderate assumptions, there can be no assurance that actual effects will be consistent with such forward-looking statements. All forward-looking statements contained in this press release qualify through those cautionary statements. Readers therefore deserve not to place undue reliance on those statements. Except as required by applicable law, the Company has no legal liability and expressly disclaims any legal liability to update or adjust any forward-looking statements, whether as a result of new information, long-term events or otherwise, as required by law. These forward-looking statements are made as of the date of this press release.

WARNING TO U. S. INVESTORS

This press release has been prepared in accordance with the needs of applicable Canadian securities law that differs from the needs of U. S. securities law. U. S. through the U. S. Securities and Exchange Commission. U. S. Securities and Exchange Company (the “SEC”). Accordingly, the technical and clinical data contained herein, aggregating any estimates of mineral reserves and mineral resources, may not be comparable to data disclosed through U. S. corporations relating to the SEC’s disclosure needs. .

Additional data related to the Company may be received by adding the Company’s Annual Information Form, under the Company’s profile on SEDAR in www. sedar. com, on EDGAR in www. sec. gov and on the Company’s profile in www. newpacificmetals. com.

Highgold Mining is a mineral exploration company targeting high-grade gold allocations in North America. HighGold’s high-grade Johnson Tract Gold (Zn-Cu) gold allocation is located in south-central Alaska, USA. UU. La company also controls a portfolio. . . LEARN MORE