“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

74% of organizations reported a moderate to significant effect on their workers as a result of the pandemic

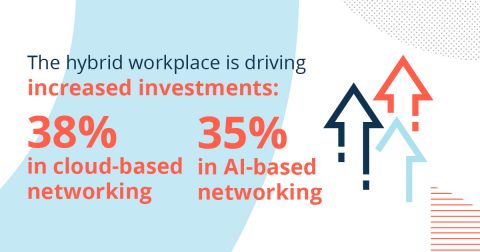

In reaction to COVID-19, 38% of IT managers plan to increase their investments in cloud-based network paints and 35% in AI-based network paints, looking for a more agile automated infrastructure for hybrid paint environments.

Businesses will revel in deep adjustments as painters move to hybrid paint environments after COVID-19, which in turn turns the way IT groups get and consume networked paint solutions. In reaction to the pandemic, IT managers are now investing more in cloud-based and artificial intelligence-powered network painting technologies as business recovery plans take shape. This is revealed through a global survey of 2,400 IT resolution creators (ITDMs) commissioned through Aruba, a Hewlett Packard Enterprise company.

This multimedia press release. See the full edition here: https://www.businesswire.com/news/home/20200812005209/fr/

In reaction to COVID-19, 38% of IT managers plan to increase their investment in cloud-based network paints and 35% in AI-based network paints as they are looking for a more agile infrastructure for hybrid paint environments. (Chart: Business Wire)

Read the full report: https://www.arubanetworks.com/assets/eo/Hybrid-Workplace-Report.pdf

As IT managers face the demanding situations of creating a highly distributed paint force and the emergence of a hybrid office (other people have to move seamlessly between paintings on campus, at home, and in the pass), they are looking to evolve their networked paint infrastructure. and evolve. CapEx investments towards “service-like” responses. The average percentage of subscription-fed IT installations will increase to 38% over the next two years, from 34% of the current total to 46% in 2022, and the percentage of organizations consuming a majority (more than 50%) “as a service”, the answers will accumulate by approximately 72% during this period.

“With the emergence of the hybrid workplace, IT managers are asked to provide a sensitive balance between flexibility, security, and edge accessibility,” said Partha Narasimhan, CTO, and HPE Senior Fellow of Aruba, a Hewlett Packard Enterprise company. “Every component of the workplace wants to evolve: the campus wants to join the generation at social distance and contactless experiences, and the workplace will have to provide connectivity, security and business level. It is increasingly transparent that, to satisfy these new desires in an economically challenging environment, IT resolution leaders are drawn to alleviating the dangers and burden benefits presented through a subscription model.”

The report, which counted ITMs in more than 20 countries and 8 key industries, tested how they responded to IT and demands after COVID-19, what investment decisions are made accordingly and existing admission models are taken into account. Several key findings were highlighted:

The effect of COVID-19 has vital implications

ITDM reports that the effect of COVID-19 has been significant for both its workers and short-term investments in the network:

22% rate the effect on their workers as “significant” (generalized casualties or layoffs), 52% consider it “moderate” (temporary discounts on certain functions) and 19% “low” (very few jobs have an oned effect).

ITDMs in India (57%) Brazil (34%) were probably the most likely to cite a significant effect on their employees, while those in Hong Kong (12%) Mexico (10%) reported the minor, highlighting a great replacement in experiences. Regions.

77% said investments in network projects had been postponed or overdue since the start of COVID-19, and 28% said the projects had been cancelled.

Project cancellations occurred in Sweden (59%) and the lowest in Italy (11%), showing that there are also significant disparities between countries in the same region, while 37% of ITDMs in education and 35% in international hotels and hotels said they had to cancel investments in the network.

The long term is brilliant: making an investment for emerging needs

On the other hand, long-term projects are aggressive, as the vast majority of ITDMs make plans or increase their network investments with COVID-19 as they try to satisfy the new desires of workers and customers.

An incredible 38% worldwide will increase their investments in cloud-based networks, with 45% staying at the same point and 15% decreasing. APAC was the world leader with 45% of the accumulated investment in cloud-based networks, achieving 59% among ITDMs in India. With cloud responses that enable large-scale remote network management, those features are especially interesting for IT groups when it’s unimaginable or difficult to be on site.

ITDMs are also looking for advanced equipment to track and understand the network, with 34% international making plans to increase your investment in analytics and insurance, 48% indicating that it will be your investment point and 15% cutting it. This enables IT organizations to troubleshoot and tune the network more efficiently, as demands grow across a distributed workforce.

It’s also in cutting-edge technologies that simplify the lives of IT groups by automating repetitive tasks. We found that 35% of international ITDMs plan to increase their investments in AI-based network technologies, with the APAC region leading the rate with 44% (including 60% of ITDMs in India and 54% in Hong Kong).

Adoption of new admission models is accelerated

As ITDMs shape their investment plans, they are used as admission patterns of choice to achieve the most productive balance between price and flexibility.

55% international says it is exploring new subscription models for hardware and/or software, 53% of controlled installations for turnkey hardware/software and 30% monetary leasing, all due to the effect of COVID-19. This reflects the greater desire for more flexible models in monetary terms in a challenging environment.

Network subscription models are most popular in the APAC region (61%) America (52%) EMEA (50%) and, nationally, the programmes are located in Turkey (73%), India (70%) China (65%).

The maximum sectors likely to take into account the subscription style are hotels / hospitality (66%), generation and telecommunications (58%) (57%). The effect of COVID-19 on IT behavior has made the preference for flexibility and predictability of spending, while reducing the threat related to initial capital costs, greater than before.

In stark contrast, only 8% globally plan to continue only with capitalization investments, the proportion is higher in the Netherlands (20%), the United States (17%), Spain (16%) France (15%). In all sectors, 15% in retail, distribution and shipping will continue to focus only on CapEx investments, compared to only 5% in IT, technology, education and telecommunications, and 2% on hotels and hotels.

“Given that the desires of consumers and workers have evolved so fully in recent months, it’s not unexpected to see IT managers looking for more flexible solutions,” Narasimhan says. “They want to adapt temporarily and ensure that the most complex distributed networks can safely experience user requests. The desire for agility and flexibility in network control is greater than ever.

While the pandemic has obviously had a negative effect on ongoing projects, this study suggests that it will also catalyze medium-term investments in complex network technologies and a transition to more flexible admission models that restrict initial capital demands. Trends that had already taken root will now accelerate, adding movements to the outer edge and adopting intelligent cloud-based and artificial intelligence-based networks.

To learn more about how Aruba contributes to hybrid architecture, log in to Aruba ATM Digital at 10 a.m. Pacific Time on Thursday, August 13, 2020.

Additional assets:

Infographic: https://www.arubanetworks.com/assets/infographic/Edge-Survey-Hybrid-Workplace_Infographic.pdf

Aruba Hybrid Workplace Page: https://www.arubanetworks.com/solutions/hybrid-workplace/

About Aruba, a Hewlett Packard Enterprise company

Aruba, a Hewlett Packard Enterprise company, is the world leader in secure and intelligent edge-to-cloud network paint responses that use AI to automate networked paints, while leveraging knowledge to drive challenging business outcomes. With Aruba ESP (Edge Services Platform) and features as a service, Aruba adopts an on-premises cloud technique to help consumers meet their connectivity, security, and financing needs in campus, branch office, knowledge centers, and remote charts, covering all facets of local cable. , wireless and long network paints (WAN).

For more information, Aruba in http://www.arubanetworks.com. For real-time updates, stay in Aruba on Twitter and Facebook, and for the latest technical discussions on mobility and Aruba products, Airheads Social on http://community.arubanetworks.com/.

About Vanson Bourne

Vanson Bourne is an independent market research specialist for the generation sector. His reputation for studies based on physically powerful and credible studies is based on principles of rigorous studies and his ability to solicit the prospects of high-level resolution managers in all technical and advertising functions, in all primary industries and markets. For more information, www.vansonbourne.com

See the businesswire.com edition: https://www.businesswire.com/news/home/20200812005209/fr/

Contacts

Pavel Radda Aruba, a Hewlett Packard corporate company [email protected]

Kathleen Keith Aruba, a Hewlett Packard Enterprise corporate company – [email protected]