\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

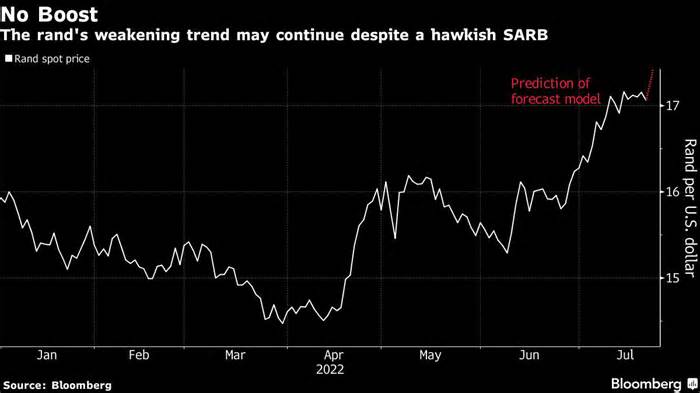

(Bloomberg) — The Reserve Bank of South Africa has tightened policy five times in a row, with rate hikes on a scale not seen in two decades. He didn’t do much to the rand.

Most read from Bloomberg

Americans who can’t afford a home move to Europe

Trump insider’s account of how he rejected calls to action as riots erupted

Three Arrows Founders Break Silence on Crypto Hedge Fund Collapse

Lieutenant Musk tested from an internal investigation into Tesla’s purchases

These are the toughest (and least) passports in the world in 2022

While Thursday’s 75 basis point gain to 5. 5%, which beat consensus, saw the currency post a modest gain on a risk-free day in the markets, it is still heading for one of the worst declines in July, unlike the next ones. comrades of the country.

Between global inflation and recession fears, investors flocked to safe havens, and emerging markets like South Africa paid the value of a sell-off. Other central banks in emerging countries, besides Hungary, Poland and Brazil, have also tightened aggressively, but this has done little to stop their currencies from falling.

Even after a cumulative tightening of 200 fundamental issues since November, cash markets forecast an additional 144 fundamental issuances at the last two policy meetings of the year in South Africa. This implies increases of 75 fundamental emissions each. Still, Bloomberg’s forecasting model, based on rand call and ask option prices, sees more than an 80% chance of the currency weakening to 17. 50 per dollar through the end of the year. The rand gained 0. 3% to 17. 00 nine7 at 9 a. m. Johannesburg on Friday.

“This is not a smart environment for a meaningful rand recovery,” said Marek Drimal, a London-based senior strategist at CEEMEA at Societe Generale SA. “Yes, there would possibly be a correction from existing reasonable levels, but it is too beaten, and too soon, for direct purchases in rand. “

Some of the rand’s losses were self-inflicted. South Africa is in its longest era of blackouts, which is likely due to hose expansion, as state-owned power company Eskom Holdings SOC Ltd. it is struggling to keep aging coal-fired power plants running. Concerns about economic expansion in China, South Africa’s largest trading partner, as well as falling commodity costs, may also weigh on the economy.

Still, the Reserve Bank said on Thursday it would act “broadly” to curb inflation, aligning itself with global central banks and triggering the most competitive financial policy tightening in a generation.

“I expect 75 basis points to accumulate in September, which would be a reaction to external financial tightening and headline inflation,” Drimal said. “But for any meaningful recovery, the rand also wants a basic stimulus from the global economy. “and especially from China. And this is unfortunately in danger.

Most read from Bloomberg Businessweek

The $260 Swatch-Omega MoonSwatch revives the brand

Sam Bankman-Fried Turns $2 Trillion Crypto Path into a Buying Opportunity

USA. The U. S. has lost control of PC chips

Post-mortem sperm extraction turns men into fathers

The ghosts of 2012 frequent Europe as the walks begin

©2022 Bloomberg L. P.