\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

Mexico’s central bank raised its key interest rate to an all-time high after inflation hit the fastest speed in more than 21 years, but abandoned the early guidance it had given in its previous decision.

Most read from Bloomberg

Surprising drop in stress hormone predicts a lot of time in Covid

Dozens of other people in China were infected with the new “Langya” virus transmitted through shrews

China has painted itself on one of the semiconductors

Media counts show close presidential race: Kenya update

Technology takes the flow of stocks as bond yields rise: closing markets

Banxico, as the bank is known, on Thursday reported a back-to-back 75 basis point increase in the benchmark rate, bringing it to 8. 5 percent, as expected by all 24 economists in a Bloomberg poll. Not since the bank began targeting inflation in 2008 has financial policy been so restrictive, with a past record of 8. 25%.

Still, the bank did not repeat the progressive direction it announced Thursday’s increase it gave in its June decision, a move some analysts interpreted as preparing investors for a reduction in rate hikes. In an accompanying decision Thursday, the board said it will “assess the extent of the upward changes to the benchmark rate for its next policy decisions based on existing conditions. “

By cutting off future guidance, Banxico “opened the door to slowing the pace” of rate hikes, said Carlos Capistran, lead economist for Mexico and Canada at Bank of America Corp. “We expect Banxico to surpass 50 fundamental emissions at its next assembly with a threat of some other 75 foundation problems.

The rate hike is in line with that of the U. S. Federal Reserve. As Mexican lawmakers tend to stick to their opposing U. S. numbers. In the face of abrupt capital outflows. Banxico started with small increases of 25 issues of funds and has tripled that speed since June. , raising loan prices through 4. 5 percentage issues over the past 14 months and more than double the policy rate over the period.

“By adopting a more progressive tone, they mean that the next financial policy resolution will most likely be influenced by what happens with the Fed,” said Pamela Diaz Loubet, a Mexican economist at BNP Paribas SA.

The bank now sees core inflation, which excludes some energy and food prices and is seen as a better predictor of long-term price readings, peaking at 7. 9% in the third quarter of 2022, up from a previous estimate of 7. 4%.

What Bloomberg Economics says

“Our base case is that Banxico continues to raise rates in line with the Fed until the outlook for U. S. financial policy continues to rise. Let the U. S. be safer. “

— Felipe Hernández, Latin American economist

— Click to view the full report

The board also said in which the balance of inflation dangers “remains strongly skewed to the upside. “

Mexican swap rates rose after the central bank’s announcement, from 2 to 3 base issues on the curve as a whole. Prior to the decision, swap rates were worth around 160 base issues for the remainder of 2022, with the policy rate ending the year at around 9. 35%.

Banxico’s resolution is scheduled for September 29.

Tightening cycle

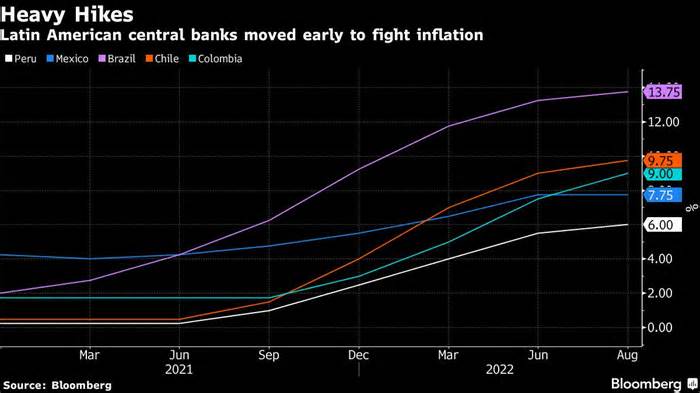

Latin American central banks began tightening financial positions ahead of the peak of their global peers, but costs continue to rise above target in the region.

Recent knowledge of Mexico has shown more evidence that inflation from volatile pieces such as energy and food has spread to key solid goods. Consumer costs rose 8. 15% in July from a year earlier, up from 7. 99% the previous month. Meanwhile, wages rose 9. 5 percent, the highest since 2001, putting more pressure on costs. The bank is targeting inflation of 3% plus or minus 1 percentage point.

“The knowledge of inflation is pretty bad, especially core inflation,” Jessica Roldan, lead economist at Casa de Bolsa Finamex, said before the bank’s decision, adding that the policy rate could reach 10% this year. a higher level, inflation becomes persistent. “

Mexico’s long inflationary path comes despite the fact that the government of President Andres Manuel Lopez Obrador has taken competitive measures in value, and expects to spend about $28 billion this year on measures such as fuel subsidies, fertilizer distribution, reducing import tariffs and striking a deal with private manufacturers to limit the value of staple foods.

The government says it has cut value gains by 2. 6 percentage points, but has not stopped inflation expectations from being reduced. Economists surveyed by Citigroup Inc’s local unit see inflation ending the year at 7. 74% and see it slowing within the diversity target through 2023, ending the year at 4. 51%.

Read more: Mexico spends $28 billion on inflation subsidies

The bank is facing a difficult few months as inflation continues to rise and the economic expansion is expected to slow after U. S. gross domestic product slows. The U. S. fell in the current quarter of the year. We see “a number of variables that recommend that the expansion in Mexico boring at the time of the year,” said Gabriel Lozano, a Mexican economist at JPMorgan Chase.

(Updates with the market’s reaction to the ninth paragraph).

Most read from Bloomberg Businessweek

The revolution of home paintings is also for women

How Employers Get Advantages from Unlimited Paid Vacation Offering

Mark Zuckerberg’s Sheryl Sandberg replacement has long been Meta’s repairman.

The beef boom has urban cowboys lining up to buy farm animals in Uruguay

Amazon’s Roomba deal is all about mapping your home

©2022 Bloomberg L. P.