VANCOUVER, BC / ACCESSWIRE / November 8, 2022 / Mawson Gold Limited (“Mawson” or the “Company”) (TSX:MAW)(Frankfurt:MXR)(OTC PINK:MWSNF) summarizes the latest news from its wholly owned Australian subsidiary, Southern Cross Gold Ltd (“SXG”), which recently announced additional effects from 4 boreholes on its Sunday Creek property, Victoria, Australia, of which it is one hundred percent owned. Mawson owns 60% of SXG following its initial public offering (“IPO”) in May 2022 on the Australian Securities Exchange (“ASX”).

Strengths:

Ivan Fairhall, chief executive of Mawson, said: “Stellar drilling effects continue to come from Sunday Creek. High laws continue in Apollo and show increasing continuity and predictability. Excitingly, we now see the new discovery domain at Golden and a combination of the Good fortune of discovery in assets: first observed as prolonged Apollo in diving, and now along the 800m in the direction of Golden.

Mawson shareholders take advantage of exploration opportunities in various households: here, through Mawson’s 60% stake in SXG, with 3 platforms in operation lately, in Skellefteå, an 85% Swedish investment through Mawson, and especially in Finland where regional and diving opportunities are returning to construction at Rajapalot’s recent PEA which highlighted a US$211 after-tax NPV5 million for the discovery of 1 moz AuEq Rajapalot”.

Discussion of results

Golden

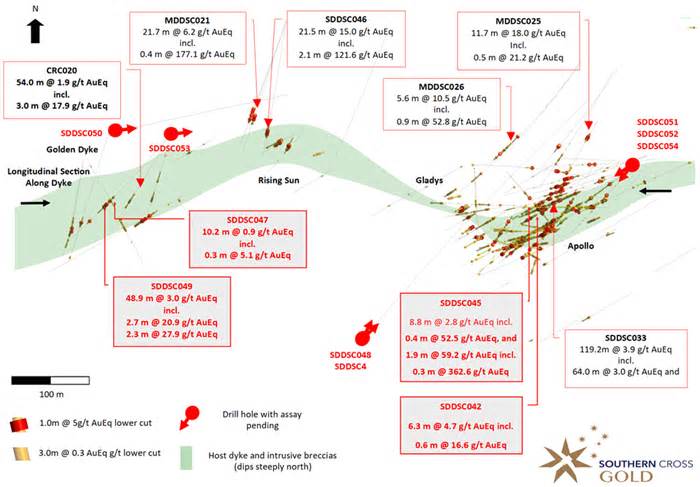

The SDDSC047 and SDDSC049 wells are SXG’s first drilling controls in the historic maximum productivity (Golden) mining domain on Sunday Creek. These effects are incredibly significant because they demonstrate that there are several mineralized zones in a 700 m domain, including:

SDDSC049 drilled 35 m under the historic Golden Yards and 160 m under the historic surface drill hole CRC020 54. 0 m at 1. 9 g/t AuEq (1. 5 g/t Au, 0. 3% Sb) from 0 m, adding 3. 0 m to 17. 9 g/t AuEq (16. 2 g/t Au and 1. 1% Sb). SDDSC049 Intersected

SDDSC047 drilled 30 m east of SDDSC049, and also reported here, demonstrates a giant arsenic anomaly zone of 177. 6 m at 206 m (28. 4 m), with a gold grade decrease of 10. 2 m to 0. 9 g/t AuEq (0. 9 g/t AuArray 0. 01 % Sb) from 192. 8 m, of which 0. 3 m to 5. 1 g/t AuEq (5. 1 g/t Au, 0. 02% Sb) from 197. 8 m and is close to failure.

Apolo

The SDDSC045 drillhole intersected a very giant area of mineralization from 97. 4 m to 186. 8 m at the rear of the shaft (89. 5 m to 1. 9 g/t AuEq (1. 8 g/t Au, 0. 04% Sb, no cut reduction applied)) related to incredibly high ratings, including:

The drill hole SDDSC042, drilled 40 m above SDDSC045, intersected a very giant mineralization zone of 111. 9 m to 146. 9 m downstream of the hole (36. 1 m @ 1. 4 g/t AuEq (1. 2 g/t Au, 0. 08% Sb cut reduction applied)) :

Well SDDSC045 with grade from 3. 8 m to 28. 9 g/t AuEq (28. 9 g/t Au, 0. 01 % Sb) from 183. 0 m, 0. 3 m to 362. 6 g/t AuEq (362. 5 g/t Au and 0. 04 % Sb) and 0. 4 m to 52. 5 g/t AuEq (52. 4 g/t Au, 0. 04% Sb) from 174. 7 m.

SDDSC042 classified as 6. 3 m 4. 7 g/t AuEq (4. 1 g/t Au, 0. 35 % Sb) from 137. 5 m 0. 6 m to 16. 6 g/t AuEq (16. 4 g/t Au, 0. 10 % Sb).

Importantly, either well is a component of a higher-grade intersection organization in a domain of 60 m x 30 m x 30 m in the Apollo footage (Figures 3 and 4). These exceptionally superior grade effects are the first drilling verification performed on an NW-SE orientation through the NNE trend Apollo projection, demonstrate the continuity of the higher grade mineralization and show the actual thickness of the Apollo projection (up to 50 m, with slopes greater than 20 m – 40 m). Several wells in this drilled domain in Las Orienteerings have now demonstrated significant grades and widths.

Drilling Update

SXG owns 3 drilling rigs at Sunday Creek in Sunday Creek at Golden, Rising Sun and Apollo prospects. Three wells (SDDSC048A/51/52) are being processed and geologically analyzed, with 3 wells (SDDSC050/53/54) drilled (Figure 2).

SXG reports specific interest in the SDDSC050 drill well, designed to drill the Rising Sun outbreak in a west-east orientation not tested in the past. An initial visual geological record of SDDSC050 indicates that the Rising Sun outbreak intersected at approximately 350 m with multiple mineralization zones ranging from 393 to 763 m with visual gold observed in some limited spaces (Photos 1-3). This appears to be the coartest mineralization intersection noted to date, pending analysis. The gap still continues at an intensity of 770 m and is the innermost gap of the allocation at 251 m (the previous innermost gap was MDDSC026 at 519. 2 m).

Introduction to Sunday Creek

The mineralized shoots at Sunday Creek are shaped at the intersection of 330° shallower subvertical mineralized veins and a steep east-west layout with north dip containing diorite and related intrusive breccias. The dimensions of each shoot will be discovered with more perforation, but in general:

Sunday Creek has a 10km mineralized trend that extends beyond the drilling domain and is explained through ancient yards and soil samples that have not yet won exploratory drilling and offers a long-term upward action perspective. The historic drilling extends mineralization 500 m west of Golden to the historic Christina mine. The 10 km northeast direction covers the historic mining sites of Leviathan, Consols, Aftermath, and Tonstal, all held under SXG’s one hundred percent exploration tenure (Figure 5).

Figures 1 through 4 show the location and plan of the project, longitudinal and cross-sectional perspectives of drilling effects reported here, and Tables 1 to 3 provide neck and research data. The actual thickness of the mineralized periods is interpreted as approximately 60%. at 70% of the sampled thickness of the high-grade mineralization. All of the above drilling effects have a decreasing cut-off of 0. 3 g/t Au over a width of 3. 0 m, with higher grades reported with a cut of five g/t Au over 1. 0 m, unless otherwise indicated.

Technical and personal training.

The qualified person, Michael Hudson, executive chairman and director of Mawson Gold, and a member of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and the technical content of this release.

Analytical samples are transported to Bendigo on-site (“on-site”) laboratory service facilities operating under ISO 9001 and NATA quality systems. measurement of gold in solution with flame AAS equipment. Samples for phased matrix research (BM011 and out-of-band strategies as needed) use aqua regia digestion and ICP-MS research. Southern Cross Gold’s QA/QC program consists of the systematic insertion of qualified criteria of known gold content, blanks in interpreted mineralized rock and quarter-core duplicates. In addition, On Site inserts white space and criteria into the research process.

The gold equivalent “AuEq” for Sunday Creek is = Au (g/t) 1. 58 × Sb (%) based on assumed gold costs of 1700 USD/oz gold and antimony of 8500 USD/ton of steel, and total steel recoveries of 93%. of the year for gold and 95% for antimony. Given the geological similarities of the projects, this formula has been followed to align with Mandalay Resources Ltd’s technical report indexed on the Toronto Stock Exchange dated March 25, 2022 on its Costerfield project, which is located 54 km from Sunday Creek. and that it has traditionally processed the mineralization of the property.

For scan results reported in the past, see the following:

Please see Mawson’s October 20, 2022 announcement for full release of Rajapalot’s PEA results. The grades and ounces of gold equivalent (AuEq) for Rajapalot align with the PEA steel costs of $1,700/oz Au and $60,000/t Co and the recovery assumptions of 95% Au and 87. 6% Co. (AuEq2 = Au g/t Co ppm/988).

About Mawson Gold Limited (TSX: MAW, FRANKFURT: MXR, OTCPINK: MWSNF)

Mawson Gold Limited is an exploration and progression company. Mawson has stood out as one of the leading exploration corporations in the northern Arctic with its main allocation of cobalt and Rajapalot gold in Finland, one hundred percent owned, and the right to earn in Skellefteå North’s gold allocation. Mawson also owns 60% of Southern Cross Gold Ltd (ASX: SXG), which in turn owns or controls 3 historic high-grade gold epizonal fields covering 470 km2 in Victoria, Australia.

About Southern Cross Gold Ltd (ASX: SXG)

Southern Cross Gold owns one hundred percent ownership of the Sunday Creek allocation in Victoria and the Mt Isa allocation in Queensland, the Redcastle and Whroo joint ventures in Victoria, Australia, and a 10% strategic interest in Nagambie Resources Limited, listed on ASX (ASX: NAG), which gives Southern Cross a right of first refusal over a 3,300-square-kilometre complex owned by NAG in Victoria.

On behalf of the Council,

Forward-Looking Statement

This press release comprises forward-looking emails or forward-looking data within the meaning of applicable securities legislation (collectively, “forward-looking emails”). All email messages contained in this document, except old fact messages, are forward-looking email messages. Although Mawson believes those expectations are reasonable, he cannot guarantee that those expectations will turn out to be correct. Forward-looking statements are sometimes referred to by words such as: believe, expect, anticipate, intend, estimate, assume and similar expressions, or are those that, by their nature, refer to long-term events. Array Mawson cautions investors that forward-looking statements are not promises of long-term effects or performance, and that actual effects may differ materially from forward-looking statements due to a variety of factors, in addition to Mawson’s expectations in connection with your interest in Southern Cross. The prices of gold, capital and others vary particularly from estimates, adjustments in world metal markets, adjustments in inventory markets, the possible influence of epidemics, pandemics or other public health crises, adding the existing pandemic known as COVID- 19 that affects the Company. business, hazards related to negative exposure to the Company or the mining industry at times; prospective exploration is conceptual in nature, inadequate exploration to delineate a Mineral Resource at the Australian projects held through SXG, and uncertainty as to whether further exploration will result in the determination of a Mineral Resource; planned drilling systems and effects other than expectations, delays in obtaining effects, apparatus failures, unforeseen geological conditions, relations with the local community, relations with non-governmental organizations, delays in operations due to concession permits, environmental and safety hazards, and other hazards and uncertainties disclosed under “Risk Factors” in Mawson’s most recent Annual Information Form filed at www. sedar. com. Any forward-looking statement speaks only as of the date it is made and, except as required by applicable securities legislation, Mawson disclaims any legal purpose or responsibility to update any forward-looking matrix, whether as a result of long-term data or other new data. occasions or effects.

SOURCE: Mawson Gold Limited