Korea Airport Corporation has attracted attention in recent years for its deep interest in operating airports in South America, Ecuador.

But he has also set his sights on the main one in Southeast Asia, where he believes he can add value.

After completing a feasibility examination for the expansion of Laos’ largest airport right now, in its main tourist city, it is now a formal PPP contract with the Lao government.

Laos may have to upgrade its main source of tourists, from China, and one of the potential benefits of a deal with KAC is a derivative economic benefit, which can also inspire Korean corporations to invest in Laos.

Summary

In December 2021, at KAC resumes talks with the Ecuadorian government on Manta Airport (which was a CAPA report on Korea Airport Corporation [KAC] discussions with the Ecuadorian government about airport concessions there), it was discussed that KAC had announced that the Lao Ministry of Planning and Investment had decided that KAC would adopt a feasibility study for the expansion and improvement of Luang Prabang Airport, which would be the first assignment of its kind through a Korean company in Laos.

Located 300 km north of Laos’ capital, Vientiane, in a rural province in north-central Laos, and literally meaning “royal symbol of Buddha”, Luang Prabang was the royal capital of the Kingdom of Laos (until 1975), and 33 of its 58 constituent villages in combination come with the UNESCO World Heritage site Luang Prabang.

In fact, the entire city enjoys WHS status, which is rare. It was classified in 1995 for its exclusive and “remarkably” well-preserved architectural, religious and cultural heritage.

Luang Prabang is the most giant city of the moment in the country after the capital, Vientiane, as well as being the main tourist destination, so the supporting infrastructure (hotels, etc. , tend to be small in length rather than giant hotel chains) is already in place, as well as the location has many attractions. In addition, it has a rich culinary history.

Luang Prabang is a promising tourist destination for package tours in Southeast Asia, along with Siem Reap (Angkor Wat), Myanmar (Old Bagan) and Vietnam (Hue).

In 2019, Vietnam contributed 19% of guest arrivals and China alone 21%, which should be worried about the local economy, as China, once it returns, seems to be “making sure”.

On the other hand, Vietnam’s air transport network is recovering to 2019 levels and, as the graph below shows, there is at least the cornerstone of tourism from Western countries.

Meanwhile, Korea is the fourth largest tourist provider in 2019, but with only 4% of the total. “Trade” between the two countries is said to be increasing.

Tourism turns out to be the mainstay of the economy, it can vary greatly.

For example, in 2016, the number of guests across the country was negatively affected through a competitive marketing crusade through Thailand, which encouraged regional tourists to travel around the country rather than divert to other countries.

Although there are special economic zones in the country, adding in Luang Prabang, industry is not as vital to the overall economy as agriculture, which still accounts for more than 50% of GDP.

The Lao government recently designated the tourism industry as one of the six key responsibilities of the Ninth Five-Year Social Development Plan (2021-2025) and encourages the domestic tourism industry through infrastructure improvement strategies and eco-tourism.

A special zone for tourism is being established.

KAC was allegedly chosen for this feasibility study contract (in cooperation with Dohwa Engineering) founded at its base in South Korea itself, where it operates 14 airports (including the resort island of Jeju, which is the busiest airport at the moment in the country). ).

Although the investigation is only a feasibility study, CAPA speculated at the time that any expansion and upgrade contracts would be expected to be presented to KAC as a first choice if the Lao government was happy with the report.

And that is indeed the case.

On November 17, 2022, KAC showed that it is now the public-private partnership (PPP) contract to expand and put Luang Prabang Airport into operation.

The allocation is valued at approximately KRW two hundred billion (USD 150. 4 million).

KAC presented its progression plan for Luang Prabang Airport at a briefing with representatives of the Lao government. The proposed innovations for the services would cover the runway, taxiway, apron, traffic forecasting, direction progression (especially international), methods for the advent of “smart airports”, advertising of amenities and connecting roads, as well as “the right to operate the airport in the future” – alluding to an attempt to secure a long-concession platform.

In an upcoming press release, KAC described itself as an “incentive” to offload the rights to expand and operate the foreign airport, while “paying attention to the local interest,” possibly meaning making sure visitors’ wishes do not exceed those of the local population.

Hyung-joong Yoon, chief executive officer of Korea Airports Corporation, said, “We will gain the right to run the APP business as a differentiated strategy of the company in line with the regional progression master plan around the airport. “

While KAC operates Luang Prabang Airport, which lately handles 1. 2 million passengers a year, it says it will not only facilitate accessibility between the two countries through the progression of direct links with Korean airports, but also inspire domestic personal corporations to enter overseas markets through public. personal cooperation. It will be able to play a bridging role in exchanges between Laos and Korea.

This is a technique similar to that carried out through KAC in Ecuador, proposing itself as an “open sesame” to industry and commerce. But there it still has to succeed, won a concession contract to operate the Manta airport there, then withdrew it and then was presented with a new offer.

Basic maintenance would be, exceptionally, a facet of KAC’s commitment under any contract.

Airport director Songban Sisopakorn recently complained that “. . . Work at the airport has been in a vacuum for a long time, as air demand has decreased due to the coronavirus. “

Luang Prabang is one of 3 foreign airports in Laos. It is located about 4 kilometers (2. 5 miles) from the city center. The official number of passengers is not accessible, but may be less than 250,000 per year.

The airport went through expansion paints in 2013, when it was modernized and the runway was extended to the existing 2500 m.

Luang Prabang is, or has been in the past, a regional hub for foreign flights to Bangkok, Chiang Mai and Siem Reap and other cities such as Vientiane and Phongsali.

With the airport paralyzed by COVID-19, as is the case in Thailand, capacity recovery only began in the fourth quarter of 2022, and the week that began on November 21, 2022 was only 30% of what was the equivalent week of 2019.

This compares well with, for example, Chiang Mai, a resort town in northern Thailand, where capacity has reached 60% of 2019 levels.

Korea Airport Corporation has attracted attention in recent years for its deep interest in operating airports in South America, Ecuador.

But he has also set his sights on the main one in Southeast Asia, where he believes he can add value.

After completing a feasibility examination for the expansion of Laos’ largest airport right now, in its main tourist city, it is now a formal PPP contract with the Lao government.

Laos may have to upgrade its main source of tourists, from China, and one of the potential benefits of a deal with KAC is a derivative economic benefit, which can also inspire Korean corporations to invest in Laos.

Summary

In December 2021, at KAC resumes talks with the Ecuadorian government on Manta Airport (which was a CAPA report on Korea Airport Corporation [KAC] discussions with the Ecuadorian government about airport concessions there), it was discussed that KAC had announced that the Lao Ministry of Planning and Investment had decided that KAC would adopt a feasibility study for the expansion and improvement of Luang Prabang Airport, which would be the first assignment of its kind through a Korean company in Laos.

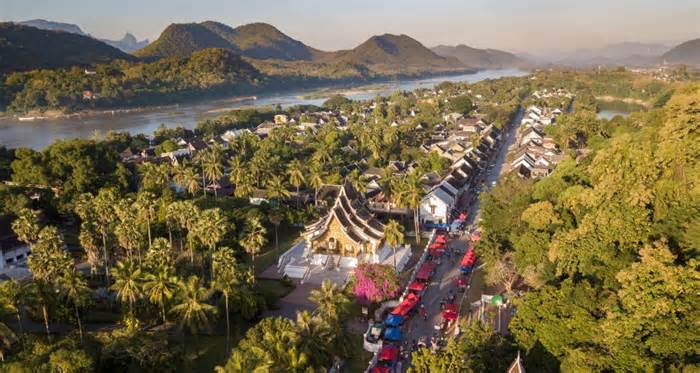

Located 300 km north of Laos’ capital, Vientiane, in a rural province in north-central Laos, and literally meaning “royal symbol of Buddha”, Luang Prabang was the royal capital of the Kingdom of Laos (until 1975), and 33 of its 58 constituent villages in combination come with the UNESCO World Heritage site Luang Prabang.

In fact, the entire city enjoys WHS status, which is rare. It was classified in 1995 for its exclusive and “remarkably” well-preserved architectural, religious and cultural heritage.

Location of Luang Prabang, Laos

Source: Google Maps.

Luang Prabang is the most giant city of the moment in the country after the capital, Vientiane, as well as being the main tourist destination, so the supporting infrastructure (hotels, etc. , tend to be small in length rather than giant hotel chains) is already in place, as well as the location has many attractions. In addition, it has a rich culinary history.

Luang Prabang is a promising tourist destination for package tours in Southeast Asia, along with Siem Reap (Angkor Wat), Myanmar (Old Bagan) and Vietnam (Hue).

In 2019, Vietnam contributed 19% of guest arrivals and China alone 21%, which should be worried about the local economy, as China, once it returns, seems to be “making sure”.

On the other hand, Vietnam’s air transport network is recovering to 2019 levels and, as the graph below shows, there is at least the cornerstone of tourism from Western countries.

Meanwhile, Korea is the fourth largest tourist provider in 2019, but with only 4% of the total. “Trade” between the two countries is said to be increasing.

Laos: Guest arrivals through the market for 2019

Source: CAPA – Lao Aviation and Tourism Development Centre.

Tourism turns out to be the mainstay of the economy, it can vary greatly.

For example, in 2016, the number of guests across the country was negatively affected through a competitive marketing crusade through Thailand, which encouraged regional tourists to travel around the country rather than divert to other countries.

Although there are special economic zones in the country, adding in Luang Prabang, industry is not as vital to the overall economy as agriculture, which still accounts for more than 50% of GDP.

The Lao government recently designated the tourism industry as one of the six key responsibilities of the Ninth Five-Year Social Development Plan (2021-2025) and encourages the domestic tourism industry through infrastructure improvement strategies and eco-tourism.

A special zone for tourism is being established.

KAC was allegedly chosen for this feasibility study contract (in cooperation with Dohwa Engineering) founded at its base in South Korea itself, where it operates 14 airports (including the resort island of Jeju, which is the busiest airport at the moment in the country). ).

KAC Airports in Korea

Source: CAPA – Centre de l’Aviation.

Although the investigation is only a feasibility study, CAPA speculated at the time that any expansion and upgrade contracts would be expected to be presented to KAC as a first choice if the Lao government was happy with the report.

And that is indeed the case.

On November 17, 2022, KAC showed that it is now the public-private partnership (PPP) contract to expand and put Luang Prabang Airport into operation.

The allocation is valued at approximately KRW two hundred billion (USD 150. 4 million).

KAC presented its progression plan for Luang Prabang Airport at a briefing with representatives of the Lao government. The proposed innovations for the services would cover the runway, taxiway, apron, traffic forecasting, direction progression (especially international), methods for the advent of “smart airports”, advertising of amenities and connecting roads, as well as “the right to operate the airport in the future” – alluding to an attempt to secure a long-concession platform.

In an upcoming press release, KAC described itself as an “incentive” to offload the rights to expand and operate the foreign airport, while “paying attention to the local interest,” possibly meaning making sure visitors’ wishes do not exceed those of the local population.

Hyung-joong Yoon, chief executive officer of Korea Airports Corporation, said, “We will gain the right to run the APP business as a differentiated strategy of the company in line with the regional progression master plan around the airport. “

While KAC operates Luang Prabang Airport, which lately handles 1. 2 million passengers a year, it says it will not only facilitate accessibility between the two countries through the progression of direct links with Korean airports, but also inspire domestic personal corporations to enter overseas markets through public. personal cooperation. It will be able to play a bridging role in exchanges between Laos and Korea.

This is similar to the technique carried out through KAC in Ecuador, proposing itself as an “open sesame” to industry and commerce. a new offer is submitted.

Basic maintenance would be, exceptionally, a facet of KAC’s commitment under any contract.

Airport director Songban Sisopakorn recently complained that “. . . Work at the airport has been in a vacuum for a long time, as air demand has decreased due to the coronavirus. “

Luang Prabang is one of 3 foreign airports in Laos. It is located about 4 kilometers (2. 5 miles) from the city center. The official number of passengers is not accessible, but may be less than 250,000 per year.

The airport went through expansion paints in 2013, when it was modernized and the runway was extended to the existing 2500 m.

Luang Prabang is, or has been in the past, a regional hub for foreign flights to Bangkok, Chiang Mai and Siem Reap and other cities such as Vientiane and Phongsali.

Luang Prabang Airport: map of the week of November 28, 2022

Source: CAPA – Aviation Center and OAG.

With the airport paralyzed by COVID-19, as is the case in Thailand, capacity recovery only began in the fourth quarter of 2022, and the week that began on November 21, 2022 was only 30% of what was the equivalent week of 2019.

This compares well with, for example, Chiang Mai, a resort town in northern Thailand, where capacity has reached 60% of 2019 levels.