n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Japan’s wage expansion showed fresh signs of strengthening in September, a progression that will be closely watched by the central bank as it looks for new evidence of higher wages that can solidify inflation before tapering stimulus.

Most on Bloomberg

WeWork Goes Bankrupt and Signs Deal with Creditors to Reduce Debt

Trump’s Testimony Criticized as ‘Record-Breaking’ by Judge: Trial Update

Latest news from Israel: Netanyahu sees a role in Gaza’s security after the war

Trump Screams at Sentencing and Lawyers on a Wild Day on the Witness Stand

Stocks Fluctuate After ‘Fast & Furious’ Rally as Markets Retreat

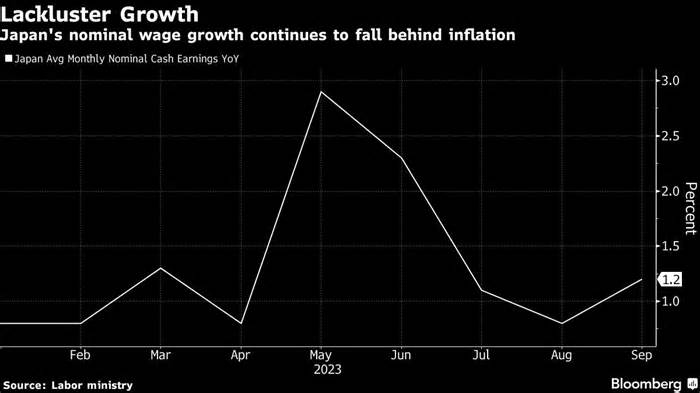

Workers’ nominal money income rose 1. 2% from a year earlier, an acceleration from the revised 0. 8% increase in August, largely due to the increase in the base salary, the Labor Ministry said on Tuesday. Japan’s governor, Kazuo Ueda, showed on Monday that the base salary of normal staff rose 2. 2%, the highest figure for a solid pattern dating back to 2016.

However, real wages continued to fall for the eighteenth month, contributing to the fall in household spending in September.

As the wage trend continues to improve, the central bank will most likely wait for more signs that a virtuous cycle between wages and costs is emerging, before embarking on primary adjustments in its policy stance. This is a resolution that top economists expect early next year. .

“This is a continuation of a bigger-than-expected trend and will be very encouraging for the Bank of Japan governor,” said Kohei Okazaki, senior economist at Nomura Securities Co. The current labor shortage will be a catalyst for additional wage increases, he said. aggregate.

Last week, the central bank further loosened its grip on 10-year yields, abandoning its commitment to buy bonds at a constant rate of 1% each day and doubling the benchmark of its yield cap. In a small step toward normalization, Governor Ueda remained cautious at the press conference following the decision, reaffirming the bank’s commitment to patiently pursue financial easing.

In his comments on Monday, Ueda downplayed the likelihood that the Bank of Japan will exit its negative interest rate before the end of the year, but speculation continues that it may still act before the first effects of wage negotiations in the spring are seen.

“If you need to check the collected effects very well, it will probably be in April,” said Yoshiki Shinke, senior economist at Dai-Ichi Life Research Institute, referring to the timing of the Bank of Japan’s end negative rates and bond yields. But if there are enough signs that corporations are willing to raise wages, the bank could act sooner, he added.

“Given the mood at the time, I don’t think that would be the case if they moved in January,” he said.

Positive progress is already being made with wage negotiations due to culminate in the spring. Rengo, the country’s largest industrial union federation, has demanded higher wage increases, while the country’s largest business lobby, Keidanren, is reportedly pushing to raise the base wage.

Some companies, including Meiji Yasuda Life Insurance Co. and Suntory Holdings Ltd. , announced ambitious wage expansion targets of up to 7%, according to media reports.

What Bloomberg Economics says. . .

“Beyond October, we expect wage expansion to remain robust for at least several months. However, risks are receding, as weak external demand, particularly in China, may simply weigh on the economy, prompting companies to raise wages.

— Taro Kimura, economist

For the full report, click here

Although Tuesday’s data showed an acceleration in wage growth, this is arguably still not enough for the BoJ, given that nominal wage increases of 3% have been discussed in the past as a necessary point to generate solid 2% inflation.

Real monetary earnings fell 2. 4% from a year earlier as price increases remained stronger than the central bank’s initial assumption. Inflation in Tokyo heated up further in October, underscoring the patience of upward pressure on prices.

Rising costs have undermined consumers’ purchasing power. Japanese households cut spending in September by 2. 8% from a year earlier, with spending up 0. 3% from last month.

Prime Minister Fumio Kishida is looking to boost consumption amid emerging costs with a larger-than-expected economic stimulus package announced last week.

The plan, which totals more than 17 trillion yen ($114 billion), includes measures such as tax cuts on the source of income and cash distributions to low-income households. It is expected to boost the economy by 1. 2% annually over the next few years. 3 years, with a global contribution of 19 trillion yen to the economy, according to the company’s calculations.

Still, those efforts didn’t contribute to Kishida’s popularity. Support for the prime minister hit a new low in a primary region, falling below a point seen as a danger zone for prime ministers, and respondents indicated they did not believe in his new economic policy. stimulus package.

–With those of Toru Fujioka and Keiko Ujikane.

(Economist updates, more details)

Most read Bloomberg Businessweek

Elon Musk’s brain implant startup is about to start cutting itself off

Top-Ranked MBA Programs Struggle to Reverse Declining Applications

In Uruguay, a tax haven with beaches and low crime

Private equity is courting a growing class of mini-millionaires

Who is in a position for a rematch between Trump and Biden?Hello?

©2023 Bloomberg L. P.