\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

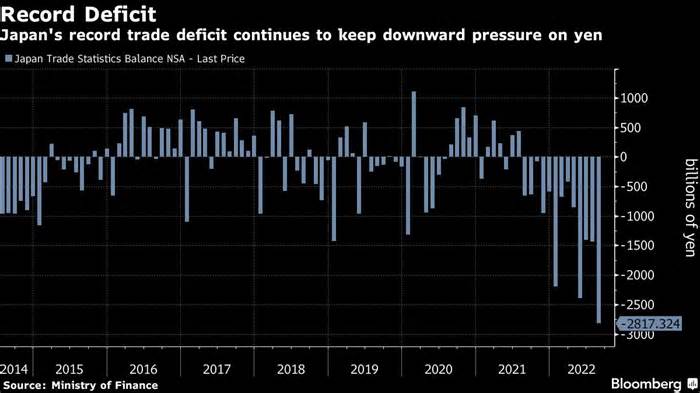

(Bloomberg) — Japan’s industry deficit hit a record high in August, underscoring the growing pain of yen weakness as import prices soar, adding to the strain on the country’s economic recovery.

Most read from Bloomberg

Terra co-founder Do Kwon faces arrest warrant in South Korea

New York Judges Anyone Who Doesn’t Tolerate “Nonsense” Can Be Named Special Teacher in Trump Case

Stocks as buyers fall get a tug-of-war opposite to the Fed: Markets close

U. S. inflation U. S. U. S. exceeds expectations, cementing the possibility of a big Fed surge.

Ray Dalio does the math: rates at 4. 5% would reduce stocks by 20%

The unadjusted industry deficit reached 2. 82 trillion yen ($19. 7 billion) last month, the Finance Ministry said Thursday. The hole is much larger than economists’ estimates and extends the red series to thirteen months, the longest era since 2015.

Imports rose 49. 9% in terms of a year ago, reaching a record high, driven by crude oil, coal and liquefied herbarium gas. Exports increased by about part of this rate, helped by a continued recovery in car shipments. Compared to last month, the movements were much more moderate, with exports falling by 0. 7% while imports rose by 1. 5%.

The record industry’s deficit adds to considerations about Japan’s solid economic recovery, as higher energy and food import expenditures can reduce consumption. A weaker yen fuels the deficit by making incoming shipments more expensive, and paying for those goods in yen also increases pressure on the Japanese currency.

The impact of emerging import prices on customers is being closely watched by policymakers, as Japan’s economy returned to its pre-pandemic period earlier this year, largely thanks to a rebound in domestic customer spending.

“The effect of the weak yen is another for businesses and families,” said Taro Saito, head of economic studies at the NLI Research Institute. “It’s helping companies export and increase their overseas sales in dollars, while families see their genuine profits fall. “

What Bloomberg Economics says. . .

“Looking ahead, we expect the industry deficit to widen in September. Falling yen is likely to inflate the import bill, while weak global demand will constrain export growth.

— Yuki Masujima, economist

For the full report, click here

So far, Prime Minister Fumio Kishida has put in place fiscal spending measures to enable families and businesses to cope with inflation. But as wage increases continue to keep pace with inflation, emerging import prices may continue to weigh on household purchasing power.

The industry report showed that the average exchange rate was 135. 08 yen against the dollar, down 22. 9% from a year ago. The yen has continued to fall against the dollar this year as the U. S. Federal Reserve continues to fall against the dollar. the Bank of Japan helps keep them at ground level.

This other position was affected on Wednesday when the yen weakened sharply in the face of higher-than-expected inflation figures in the United States. The move prompted a rare BOJ type check that reinforced warnings of an intervention imaginable through Finance Minister Shunichi Suzuki.

Read more: The yen rises before the precursor of the BOJ intervention

Meanwhile, exports appear to be slowing for a month now, suggesting that expansion is already slowing in Japan’s major markets, adding the United States and Europe. Central banks around the world continue their fight against inflation, raising rates even at the expense of economic expansion.

In addition to currency influence, global commodity price inflation has boosted the price of the industry this year. Imports and exports increased by 22. 1% and 49. 9% respectively in price, while they fell slightly in volume, meaning that true industrial activity is largely unreplaced.

“Recently, exports are not expanding much in volume, even though the yen is falling,” NLI’s Saito said. “

(Updates with more main points of the report, comments from economists)

Most read from Bloomberg Businessweek

Ethereum merger raises stakes and reshapes the crypto universe

Chinese Brands Circumvent U. S. Price Lists with Help from Mexico

Administrative jobs are in the next recession

A dubious truck, an army of incompetent whistleblowers and spies: in nikola’s very saga

Tesla Autopilot Test

©2022 Bloomberg L. P.