n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Japan’s 3pl Pharmaceutical Market Volume Share of Generic Drugs in the Field

Dublin, March 22, 2024 (GLOBE NEWSWIRE) – Japan’s Pharmaceutical 3PL: Market Share Analysis and Industry Trends

Reflexes

The pharmaceutical industry’s third-party logistics market is developing as more and more people are willing to use online delivery services. This trend has led to a growing demand for third-party logistics solutions. Japan is the leading force in the third-largest independent pharmaceutical logistics market, with the government providing incentives. The Japan Pharmaceuticals and Medical Devices Agency, in partnership with Japan’s Ministry of Health, Labor and Welfare and pharmaceutical companies, has created a platform for online data sharing and patient consultation services.

The demand for temperature-controlled logistics to ship biologics across foreign borders and the expansion of biopharmaceutical companies’ distribution networks to drive sales are driving the market expansion. This serves as motivation. Pharmaceutical logistics organizations have detected a massive increase in the use of automated storage and retrieval systems in emerging countries. By restricting supply disruptions and prioritizing must-have treatments, key market players have played a vital role in the fight against COVID-19. .

For example, Nippon Express has the WHO popular GDP certification for the East Japan Pharmaceutical Center in Kuki, Saitama Prefecture. This is because it has a garage and transit with two temperature zones to meet the demand for high-quality logistics. Popular GDP certification from the WHO (World Health Organization) for the storage and shipment of medicines in two temperature zones (ambient temperature: 15-25°C, cold room: 2-8°C).

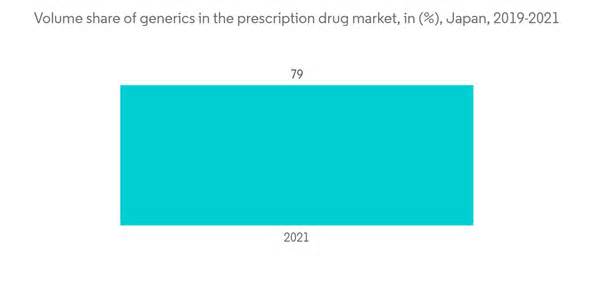

3PL Pharmaceutical Market Trends in Japan The Generic Drug Market placeplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplace. Developing in the countryThe generic drug marketplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplaceplace. Japanese generics are now one of the fastest developing segments of the pharmaceutical industry as increasing life expectancies and an aging population push existing suppliers to seek new solutions. Japan is a country known for its superior generation and strong competition in the market. Fitness spending per capita is also among the highest in the world. Comparing Japan to other evolved markets such as the United States and the European Union, generic drug penetration has traditionally been lower in Japan. However, since the beginning of the century, the number of people taking generic medications has increased due to a change in government policy. In reaction to the country’s aging population and the growing burden of brand-name drugs, the government passed a law aimed at cutting medical expenses. spend and move money from reasonably priced generics to cutting edge products. In September 2020, the government set a generic drug penetration target of 80%, although it has only achieved around 2% of this target. In the Japanese prescription drug market, as of September 2021, generics maintained a constant percentage of approximately 79%. Generics were a smart market for corporations and Americans looking for brand-name drugs at reasonable prices. By manufacturing generic versions of more expensive brands, pharmaceutical corporations attempted to make them taste, look, smell, and even feel like the more expensive brands. These copied versions were named after the most popular drug names from major manufacturers, so consumers may barely notice the difference between a generic countercomponent and its brand name. Pharmaceutical imports are developing in the country. Japan is an export market for American pharmaceuticals and the third largest pharmaceutical market. in the world. The physical care sector has been placed on the market through the Government of Japan (“GOJ”) since 2013 as an expansion engine as a component of the country’s economic expansion and recovery strategy. The Japanese pharmaceutical industry, like the fitness sector, has recently sparked new interest. This increased interest in Japan’s fitness sector is partly due to the COVID-19 pandemic, which has put a spotlight on the price of cutting-edge fitness products. The desire to strengthen the drug discovery environment in Japan is another important factor driving interest in the country’s pharmaceutical industry. About 20% of all pharmaceutical imports from Japan consist of American products, including those manufactured locally through American corporations and those that have been licensed to Japanese producers. Until 2025, the pharmaceutical market in Japan is expected to contract at a rate of 0. 2. -1. 2% year-on-year, while the global pharmaceutical market is expected to grow 4. 4%. The concomitant decline in Japan’s off-patent drug market is one of the things contributing to the expected decline of the country’s pharmaceutical sector. However, the Japanese market for patented medicines, where products from American corporations shine, is expected to continue growing in this same period. For more information on this report, please visit https://www. researchandmarketplaceplaceplaceplaceplaceplaceplaces. com/r/sqiib2

About ResearchAndMarkets. com ResearchAndMarkets. com is the world’s leading source for foreign market research and market knowledge reports. We provide you with the latest knowledge on foreign and regional markets, key industries, larger companies, new products, and the latest trends.

Attached

Japan’s 3pl Pharmaceutical Market Volume Share of Generic Drugs in the Field