\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

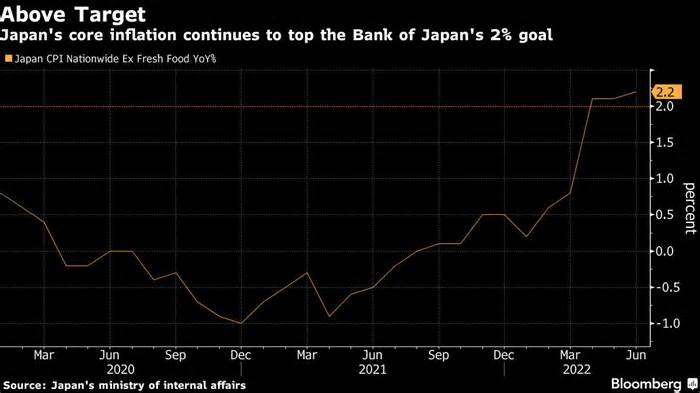

Japan’s top inflation gauge has still exceeded the Bank of Japan’s 2% target, an outcome that will likely remain a hypothesis about imaginable policy changes at the central bank despite Gov. Haruhiko Kuroda’s continued commitment to ultra-low rates.

Most read from Bloomberg

Americans who can’t afford a home move to Europe

Lieutenant Musk tested from an internal investigation into Tesla’s purchases

These are the toughest (and least) passports in the world in 2022

Biden hires Covid as resistance to the pandemic

Former Coinbase Director Arrested in U. S. Cryptocurrency Insider Trading CaseUSA

Consumer prices of new foods rose at a faster rate of 2. 2% in June compared to a year earlier, and energy costs rose due to a weaker yen and higher costs of processed foods were the main contributors, according to Interior Ministry data released Friday.

The result was in line with economists’ estimates and would have been more potent without the effect of strengthened government measures to restrict gains in the price of fuel.

Despite continued gains in value, the BOJ is unlikely to leave its atypical position among global central banks anytime soon. Even as the Federal Reserve raises rates massively to fight inflation and the European Central Bank joins the wave of global policy tightening with its first rate hike in more than a decade, the BOJ remains convinced that local inflation is sustainable.

Still, ongoing gains above the value target pose a communication challenge for the BOJ. The central bank’s continued easing has come under fire as it has helped the yen fall to its lowest point in 24 years against the dollar, amplifying the rise in food and energy. import prices for households.

“What is going down in Japan is still the charge inflation, not the sustainable inflation that the BOJ seeks, supported through wage gains,” said Taro Saito, head of economic studies at the NLI Research Institute. Not emerging much Today’s knowledge will not make the BOJ reconsider its point of view.

The main points of June inflation know to some extent the BOJ’s argument that existing inflation is largely based on pressure from charges. Energy prices were once again the main driving force behind the increase, up 16. 5% from last year. Quarters of a percentage point to headline inflation, which helped boost the figure in June.

New food and energy prices rose 1%, the biggest increase since February 2016.

The central bank on Thursday released its latest inflation projections after its resolve to keep interest rates at lows. The BOJ now forecasts average core inflation of 2. 3% in the year ending in March, the first time it has forecast value gains above 2% for the existing 12-month period outside of years of tax increases since the target was set in 2013.

But then it sees inflation weakening below its target next year, a sign that sufficient value gains probably won’t last.

After Thursday’s decision, Kuroda said he had “no intention” of raising interest rates while the economy still needed to and value gains were not backed up by steep wage increases. the changes would fail to prevent the weakness of the yen.

As the central bank clings to its position, the government has stepped in to ease the pain of rising electricity and food prices.

After this month’s election victory, Prime Minister Fumio Kishida promised more measures to restrict value increases to customers and businesses. The government estimates that existing measures, which include gas subsidies, reduce the overall value of customers by 0. 5% from May to September. The headline CPI rose 2. 4% in June.

Finance Minister Shunichi Suzuki said on Friday that the government was tracking the imaginable negative effects of emerging costs on the economy, such as reducing the purchasing power of families.

What Bloomberg Economics says. . .

“We expect core inflation to hover around 2% for the remainder of 2022. Currency weakness keeps the burden on imported goods high, while government subsidies to limit gasoline tariffs keep inflation from rising. “

— Yuki Masujima, economist

For the full report, click here

Kishida also called for higher wage increases as part of his efforts to achieve a more equitable distribution of wealth. But wage increases fail to keep up with inflation, and May’s figure looks like a 1. 8% drop in real wages from last year.

(Adds finance minister Suzuki. )

Most read from Bloomberg Businessweek

Sam Bankman-Fried Turns $2 Trillion Crypto Path into a Buying Opportunity

USA. The U. S. has lost control of PC chips

Post-mortem sperm extraction turns men into fathers

Mortgage boycott how deep China’s housing crisis is

Brain-computer interface start-up implants the first in an American patient

©2022 Bloomberg L. P.