\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) – Subscribe to the New Economy Daily newsletter, use @economics and subscribe to our podcast.

Most read from Bloomberg

Americans who can’t afford a home move to Europe

These are the toughest (and least) passports in the world in 2022

Kissinger warns Biden that he opposes an endless relationship with China

Ford plans up to 8,000 task cuts to fund investment in electric vehicles

Putin that the pipeline will restart as the clock ticks

The Bank of Japan has raised its value forecast more than expected in a move that will remain the hypothesis of a possible policy update after leaving its lower interest rates unchanged.

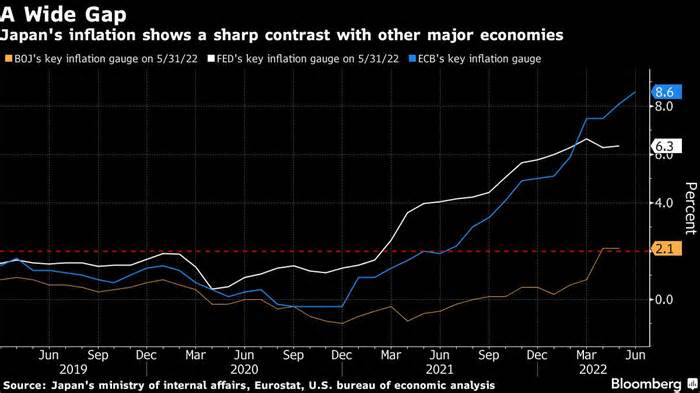

Standing, the BOJ is expected to hold the latest rate among major evolved economies later on Thursday, assuming the European Central Bank makes its first hike in more than a decade, as is sometimes expected.

Recent fears that the global economy will be a tough landing as central banks scramble to fight inflation have helped ease market tension on the BOJ, with fewer speculative bets opposed to the yen and Japanese bonds.

This left Governor Haruhiko Kuroda with the possibility of continuing with a short-term interest rate of -0. 1% and a 0. 25% cap on 10-year yields, even if this mix contributes to the yen’s weakness.

Still, tension between the BOJ’s policy stance and the market is expected to resume if fears of a global recession are dispelled.

Kuroda watches the bets in the market for BOJ Pivot his mandate

“While the BOJ has shown no signs of any progress toward tightening in the near term, its new inflation forecasts are more potent than the market outlook,” said Nobuyasu Atago, lead economist at Ichiyoshi Securities Co and former head of the BOJ’s value statistics division.

“This is confusing because the BOJ wants to know that by releasing those higher forecasts, the hypothesis about policy replacement will not go away,” he added.

The Japanese currency remained largely unchanged around 138. 20 against the dollar after fluctuating without delay following the BOJ’s decision. Last week it set a new 24-year low at 139. 39. The lack of movement suggests that investors did not see a sufficiently transparent transaction based on the most recent decision.

Still, the currency is not far from the 140 point against the dollar that would most likely revive the hypothesis about imaginable government intervention, although the likelihood of such action would possibly still be limited.

Japan’s central bank continues to act too temporarily to raise rates and hit the economy as it has in the past.

It now forecasts average inflation of 2. 3% for the year ending in March. That’s still a far cry from some of the rampant price growth abroad, but it’s the first time the BOJ has expected price gains above its 2% target point for existing ones. year, unless it has an effect on sales tax increases.

It then sees momentum slow, justifying further easing to achieve sustainable inflation. His view that the recovery will be slower than expected this year also supports this thesis and highlights in part the impact of the blockades on China and most of it. it is likely to have an effect on emerging energy consumption and food prices.

To some observers, the combination of a favorable value forecast and an unfavorable growth outlook seems like a typical central bank hedge to keep its characteristics open. If the global economy had a primary slowdown, then stocks could continue to grow at a steady pace. .

According to Tim Baker, director of macroeconomic studies at Deutsche Bank AG in Sydney, the Reserve Bank of Australia must wait too long to achieve an inflation target.

“Both the RBA and boJ have spent many years underestimating the target and will most likely remain accommodative for too long just because they need to be sure that inflation is rising sustainably. “

A prolonged onslaught by speculators on the Down Under bond market and a rise in inflation led the RBA to abandon its target of controlling the yield curve at the end of last year, as a result of which the BOJ is well aware.

Japan’s central bank also said it would continue to offer to buy an unlimited amount of bonds at a constant rate on a daily basis, underscoring its determination to protect its own YCC framework. Last month, it was forced to buy a record amount of bonds to preserve its yield cap.

It was the first political assembly since the shocking killing of former Prime Minister Shinzo Abe, who chose Kuroda to head the bank and allowed him to become the longest-serving governor in the BOJ.

Some economists, adding Hiroaki Muto of Sumitomo Life Insurance, argue that the death would possibly have strengthened Kuroda’s resolve to stick to relaxation as he seeks to continue Abenomics’ legacy in which he is a key player.

Prime Minister Fumio Kishida’s resounding victory in a key national election earlier this month also removed a potential source of tension to replace for the time being. family suffering caused by the higher charge of living.

The BOJ’s continued retention trend and penchant for further easing show that it is still ready to threaten further yen weakening and further attacks on its yield ceiling as it pursues its target of stable expansion with sustained inflation.

In addition to the rearguard action to fend off speculators, a clearer signal of the upcoming policy update would emerge with clearer symptoms of sustained value growth.

“The BOJ concluded that while it sees some corporations passing on value pressures to consumers, there is still momentum to keep inflation above 2% sustainably,” said Harumi Taguchi, senior economist at S.

(Add an economist’s comment and more main points from the statement)

Most read from Bloomberg Businessweek

Sam Bankman-Fried Turns $2 Trillion Crypto Path into a Buying Opportunity

Post-mortem sperm extraction turns men into fathers

Brain-computer interface start-up implants the first in an American patient

Mortgage boycott how deep China’s housing crisis is

JD Vance would possibly want Peter Thiel’s rescue

©2022 Bloomberg L. P.