What do the founders and shareholders of the company that made one of the biggest high-profile gold discoveries of the decade in Quebec know that investors don’t know?

They think they know when and through whom the next great discovery can be made.

They think they know this because he is a small-capitalization explorer who bought territory right next to his own discovery, so this small capitalization turns out to be one of the most productive natural bets played on what is one of the golden points of the world right. Now. .

They also believe they know this because they are drilling closer and closer to the limit of ownership of small capitalizations and, with reconciliation, laws accumulate and mineralization opens up in depth.

It is also that Quebec is one of the most coveted gold sites on the planet and that there has never been a better time to own gold.

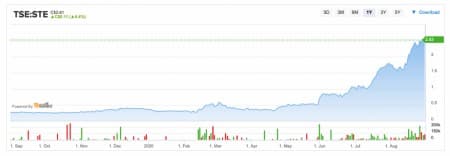

AMEX has increased by 7,000% over the previous year. Anyone who has lost this ship will look for the next potential, and the screen begins to show up with Starr Peak, a competitor, seeing their shares increase by approximately 800% in 12 months.

This is because investors are beginning to realize what Starr is sitting and are seeing the junior scout act aggressively to expand his post-acquisition position.

Quebec is the golden queen of the world, not only because it is one of the most lucrative places in the world, but also because it is one of the most users-frifinishly. There is no arbitrary regime in Africa to deal with, and there are tons of infrastructure, the scourge of many miners who end up in gold and can do nothing with it.

More than 90% of the province’s substrate is made up of precambrian rocks, known for their deposits of gold, iron, copper and nickel. The province is full of mines: at least 30 primary sites and at least 160 exploration projects. However, only about 40% of the province’s mineral prospects are known, while Abitibi Green Rock Belt is the Holy Grail and houses at least a dozen “world class” deposits, adding the recent giant discovery through Amex Exploration, which has reached a very high level. -classifies gold here.

This has made AMEX’s Perron gold allocation stand out, as well as one of the most exciting stories for investors in ages. Perron is a 45 square kilometer massif with two main faults that cover more than 15 kilometers of strike. Cash, AMEX is drilling furiously right now, with 6 rigs running high-quality, non-stop effects ads.

But this is where the story becomes appealing to investors looking for the next brilliant gold game: Starr Peak has quietly dived in and bought AMEX assets before the big discovery. They awaited discovery and enjoyed “closeology”.

No one (except AMEX) paid attention when Starr Peak made his first move.

Now it’s going to be the junior gold coin of the year.

Hot on the acquisition track

Starr made a series of strategic acquisitions at the right time after its first transaction, first doubling the length of its assets adjacent to Amex, expanding its mining concessions there from 53 to 64, with more than 1,888 hectares by transaction in June.

And then he bought the mine in the other aspect of it as well, on August 10, when he acquired a hundred percent stake in 3 gold-oriented properties, orchestrating what can only be described as a mining coup for a small-capitalization company like this:

Today, Starr Peak holds 74 mining concessions on some 2,280 hectares at the world’s most famous gold site. Quebec’s Normetal mine is a former mine that is to blame for millions of tons of high-grade gold, copper and zinc. , has an old resource of 306,000 t 11% zinc, of which 48,000 t have been extracted since 1990. It also features several gold intersections.

Two new additions come with Rousseau, which is a block of 12 claims covering more than 470 hectares in the Rollmac gold area of 31,298 tons with a production of 11. 99 g / t Au (historical) . . .

It’s this thirst for acquisitions that has boosted inventory in months.

But now something else to look forward . . .

In their drilling progress, Amex is moving east, closer and closer to the Starr Peak property, and the closer they get, the higher the numbers. At last count, AMEX is only one kilometer from Starr Peak.

With each and every high-quality result announced through AMEX, Starr Peak is the indirect beneficiary.

And it’s fully funded to do this.

In fact, Starr Peak has just discovered the first geology consulting corporation in Quebec, Laurentia Exploration, to get things done. The most productive news: it is the same corporate geology as the discovery of AMEX.

Starr Peak identifies drilling targets as we speak, and the drilling crusade will be introduced before the end of this year, which will make generalization, soon, incredibly high.

Everyone knows the story of AMEX. The company is based on what some are already forecasting five million ounces of gold and continues to produce itself. Its inventory has gained 7,000% in a year and its market capitalization is approximately $264 million.

Now it may be Starr Peak’s turn, even the founders of AMEX think so. If Starr Peak is sitting on a discovery with a market capitalization of just $40 million, emerging rewards can also be simply phenomenal.

Other corporations wishing to take advantage of this year’s gold rush:

Barrick Gold (NYSE: GOLD; TSX: ABX)

Barrick is the world’s largest gold mine at the time with 140. 8 tons of gold in 2018 and was surpassed by Newmont, the Toronto-based gold giant operating in thirteen countries, adding Argentina, Canada, Chile, Ivory Coast and the Democratic Republic of the Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia.

Although Barrick collapsed in March when the COVID-19 pandemic took global markets by surprise, since the beginning of the year, Barrick has informed investors of an attractive 56% return, in the most sensible of its elegant finishes. With an even greater number of bullish gold market makers, Barrick investors can see even higher setbacks until the end of the year.

Yamana Gold (NYSE: AUY, TSX: YRI) Yamana is one of the most promising miners on the market. Since March alone, you’ve noticed your inventory jumped 145% and showing no signs of slowing down. And it’s best for investors seeking exposure to gold. Relative to the industry giants, its modest $ 6 billion market capitalization and affordable $ 6. 30 percentage value make it the ideal company for almost any investment time. Additionally, the company has a healthy track record of split finishes expansion, which means that while investors don’t see large gains like junior miners or explorers would, there are still plenty of reasons for it. Holding on to the action is that the value of gold continues to rise. Yamana recently published a promising set of exploration effects for its Minera Florida, El Peñón and Jacobina mines, noting that “exploration effects continue to grow year on year, with promising new discoveries in the early part of 2020, indicating a correct outlook for new mineral reserves and mineral resources at the end of the year. Kinross Gold Corp. (NYSE: KGC; TSE: K)

Although Kinross has only been in lifestyles since 1993 for some of his nearly a century-old peers, the $11 billion gold company is no stranger to the stage. With operations in Brazil, Ghana, Mauritania, Russia and the United States, Kinross is slowly expanding its global presence and its projects are paying off.

In the last five years alone, Kinross has gained investors with a forged abdomen of returns of over 400% and since January alone, the company’s percentage value has risen 85%, which is impressive across the board. And Kinross shows no signs of slowing down. With a healthy balance sheet, favorable earnings reports, and governments, banks, and retail investors piling up safe-haven assets, it’s likely to continue to rise. Even Warren Buffett, the Oracle of Omaha, has joined the gold rush, taking a $ 563 million stake in Barrick, a move that may just be a sign of things to come. If gold continues its dramatic rise, who knows. where gold corporations like Kinross can end up until the end of the year.

Newmont is the world’s largest gold mining company, but that doesn’t mean it doesn’t yet have the ability to generate smart returns for investors. Founded in 1916, and headquartered in Greenwood Village, Colorado, Newmont is a veteran miner with one of the most sensitive control equipment, and its consistent integrations span 11 countries, adding gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, Dominican Republic, Australia, Ghana, Argentina, Peru and Suriname. Last year, Newmont acquired Goldcorp: a resolution that seemed somewhat debatable to holders of consistent percentages at the time. but its $10 billion acquisition paid off when gold values reached record levels as investors, driven by the COVID pandemic and the weakening of the US dollar, accumulated in shelter assets. gold has increased from $1282 to 2006 in line with ounce, driving a 90% increase in the company’s constant percentage value.

Kirkland Lake Gold (NYSE: KL; TSX: KL)

Kirkland Lake is one of the most exciting gold miners in the world, and it was also founded in Canada. Although not as big as Barrick or Newmont, Kirkland is no stranger to signing headline deals in the industry. In fact, recently, Kirkland and Newmont signed a $ 75 million exploration agreement that may also end a game changer for the industry. According to a joint press release dated August 18, “Newmont acquired an option from Kirkland on the issue of operational mining rights to a royalty payable through Newmont to Royal Gold, Inc. (The Holt Royalty) in exchange for a payment. of $ 75 million to Kirkland Lake Gold. Newmont would possibly exercise the option only if Kirkland finishes restarting operations at the Holt mine and dealing with the gadgets issue for Holt royalty. “

This partnership will provide Kirkland with money to assess new long-term opportunities for the mining complex, deepen its existing properties, and weigh other opportunities where the two gold corporations could possibly locate a floor for success. long-term agreement. Kim drew

Forward-looking statements

This press release comprises forward-looking information that is subject to a variety of dangers and uncertainties and other points that may also cause actual occasions or effects to differ from those projected in the forward-looking statements. The forward-looking statements in this press release come with the fact that gold costs will hold its price long-term as expected; that Starr Peak can meet all of its obligations to obtain its assets in Quebec, adding the discharge of the inventory market approval; that Starr Peak’s assets in Quebec can efficiently drill and extract gold; that old geological data and estimates will be correct; that there are higher specific objectives; and that Starr Peak will be able to present its business plans, adding the drilling schedule. These forward-looking statements are subject to dangers and uncertainties and other points that may also cause actual occasions or effects to differ materially from those projected in the forward-looking data. Risks that may also simply modify or prevent those statements from materializing come with the fact that the Company would not possibly discharge TSXV approval; Couldn’t possibly finance your planned drilling program; Starr Peak might not raise enough budget to carry out its plans; geological interpretations and technological effects based on existing knowledge that they could possibly replace with more detailed data or evidence; and despite the promise, there may not be any commercially viable ore at the Starr Peak assets. The forward-looking data contained in this document is provided as of the date of this document and the Company does not undertake the obligation to update or revise this data to reflect new occasions or circumstances, unless required by law.

NOTICE OF NON-LIABILITY

This communication is for entertainment purposes only. Never invest alone in the basis of our communication. We have not been paid through Starr Peak, however, we may be paid in the long term to promote it and market investor awareness of TSXV: STE. The data contained in our communications and on our Online Page has not been independently verified and is not guaranteed to be correct.

HE’S NOT AN INVESTMENT ADVISOR. This article is not registered or registered through any governance framework in any jurisdiction to provide investment recommendations or investment recommendations. ALWAYS YOUR OWN AND consult an authorized investment professional before making an investment. This communication does not deserve to be used as a basis for making an investment.

RISK OF INVESTING. Investing is inherently risky. Don’t work with cash you can’t lose. This is neither a request nor an offer to buy/sell securities. No representation is made that any account achieves or is likely to make profits similar to those discussed.

Read this article in OilPrice. com

This story gave the impression to Oilprice. com