Since the Covid-19 (coronavirus) pandemic started spreading around the globe, most of the attention has been on two areas: health and the economy. One of the main questions over the past few months was what the global economic outlook is looking like in 2020 and beyond, and which sectors of the economy will suffer the least and the most. Some analysts were forecasting moderate growth for telecoms, while others were more conservative in their outlook, predicting a decline, in line with the global GDP.

The first effects of the quarter will be published in the coming weeks and will give us an indication of the industry’s resistance to the crisis. For a review of what to expect, this is a wonderful opportunity to take a look at the recently released maximum effects, Q1 2020.

There are several points that explain why this happened. First, the functionality of the group was greatly influenced through its geographical footprint, with the spread of the virus and the severity of the blockade in several regions. Second, telecommunications operators are non-cyclical enterprises, which means that their functionality is less volatile in times of recession, due to the continued demand for the essential service they provide; Connectivity It is also vital to note that while Covid-19 was one of the points that affected the monetary functionality of the first quarter, it was not the only factor, and was primarily indirectly similar to monetary functionality through economic impact.

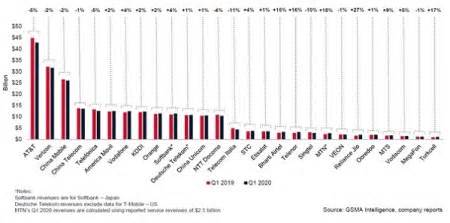

The monetary effects for the first quarter of 2020 demonstrate this (see the table below, click to enlarge).

While maximum telecom operators have suffered a decline in non-recurring revenue, with closing restrictions requiring the maximum of their outlets to be closed, service revenues have increased due to an accumulation in the use of knowledge, either on the constant and cellular side, due to a shift to house paints and online entertainment construction.

In our latest Global Financial Reference Analysis report, we decided that 3 teams in South America, MENA and Africa will deepen their monetary functionality and key policy adjustments and assess the regional effect of Covid-19. Looking at regional differences, Telefónica, which has a giant footprint in South America, reported a negative effect of Covid 19 on its operations in the first quarter, with a 5% revenue drop, which has an effect on profitability. The main contributing factors were corporate consumers affected by the pandemic and declining income from prepayment, homeless and phone.

Etisalat, which is basically provided in the MENA region, experienced a 1% expansion in sales, driven through activities in Egypt and Chad. However, expansion slowed from the 2.4% accumulated in the fourth quarter of 2019, due to Covid-19’s effect on domestic operations.

And MTN, which operates in Africa, reported that Covid-19 had a limited effect on its functionality during the first quarter, as the blocking measures at the maximum of its footprint were only introduced in the last week of the quarter. However, in April 2020, the pandemic was a catalyst for a build-up of knowledge trafficking in MTN’s footprint, up 115% from April 2019, with the largest constructions in Nigeria and Ghana.

In terms of profitability, the aggregate EBITDA margin of the 27 teams analyzed decreased only slightly, from 34% in the first quarter of 2019 to 33.7% in the first quarter of 2020, with 20 teams registering an EBITDA margin of more than 30%. On the capital expenditure side, as the 2020 budgets set in 2019 envisaged the global pandemic, teams continued to implement 5G and 4G updates in the first quarter and spent $4 billion more in the quarter than in the first quarter of 2019.

The biggest challenge in the coming months will be managing bad debts and balancing liquidity. On the capital expenditure side, the devaluation of the local currency opposed to the US dollar in emerging markets can lead to a slowdown in investment. Other points that would possibly reduce the investment are disruptions to the source chain and limitations on installing new sites due to blocking restrictions, i.e. in the case of a covid-19 moment wave.

In terms of capital expenditure factors, capacity innovations can lead to increased infrastructure spending. However, the maximum of the 27 computers report that their networks are facing increased knowledge traffic, and since the maximum number of countries have already noticed the transition to domestic work, the rate of expansion of knowledge traffic in the first quarter is unlikely to continue to increase. The rest of 2020.

– Alla Shabelnikova – Financial Analyst / Senior Forecaster, GSMA Intelligence

The editorial reviews expressed in this article are only those of the and will not necessarily reflect the perspectives of the GSMA, its members or associate members.

Read more

Intelligence Report: Does 5G promise a brighter long-term for South Africa?

Intelligence report: What do operators want to succeed in business?

Intelligence Brief: Is 5G a smartphone lifeline?

Covid-19 industry impact: LIVE

Mobile Mix: delight the world

Feature Video: GSMA Thrive China 2020 highlights

© 2020 GSM Association. The terms and logos GSMA, Mobile World Live, MWC Barcelona, MWC Los Angeles and MWC Shanghai are registered with the GSM Association

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners. By continuing to use our site, you accept our use of cookies.